Ethereum has a major DeFi lead in several key metrics, including the overall number of DeFi apps, number of DeFi users, number of DeFi developers, and total value transacted through DeFi apps.

As the race for decentralized finance (DeFi) supremacy heats up, Ethereum is still leaps and bounds ahead of the pack, and it doesn’t look like that’s about to change any time soon. In the last few months, a wide variety of other blockchains have seen DeFi development activity skyrocket, with platforms like TRON, Cardano, EOS, Algorand, KAVA, and several others seeing a surge in the number of DeFi-related apps launched.

But as of yet, none have managed to come close to Ethereum’s success – despite many claiming to offer advantages over the platform, such as lower fees, better scalability, or better development tools.

Here we take a look at an often-overlooked reason why this may be.

DeFi Is About Community

Photo: Pixabay

Although several next-generation blockchains have appeared in recent years, many of which offer impressive scalability, speed, interoperability, and more. None have managed to overtake Ethereum as a hub for decentralized finance.

This is because DeFi is as much about new, exciting technologies and opportunities as it is about community. Though it is true that Ethereum sometimes suffers from high fees and delays during peak times, it also has by far the largest community in the cryptocurrency scene (barring Bitcoin).

Over the past six years, Ethereum has been gradually growing its community, including fervent developers, node operators, and general enthusiasts, giving it a solid foundation for the rapid uptake of new, innovative protocols and tools.

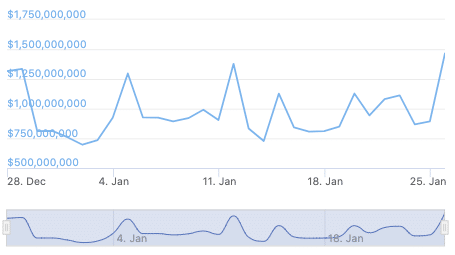

Because of this, Ethereum has a major DeFi lead in several key metrics, including the overall number of DeFi apps, number of DeFi users, number of DeFi developers, and total value transacted through DeFi apps. As a result, a single Ethereum DeFi app (Uniswap) has more transaction volume and total value locked (TVL) than all other DeFi apps on all other blockchains combined.

Uniswap trading volume exceeds that of all other DeFi apps (on other blockchains) combined. Photo: Coingecko

Uniswap trading volume exceeds that of all other DeFi apps (on other blockchains) combined.

This not only means DeFi apps on Ethereum have a drastically higher chance of success than those on competing blockchains, but they also have a better chance of receiving investment, generating community code contributions, and earning recognition – since there is always a legion of vocal, passionate community members to draw from.

If DeFi was a race, then Ethereum is inches from the finish line.

Leveraging the Community

Other projects that have already built a strong community likely have some understanding that this community is an essential part of their success. This is why many of them build on Ethereum.

Take NewsCrypto as an example. As a community-centric platform for analyzing crypto markets and improving trading performance, NewsCrypto has managed to develop a substantial community of its own.

NWC/ETH is live on @UniswapProtocol! 🦄

We are curious to see what a $1B volume a day market can do for NWC!

Official link to trading pair:https://t.co/wY7pnTEZC2

Warning signBeware of fake NWC trading pairs on Uniswap. pic.twitter.com/SnR8WbZK8B

— NewsCrypto.io (@NwcPublic) January 25, 2021

Despite originally launching the NewsCrypto Coin (NWC) token on the Stellar blockchain, it recently launched it on the Ethereum blockchain as an ERC-20 token. This allowed it to list to token on Uniswap, opening the doors to DeFi to its hundreds of thousands of users – something that could not be done on Stellar.

With that said, Polkadot stands out as one of Ethereum’s biggest potential rivals. Though the platform is still arguably in its early days of development and only launched its mainnet recently (mid-2020), the number of upcoming DeFi launches on the platform number in the hundreds.

Not only this, but it also has a staggering community behind it, which may help it succeed where other platforms have failed.

But for now, it remains Ethereum vs everyone else.

Having obtained a diploma in Intercultural Communication, Julia continued her studies taking a Master’s degree in Economics and Management. Becoming captured by innovative technologies, Julia turned passionate about exploring emerging techs believing in their ability to transform all spheres of our life.