The digital asset company Kraken announced it has acquired the non-custodial staking platform Staked for an undisclosed sum. While the sum of the purchase was not disclosed, the company claims that it was “one of the largest crypto industry acquisitions to date.”

Kraken Acquires Non-Custodial Staking Firm Staked

On December 21, Kraken announced that it acquired the staking firm Staked, a company that specializes in providing people with access to proof-of-stake (PoS) networks. “Staked helps investors earn yield from staking and defi without taking custody of their crypto assets,” the firm’s website explains. Kraken is one of the largest crypto exchanges worldwide in terms of trade volume and digital asset reserves.

In terms of global crypto-asset reserves data from Bituniverse, Peckshield, Chain.info, and Etherscan, metrics show Kraken is the fourth-largest exchange in terms of reserves held today. Kraken holds $15.81 billion in digital assets according to the data, and those reserves represent more than 102,000 bitcoin (BTC) and 2.27 million in ethereum (ETH) on December 22. The acquisition announcement notes that Kraken wants to play a major role in providing staking services to consumers and institutions.

“We are excited to add Staked to our portfolio of yield products, which has seen great uptake by a growing population of crypto investors,” Jesse Powell, the CEO and co-founder of Kraken remarked about the announcement. “Staked is highly complementary to our existing staking business and will allow us to further strengthen our product offering through world-class infrastructure for clients who prefer to retain custody of their staked assets,” Powell added.

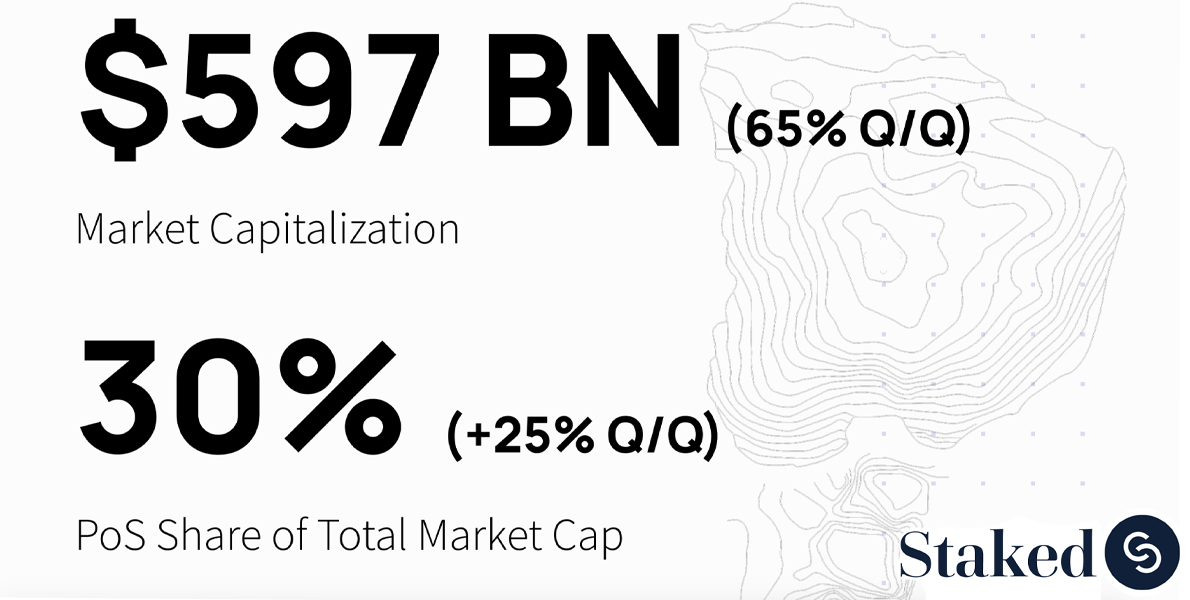

Staked explains in its 2021 third-quarter report that “Q3 was an absolute banner quarter for PoS crypto assets.” The report goes on to explain that there were four PoS assets in the top ten in Q3, and 28 PoS crypto assets in the top 100 coins by market capitalization. “The market cap of the top 35 PoS assets represented 30% of the total crypto market capitalization as of [September 30],” Staked wrote at the time. “Marking the first time PoS assets have accounted for [more than] 25% of the total crypto market cap,” the report adds.

The acquisition of Staked makes it Kraken’s fifth acquisition in 2021, according to the announcement on Tuesday. Kraken also noted that the company’s trade volume across spot, margin, and futures grew by 430% this year. “Kraken’s acquisition of Staked represents an exciting new chapter for us,” Tim Ogilvie, the CEO of Staked said in a statement. Kraken is not the only crypto firm making acquisitions as the company Coinbase scooped up numerous startups in 2021 as well.

What do you think about Kraken acquiring Staked for an undisclosed sum? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.