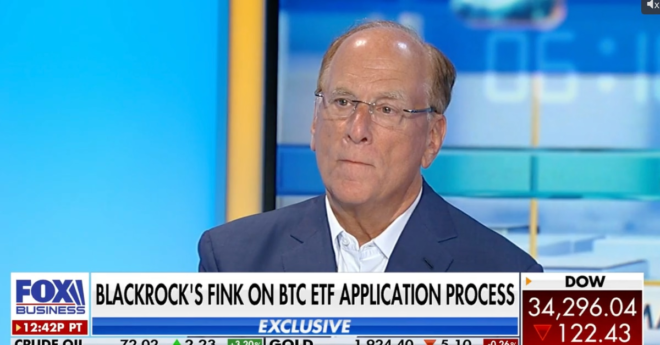

If you’ve been in crypto for a while, you’ll know that ETFs have long been considered key for building a broad-based market for digital assets. And recent news that BlackRock, no less, had submitted a proposal to set up such a vehicle raised hopes. If a bellwether, well-connected institution like BlackRock was getting into Bitcoin ETFs, surely an approval, and the first U.S. crypto ETF, couldn’t be far off.

Don’t Expect a Flood of Spot-Bitcoin ETFs Soon – Experts