However, some tech stocks took the heat on Tuesday following the heightened talks about the inflation concerns.

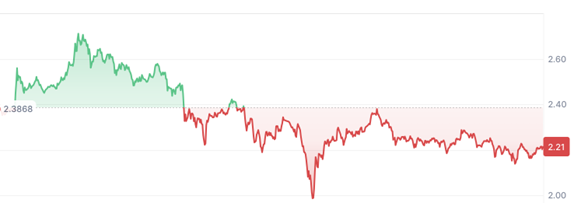

The Dow Jones Industrial Average got back to winning ways of gains on Tuesday after erasing some of its 360-point losses. The index tracking the stock performance of 30 large companies listed on public exchanges in the United States, closed up 0.05%, adding 15.66 points to 31,537.35.

The slight gains of Dow Jones (INDEXDJX: .DJI) recorded came after Fed chair Jerome Powell eased off the concerns against higher interest rates and economic inflations. The S&P 500 (INDEXSP: .INX) also accrued some gains with a 0.13% to 3,881.37. Of the major stock market indices, only the Nasdaq Composite (INDEXNASDAQ: .IXIC) ended the day with slight losses as it closed 0.50% down to 13,465.20.

Will Dow Gains Continue?

As reported by CNBC, the Nasdaq Composite dropped below its 50-day moving average in intraday session on Tuesday, a dip it quickly reversed.

“The economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved,” the Fed chief said in prepared remarks for the Senate Banking Committee.

The fears of an increase in inflation have peaked over the past weeks as market stakeholders worry the central bank may increase borrowing costs amid a price hike that may be stirred by new stimulus rollouts.

“The Fed is focused on employment and seems very willing to absorb higher inflation and excesses in financial market that brings financial instability in hopes of getting there,” Peter Boockvar, chief investment officer at Bleakley Advisory Group, said in a note. “But, as seen in the long end of the yield curve, the markets have a say here too and they are speaking loudly. Hopefully, at some point, Fed officials will listen.”

Tech Stocks Buckled amid Inflations Rumors

Some tech stocks took the heat on Tuesday following the heightened talks about the inflation concerns. The shares of business intelligence and software firm MicroStrategy Incorporated (NASDAQ: MSTR) dropped 21.09% to $691.23. Electric vehicle manufacturer Tesla Inc (NASDAQ: TSLA) also dipped low by 2.19% to $698.84, and Microsoft Corporation (NASDAQ: MSFT) was also not spared as it shed $1.24 representing a 0.53% dip. MSFT ended the day at $233.27 per share.

“The sell-off in tech darlings and much-loved small-caps could be interpreted as the beginnings of market jitters,” said Chris Larkin, managing director of trading and investing product at E-Trade. “That’s not to say that equities have run their course, it’s more like cyclical sectors like energy and financials are more attractive, while tech takes a backseat.”

Despite these losses, however, some publicly listed companies in the financial services sector which are bound to benefit from higher interest rates recorded appreciable gains. Amongst these, the American Express Company (NYSE: AXP) surged 0.73% to $136.94, and investment banking firms, Morgan Stanley (NYSE: MS) soared 0.10% to $ 77.50 while JPMorgan Chase & Co (NYSE: JPM) closed Tuesday with a 0.80% gain to $150.61 per share.

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.