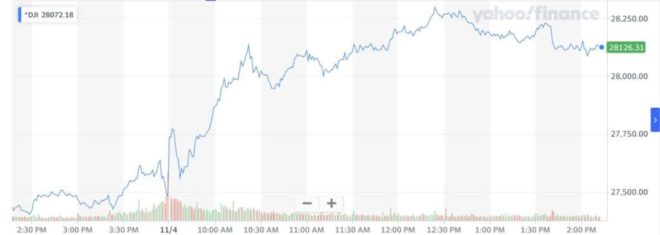

- The Dow Jones rallied 680 points on Wednesday.

- Election volatility saw huge gains for healthcare and tech stocks.

- Hopes of fiscal stimulus are alive again after Mitch McConnell’s constructive comments.

Election volatility was back mid-week, as the presidential election swang in the direction of Joe Biden. Weak U.S. data didn’t stop the Dow Jones from rallying over 700 points as hopes of fiscal stimulus are on the rise again.

Dow Jones Rises Despite Weak Data

All three major U.S. stock market indices rallied on Wednesday, as the Nasdaq led the way with a 4% gain, and both the S&P 500 and Dow Jones rose more than 2%.

While investors fixated on the election results, the U.S. economy spat out a particularly worrying ADP employment report, which showed a gain of just 365,000 jobs versus forecasts for 650,000. The ISM non-manufacturing PMI was also weaker than anticipated, only further highlighting the slowdown in the economy.

Watch the video below for an analysis of the latest sentiment data.

One thing was clear on Wednesday: Senate Republicans are ready to talk about stimulus. Mitch McConnell provided a clear boost to risk appetite as he acknowledged several key Democrat demands over bailing out municipalities. He also indicated that an aid package was needed this year. With his Senate seat restored, it appears that McConnell is finally ready to do a deal with Pelosi, something he refused to do when Trump needed it before the election.

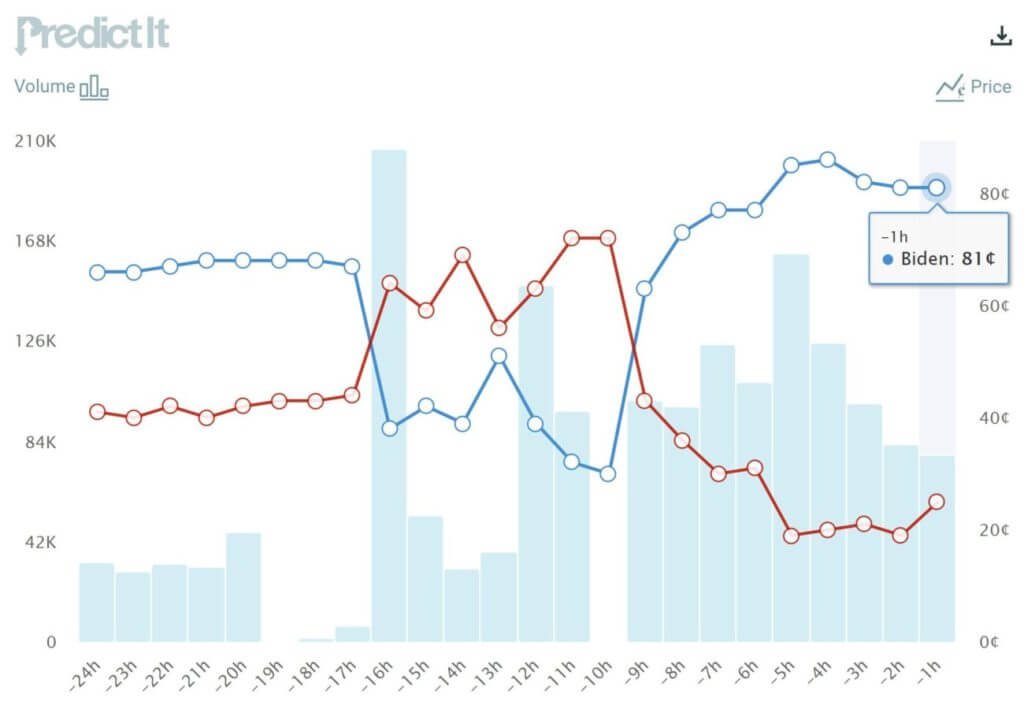

Donald Trump is making plenty of headlines claiming to have won, but betting and financial markets have Joe Biden as the dominant favorite. With battleground mail-in votes outstanding in PA, WI, GA, AZ, and NV, it seems there are enough Democrat votes left to potentially put Biden over the top.

What matters for the market is that it looks like the U.S. will have a clear winner. Travis McGhee, Chief Commercial Officer for Nadex, agreed with this stance, telling CCN.com that it’s less about Trump vs. Biden and more about moving on from election uncertainty:

In my opinion equities are melting up as we see, or at least feel more confident, contested election fears are unwinding. This is taking time, particularly with the rust-belt states, which is leading to this slow grind higher as the picture becomes more clear. This market wants a clear winner, regardless of who wins. At this stage, it feels like there will be a definitive winner, it may simply take a few days to get the final confirmation.

With plenty more volatility expected ahead, Dow bulls continue to feast for a second straight day despite the aggressive legal rhetoric coming out of the White House.

Watch the video below for the latest on the election result.

Dow 30 Stocks: UnitedHealth Scorches Higher

In a mostly euphoric looking Dow 30, the index’s heaviest weighted stock UnitedHealth posted a stunning 12% rally. Fueling this rally was the likelihood that the Republican party would at least hold onto the Senate, making major overhauls to healthcare unlikely despite the potential for a regime change in the White House.

Watch the video below for a cautious analyst take on the buoyant mood in financial markets.

At the other end of the Dow Jones was Caterpillar stock, which fell 6%. Dow Inc. was the next weakest in the Dow.

Rising coronavirus cases continue to boost the “stay at home” stocks, with Microsoft and Apple posting 5% and 4% rallies, respectively.