- The Dow Jones posted modest gains Wednesday.

- Surging technology and communication stocks propelled the S&P 500 and Nasdaq to new all-time highs.

- The Dow is getting a major shake-up next week, with Salesforce.com, Amgen, and Honeywell replacing ExxonMobil, Pfizer, and Raytheon Technologies, respectively.

The Dow Jones Industrial Average rose on Wednesday but continued to underperform its wider-market peers after the index announced significant changes to its constituents.

Dow, S&P 500, Nasdaq Rally

All of Wall Street’s major indexes reported gains Wednesday, though the Dow continued to underperform its peers. The Dow 30 edged up 35 points or 0.1%.

Among the current Dow 30 industrials, Dow Inc. (NYSE:DOW) rallied 2.1%, Home Depot Inc. (NYSE:HD) gained 1.7%, and Microsoft Corp (NASDAQ:MSFT) rose 1.6%. On the opposite side of the ledger, Walgreens Boots Alliance (NYSE:WBA) and ExxonMobil Corp (NYSE:XOM) each fell more than 2%.

Technology stocks lifted the broader market to new all-time highs, with the S&P 500 Index gaining 0.8% and the Nasdaq Composite surging 1.2%.

The CBOE Volatility Index, commonly known as the VIX, continues to trade just above its historical average. VIX rose 2.9% to 22.67 on a scale of 1-100, where 20 represents the historic average.

Significant Changes Are Coming to the Dow

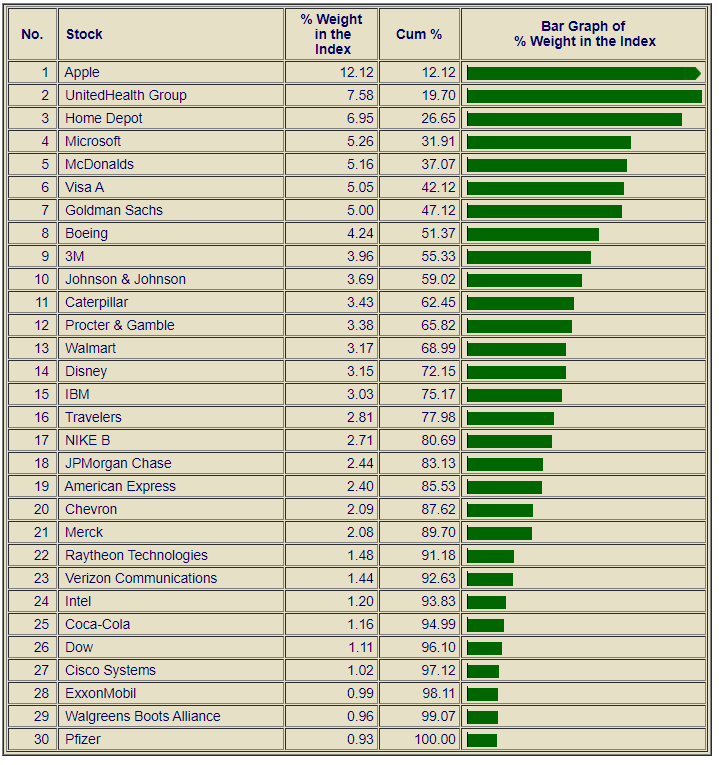

The Dow 30 index is preparing for major adjustments next week. In a decision that was prompted by Apple’s (NASDAQ:AAPL) upcoming four-for-one stock split, S&P Dow Jones Indices announced earlier this week it would swap out three companies to reduce its exposure to the technology sector.

Beginning Aug. 31, ExxonMobil Corp (NYSE:XOM), Pfizer Inc. (NYSE:PFE), and Raytheon Technologies (NYSE:RTX) will be replaced by Salesforce.com (NASDAQ:CRM), Amgen (NASDAQ:AMGN), and Honeywell International (NYSE:HON).

ExxonMobil’s exit is especially notable given the oil giant’s 92-year history on the index. Like other energy producers, Exxon has been hit hard by the multi-year collapse in crude prices. Exxon and Chevron Corp (NYSE:CVX), another Dow constituent, posted their largest quarterly loss in history last month.

As a whole, energy stocks are down more than 33% over the past 12 months. By comparison, information technology is up over 55%.

Unlike the S&P 500 and Nasdaq, the Dow hasn’t returned to its pre-crisis high. The Dow closed at 29,551.42 on Feb 12, according to Bloomberg data.