- Economists predict a high probability of a “double-dip” in the U.S. economy in the fourth quarter.

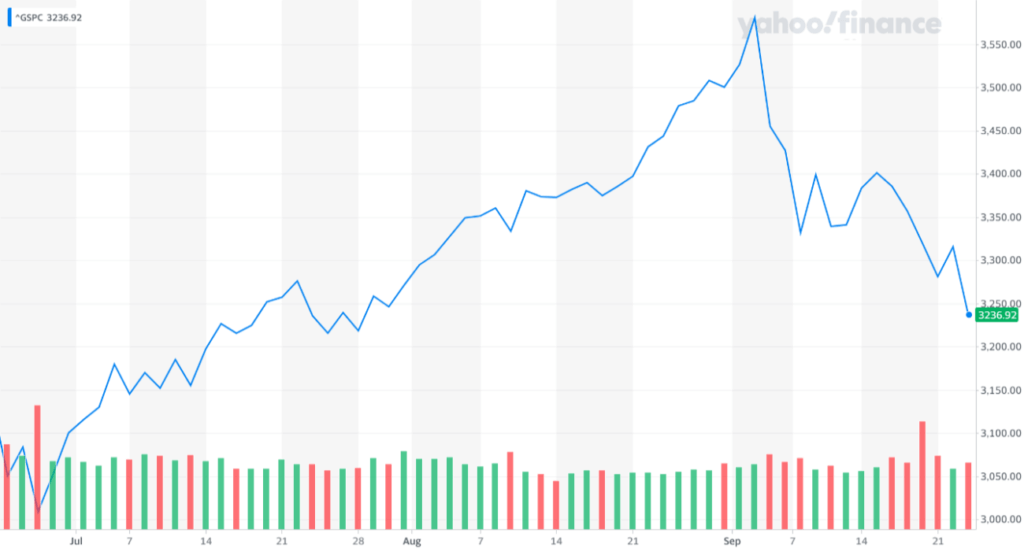

- The U.S. stock market is a 10% drop away from entering a bear market after major indices dropped by 8% to 10% in the past month.

- The prospect of regional lockdowns in Europe and the high level of baseline cases in the U.S. threaten investor confidence.

Economists anticipate an economic winter to arrive in the fourth quarter, warning against the high probability of a “double dip.” The U.S. stock market faces a steep correction in the near term as the economic growth stalls.

The fundamental reason behind the predictions for a contraction in the fourth quarter is the uptick in COVID-19 cases.

Following the upsurge of virus cases in Europe and the U.S., infectious disease experts have warned against the numbers.

The Stock Market Continues to Drop as Fear Around Economic Slump Intensifies

According to ING chief economist Carsten Brzeski, the probability of a double-dip and another contraction “increased significantly.”

The economist expects governments across Europe to implement regional lockdowns, which might hinder the overall stock market sentiment.

More prominent economists echoed a similar sentiment in the last few days. IHS Markit chief economist Chris Williamson also anticipates “a lot more restrictions.”

In the near term, Williamson emphasized that it is “really going to curb growth,” especially heading into the last quarter.

Overall, both economists and strategists are concerned that risks in the markets are surging.

Also read: 4 Catalysts For S&P 500 ‘Anxiety’ Quarter Shouldn’t Surprise You

Berenberg chief economist Holger Schmieding described the pandemic as “the key risk” to the firm’s prediction for a “tick-shaped recovery.”

In the past month, major U.S. stock market indices dropped between 8% to 10%. The S&P 500 has declined by 9.6% since September 2, recording a brutal sell-off.

Analysts consider the stock market to be in a bear market when it falls by 20% or more from its peak. The S&P 500 and the Nasdaq are around 10% away from officially entering a bear market.

As the stock market momentum weakens, the pandemic-induced economic stagnation is showing no signs of improvement. At least until the year’s end, scientists expect the pandemic to worsen significantly.

Infectious Diseases Experts and Epidemiologists Ring Alarms on the Pandemic

This week, Dr. Jeanne Marrazzo issued a dire warning against the virus numbers in the U.S.

Marrazzo, the director of the University of Alabama School of Medicine Division of Infectious Diseases, told CNN:

“The bottom line is that it doesn’t matter what side of the aisle you’re on politically. The numbers are the numbers. You can’t argue with them. And they are not going in the right direction.”

As Anthony Fauci stated in early September, the biggest problem to the U.S. is the high level of baseline cases. Because the U.S. already has a substantial backlog of virus cases, it is harder to prevent local outbreaks.

But the prospect of vaccine production and distribution is not improving, and the stock market is reacting fiercely. Fauci said that all of the doses would not be ready by the end of 2020.

Fauci told Congress about the challenges of having vaccines ready by the year’s end. Watch the video below:

Even if vaccine manufacturers can create vaccines and somehow distribute starting December, most cannot receive vaccines until mid-2021. Fauci said:

“We’re not going to have all of the doses available, for example, by the end of December, they will be rolling in as the months go by. By the time you get to maybe the third or fourth month of the 2021, then you’ll have doses for everyone.”

The confluence of the declining U.S. economy and the worsening prospect of vaccines by the year’s end pose a significant threat to the stock market recovery.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.

Samburaj Das edited this article for CCN.com. If you see a breach of our Code of Ethics or find a factual, spelling, or grammar error, please contact us.