If you haven’t noticed, crypto exchanges have been making money hand over fist despite the crypto winter.

Economist and trader Alex Kruger apparently did and started a conversation about crypto exchange fees, posing the question of whether customers are being overcharged. In a comparison of crypto trading fees versus that of stocks and foreign exchange, crypto exchanges are the worst offenders.

While social trading platform eToro supports cryptocurrency, including a recent expansion into the U.S. market, the Tel Aviv-based company was missing from his list. Nonetheless, Kruger, who boasts a 26,700 Twitter following, didn’t hold back when a commenter remarked about the trading platform in the thread and suggested that the economist examine eToro’s fees, too. Kruger responded:

“eToro is the ripoff king.”

Etoro is the ripoff king.

— Alex Krüger (@krugermacro) March 28, 2019

CCN reached out to eToro and received the following response from a spokesperson:

“I’d like to highlight that eToro is not a crypto exchange, we are multi-asset trading and investing platform. We will be launching an exchange in the coming months and will be glad to share further details with you about the exchange then.”

Indeed, eToroX, which is in beta format, is comprised of a crypto wallet and exchange. Meanwhile, the company’s spokesperson added that trading and investing platform eToro is transparent with fees, which are displayed on the website and which vary based on asset class. eToro also recently announced that it will soon go “commission free” on stocks in the U.K.

There is also a minimum withdrawal amount of $50 and a hefty withdrawal fee of $25.

The issue that traders appear to have with regard to eToro is the spread, which Reddit members describe as “big” in a recent thread. Another trader who has been using the platform for more than two years said: “Can’t complain. Just they really took advantage of the crypto boom! Those fees,” followed by laughing emojis.

eToro has amassed more than 10 million users across “Europe, Asia, and the Middle East,” according to Bloomberg. Even if traders complain about the fees, they must not be overly turned off by them.

Kruger’s Analysis

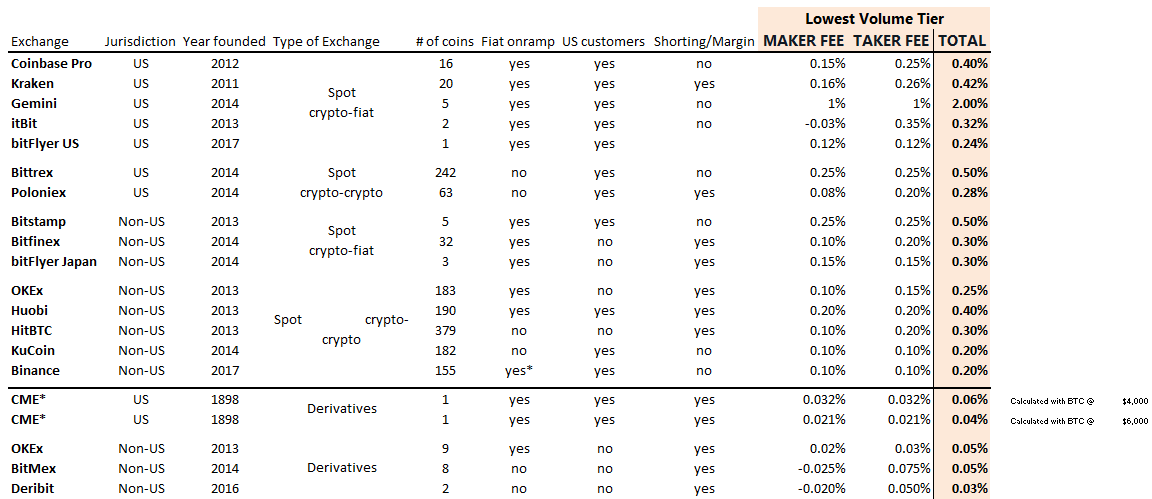

Considering that eToro is a trading and investing platform and not technically a crypto exchange, that may explain why Kruger left the company off his table. He spotlighted the average maker fee + taker fee on crypto spot exchanges (with the exception of the Winklevoss’ Gemini) based on the “lowest volume tier,” which is what fees are based on and where most traders fall. He came up with an average of 0.33%.

Meanwhile, he compares the fees with stocks, pointing to Fidelity that charges a flat per-trade rate of $4.95. He did the back-of-the-napkin math, determining that it “puts the maker fee + taker fee at 0.02% for a $50,000 trade, and at 0.33% for a $2,900 trade.” Stock market traders can gain access to cheaper fees still via broker fee structures that charge per share rather than on a per-trade basis.

Results are similarly dramatic in the forex market, where an “FX trader on Oanda would pay 0.008% for a round trip (i.e. in and out of a position).” By way of comparison, “Coinbase is 48x more expensive, while trading on BitMEX is 6x more expensive.”

Factor in volatility and crypto is still the most pricey asset class to trade. Over the past couple of years, crypto’s volatility surpassed that of the euro and the S&P 500 by 12x and 7x, respectively. as a result.

Ultimately, Kruger concluded:

” Crypto fees are generally high even after adjusting by relative volatility.”

The report adds insult to injury for crypto exchanges, many smaller ones of which are under scrutiny for overstating trading data, according to research.