Price Point

In a run reminiscent of its stunning ascent in early January, bitcoin’s price blew past $45,000, $46,000 and $47,000 in less than an hour late Monday, eventually topping $48,000. By early Tuesday, the largest cryptocurrency had settled down to about $45,200.

The powerful rally came after Elon Musk’s electric-vehicle company, Tesla (TSLA), announced it had bought $1.5 billion of the cryptocurrency. Bitcoin (BTC) now has a market capitalization of nearly $890 billion, which would rank it ahead of all but six of the world’s largest publicly trading companies, including No. 7 Tesla at $829 billion.

For those keeping track of Tesla’s bet, it appears to be paying off so far. Based on the 18% gain in the cryptocurrency’s price over the past 24 hours, the investment has already generated a paper gain of about $270 million.

Ether (ETH), the native cryptocurrency of the Ethereum blockchain, climbed early Tuesday to a new all-time high of $1,825, based on CoinDesk 20 data. The increase pushed the second-largest cryptocurrency’s market value past $200 billion for the first time. Traders cited expectations the CME’s new ether futures might prompt more institutional investors to bet on the cryptocurrency’s price. At the same time, data showed the balance of ether on exchanges falling to a 16-month low – taken as a sign few investors are queuing up to take profits, even at these unprecedented price levels.

In traditional markets, investors in bond markets were focused on the “great reflation trade,” amid signs President Joe Biden is pushing forward with his $1.9 trillion stimulus proposal despite opposition from lawmakers in the minority Republican Party as well as from some fellow Democrats. Stocks were lower, while gold strengthened 0.6% to $1,842 an ounce.

Market Moves

Corporate treasurers might follow Tesla into bitcoin

Tesla’s purchase of $1.5 billion of bitcoin has opened a spigot of speculation on how many corporate executives might soon follow CEO Elon Musk’s lead and steer their firms into cryptocurrencies.

“It will now become increasingly common for company treasuries to have an allocation to bitcoin,” says Joe DiPasquale, CEO of the cryptocurrency hedge fund BitBull Capital. He predicts the trend could help send bitcoin prices to $80,000 by year’s end.

Musk commands an audience partly because he’s reportedly one of the world’s richest men – just as investors once hung on Berkshire Hathaway CEO Warren Buffett’s every word when he was the world’s richest man; he had the hot hand.

“If any lesser mortals had made the decision to put part of their balance sheet in bitcoin, I don’t think it would have been taken seriously,” Thomas Hayes, managing member at Great Hill Capital LLC in New York, told Reuters.

And yet it is being taken seriously. Not only are big investors with almost-unassailable reputations like Bill Miller going into bitcoin, at least partly because of its perceived use as a hedge against central bank money printing, but retail traders are flocking to the fold. In January, some $3.5 billion poured into exchange-traded funds that track inflation-protected bonds, the strongest monthly inflow on record, Bloomberg News reported last week.

Michael Saylor, the MicroStrategy (MSTR) CEO who has become the biggest proselytizer for corporations putting treasury money into bitcoin, congratulated Musk on Monday in a tweet. “The entire world will benefit from this leadership,” Saylor wrote.

Mitch Steves, an analyst with the brokerage firm RBC Capital Markets, wrote Monday in a report that he thinks Apple (AAPL), the iPhone maker that is also the world’s largest company, should start its own cryptocurrency exchange. According to CoinDesk’s Nathan DiCamillo, Steves wrote that “the potential revenue opportunity would be in excess of $40 billion a year.” That’s enough to move the needle, even for Apple.

“There’s no doubt in my mind that in the coming weeks and months, we’ll see many more Fortune 500 companies making similar announcements as they look to diversify their tremendous cash balances out of the flailing U.S. dollar,” said Mati Greenspan, founder of the foreign-exchange and cryptocurrency analysis firm Quantum Economics.

Craig Erlam, senior market analyst for the foreign-exchange brokerage Oanda, says the corporate herd may still move slowly. Indeed, few CEOs possess the well-documented moxie of Musk, who not only started his own private spaceflight company as a moonlighting gig but also once sent a single tweet that resulted in a $40 million fine from the U.S. Securities and Exchange Commission. “Some other companies may be tempted to follow but the vast majority will be far too cautious to expose themselves to the volatile world of cryptos,” Erlam wrote in an email.

David Grider, an analyst for the independent investment-research firm FundStrat, estimated Monday in a report that some $215 billion of additional demand for cryptocurrencies could materialize if all the companies in the Standard & Poor’s 500 Index followed Tesla’s lead.

“We don’t think this happens overnight, but we do think there’s much more room for corporate treasury penetration and expect the trend to continue,” Grider wrote.

As always with fast-moving market trends, fear of missing out, often known by the acronym FOMO, can be a powerful force. The more big corporate moves into bitcoin, and the higher bitcoin goes as a result of those moves, the more treasurers might feel pressure to join the crowd. Grider suggests that some companies might buy bitcoin as a hedge against the possibility their companies might someday get disrupted against blockchain technology; if they lose out to the competition, the reasoning goes, at least they’ll have the bitcoin.

Maya Zehavi, a blockchain consultant, put it this way to Reuters: “The downside of staying on the sidelines will only become costlier over time.”

Bitcoin Watch

‘It’s a call-buying frenzy’

Investor interest in call options (bullish bets) has increased, a sign that some investors are positioning for a continued price rally, CoinDesk’s Omkar Godbole writes.

- “We are seeing high volume across the board in call options ranging from $56,000 to $72,000,” Matthew Dibb, co-founder and COO of Stack Funds, told CoinDesk. “If the options market is any indication of the enthusiasm across investors, we will be going a lot higher.”

- Multiple 100-plus call option contracts have been bought at strikes of $44,000, $48,000, and $52,000, according to Swiss-based data analytics platform Laevitas.

- “It’s a call-buying frenzy,” Laevitas tweeted late Monday.

- The one-, three- and six-month put-call skews, which measure the cost of bearish puts relative to calls, are firmly entrenched in negative territory, per data provider Skew. That’s an indication call options are drawing higher demand than puts.

According to Godbole, the broader bias in the bitcoin market should remain bullish as long as the trendline rising from $10,000 is held intact. (See chart above.)

The “Elon rally” has established $42,500 as the new support, and prices could rise to $50,000 in coming weeks, according to Dibb.

Token Watch

Ether: On the first day of trading in the CME’s new ether futures, some 388 contracts changed hands, equivalent to about 19,400 ETH, or $33 million, Tim McCourt, global head of equity products for the Chicago-based exchange, told The Block. “The response to ether has been overwhelming,” McCourt said. For comparison, when the CME debuted bitcoin futures in late 2017, nearly 1,000 contracts changed hands on day one, according to McCourt.

Cardano (ADA), polkadot (DOT): Ether? Bah. A growing number of cryptocurrency traders are betting on “Ethereum killers,” or tokens associated with blockchains that could someday rival Ethereum’s domination of decentralized finance, known as DeFi, CoinDesk’s Muyao Shen writes. Cardano has vaulted into the top ranks of digital assets, with a market value of about $22 billion, while polkadot is just behind, at about $20 billion. Both have now surpassed XRP‘s $16 billion though still represent a fraction of ether’s $201 billion.

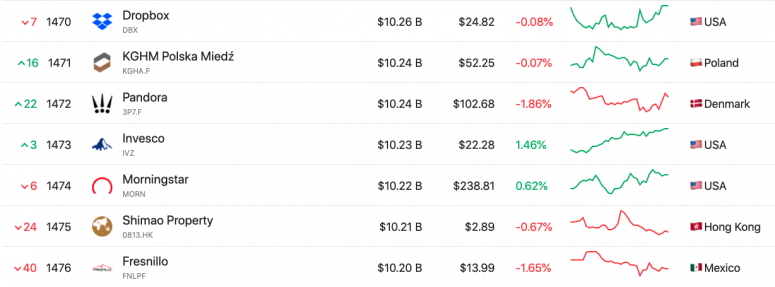

Dogecoin (DOGE): Prices for the doggie-faced meme token, started in 2013 as little more than a joke, were higher for a fourth straight day, topping 8 cents. The token now has a market capitalization of more than $10.3 billion. That’s more than Dropbox, the cloud data-storage company; Pandora, the music-streaming service; Invesco, the mutual-fund company; and Fresnillo, the world’s largest silver-mining company, according to the website CompaniesMarketCap.com.

First Person

Opinions, observations and other perspectives

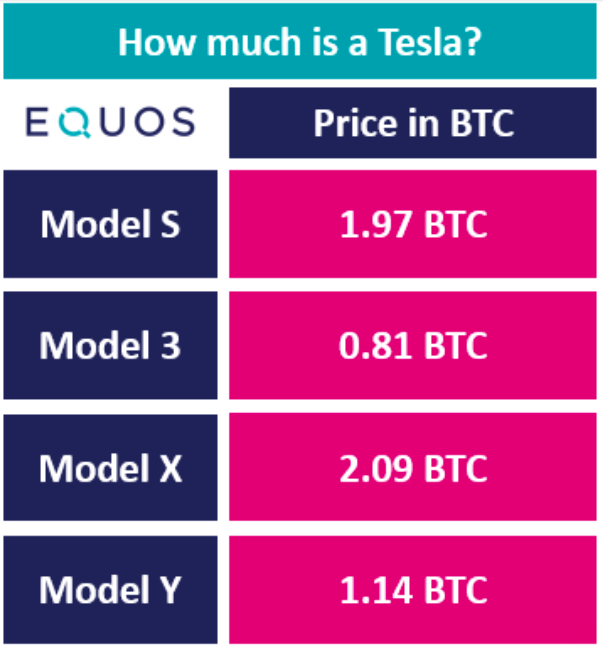

Matt Blom, head of sales and trading at EQUOS, had a lot of fun imagining Tesla’s new price list, below, which appeared in his daily newsletter on Monday.

Even so, Antony Welfare, executive director for enterprise at NEM Software couldn’t help but dwell on the future price of a Tesla Roadster, currently priced at $250,000, or a little over 5 BTC: “By the end of this bull market it will be more like 2 BTC,” he noted in a comment emailed to First Mover by a PR representative.