Africa is the home to 1.2 billion people and what has been described as the world’s largest trade area — the African Continental Free Trade Area. Africa is forging a new path to driving development, and access to financial services will play a significant role in its economic growth. The need to provide improved systems for poverty reduction, if not alleviation, is further accentuated when one considers that 416 million Africans live in extreme poverty, and access to financial services is right at the heart of the solution.

In a review of the impact of financial inclusion on economic growth, the World Bank argues that “such services must be provided responsibly and safely to the consumer, and sustainably to the provider.” Construed appropriately, financial inclusion has the potential to reduce poverty and inequality by helping disadvantaged groups to benefit from opportunities that otherwise would not have been available.

Related: Financial inclusion, cryptocurrency and the developing world

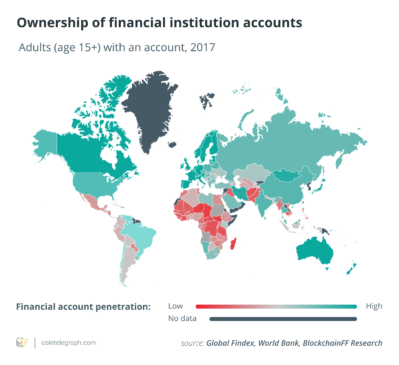

Innovation in financial services through time has expanded access to and improved financial inclusion globally. Traditionally, these have been in the form of the proliferation of banks and other financial institutions, decongesting banking services, and the development of microfinance, microcredit, microsavings, microinsurance, among other such services. Despite this expansion, regions such as Africa lag behind in financial inclusion, with implications for financial intermediation, value creation and, ultimately, economic growth. Data from the 2017 global financial access database shows that the number of adults in Africa with bank accounts is way below the median mark of 50%.

The brick-and-mortar model of banking and financial services provision will not change the dynamics for Africa within the foreseeable future; however, emerging technologies will. Fintech must be contextualized within the existing socio-economic constructs to determine factors that underlie their adoption and utilization, which, in turn, will bring to the forefront the most effective fintech solutions capable of supporting the growth and development agenda of the continent.

Related: Unpacking the potential of blockchain and infrastructure in Africa

The Chinese model for Africa

In the last 20 years, China has been providing a template around which Africa could model its fintech solutions. By understanding the importance of credit and payment infrastructure and the creation of new types of financial service providers such as peer-to-peer lending, online microcredit and finance, and consumer finance, Chinese policymakers have recognized the need to expand financial services access to rural consumers.

It is, therefore, unsurprising that new digital financial products have emerged largely due to the network effect: the use of online social media and e-commerce platforms. These network-based business models have integrated financial services into existing platforms that have ultimately led to millions of Chinese exiting the poverty trap.

The Chinese approach has been successful due to its homogeneity — central management and policy planning, which, incidentally, also act as a headwind for further expansion to last-mile service consumers. There is room to explore big data and cross-subsidization opportunities to ensure the ultimate goal of universal financial access is reached.

Internet penetration and identity management systems are key game components in the Chinese experience. Africa lags behind in this regard, with internet penetration less than the global average (currently at 39%), and it has a fragmented policy planning and administration due to the heterogenous political systems.

The cost of mobile data plans is the highest on the continent compared to other regions of the world, with some prices reaching almost 9% of people’s income. Zimbabwe, for instance, had costs that were 289 times that of India at the close of 2017 for a gigabyte of data.

High levels of illiteracy and the complexities around the use of smartphones also impact their use and, ultimately, the use of internet-based applications. The World Bank estimates that access to electricity is at about 43% for the continent and that this has significant implications for modern economic activities, limiting technology adoption and internet use.

Emerging tech solutions

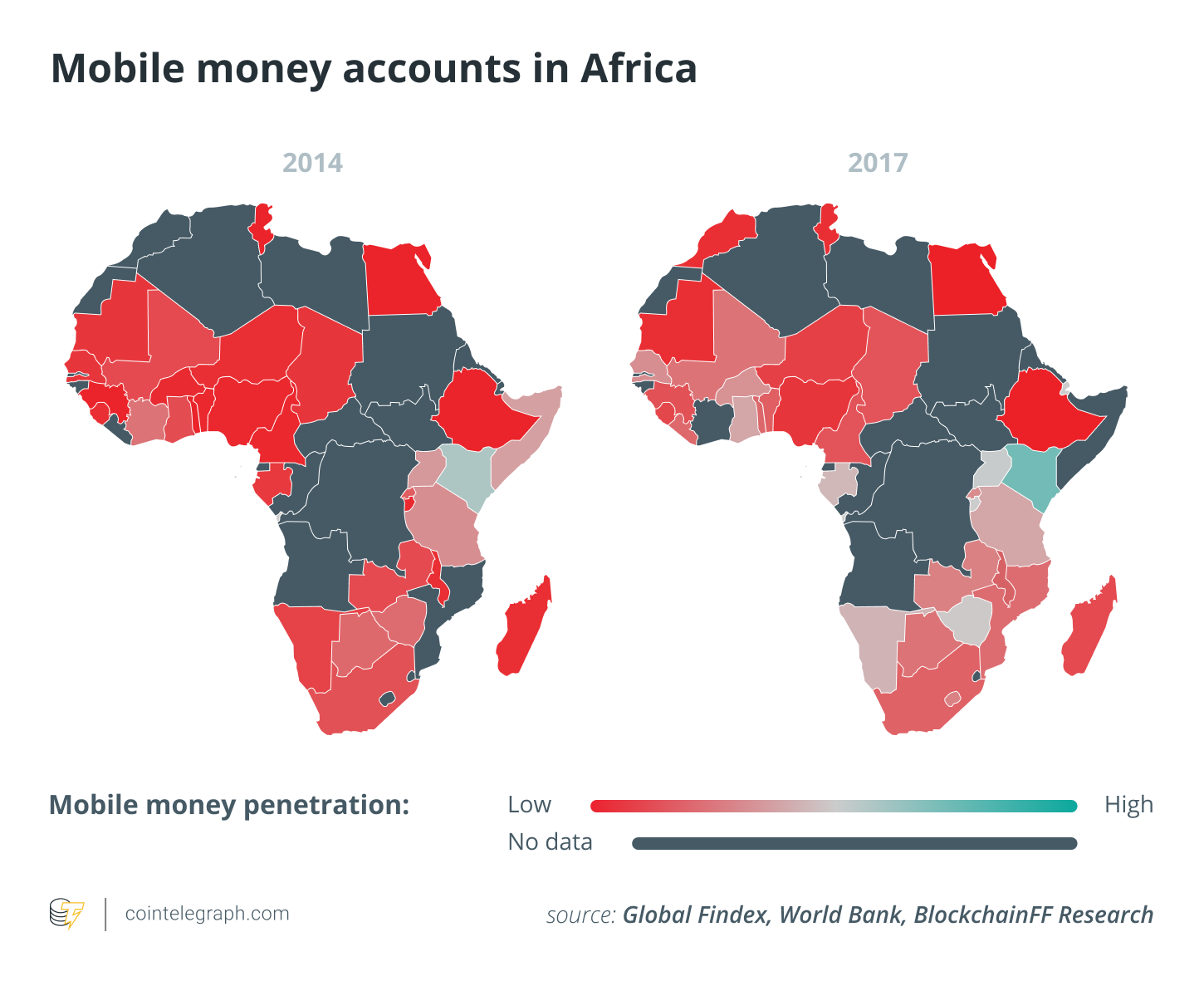

This is where alternative technologies such as the use of Unstructured Supplementary Service Data, or USSD, by telecommunication service providers and distributed ledger systems as seen in various applications of blockchain technology come into play. The expansion mobile money service by actors such as M-Pesa, MTN, Bharti Airtel, Orange and other GSM service providers across sub-Saharan Africa has provided access to receipts, payment and credit to economic agents that, hitherto, would have no access to these services from mainstream banking. This unique service provision, at a very basic level, allows mobile phone owners to receive and transfer funds using USSD-based systems for mobile network operators. Interoperability of the service among network operators in Ghana, Nigeria and Kenya, for instance, has increased their speed and volume of transactions between borders — far in excess of that provided by the mainstream banking institutions.

The ability to operate without internet connectivity is quickly expanding the usage of mobile money services, with opportunities for derivative service provision in loans, credit and insurance.

Financial inclusion and gender inequality

Mobile money transfer systems also contribute to bridging another important inequity in access to financial services — gender. Socio-cultural traits of most countries on the continent have left women without access to land, landed property and other items of identification necessary for Know Your Customer requirements by financial sector regulators and commercial banks.

As more governments on the continent make biometric identification systems mandatory and provide available access to telecommunication services, this gap could further be breached with the opportunity for female entrepreneurs to gain profit from mobile money services. China and India have taken the lead in this regard, and Africa can consider short-circuiting the KYC requirements by using this technology to expand financial service access.

Other fintech solutions built on distributed ledger systems like blockchain will also be relevant going forward for Africa. Once we construe access to financial services or financial inclusion as a means to an end, it will be imperative that considerations for smart contracts without the burden of an elaborate and bureaucratic trust system be mainstreamed to support the vast informal sector of the African economy.

Initiatives such as the use of security token platforms to digitizing African real estate, stocks, commodities and fine art spearheaded by the African Union and African Development Bank, will provide the backbone for driving intra-African trade — an agenda key to the implementation of the continental free trade area, given their borderless features.

Is there a demand for innovations?

In 2019, Nigeria, for instance, topped the world in Google searches for Bitcoin (BTC), with similar trends observed in Ghana, Kenya and South Africa. As internet penetration increases across the youthful continent (nearly three-quarters of the African population is below 35 years old, according to data from the United Nations), these services must become ubiquitous and level the playing field for opportunity and prosperity for all Africans.

With young entrepreneurs finding bridges across traditional value chains of the African economy and connecting innovative fintech solutions to gain profit, granted that the right environment is curated, Africa will see not only an expansion in access to financial services but an inclusive design to possibly lead the world in non-internet-based solutions to addressing economic development and growth.

This article was co-authored by Mario Egie and Aly Madhavji.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Mario Egie is the CEO of Kite Financial. Mario has a first degree in physics and has been working as a software developer for more than 4 years. He is the winner of the Tony Elumelu–U.S. Consulate entrepreneurship award of 2019. With a keen interest in African capitalism, Mario founded Kite Financial — a Nigerian blockchain-cryptocurrency startup that is ushering a new financial infrastructure, which will provide the youthful continent financial access, inclusion and freedom.

Aly Madhavji is the managing partner at Blockchain Founders Fund, which invests in and builds top-tier venture startups. He is a limited partner at Loyal VC. Aly consults organizations on emerging technologies, such as INSEAD and the United Nations, on solutions to help alleviate poverty. He is a senior blockchain fellow at INSEAD and was recognized as a “Blockchain 100” Global Leaders of 2019 by Lattice80. Aly has served on various advisory boards, including the University of Toronto’s Governing Council.