Monday’s crypto bloodbath has weighed disproportionately heavily on EOS, as the fourth-largest cryptocurrency recorded a 12.4% drop against the US dollar – its worst one-day performance since February 24.

EOS Price Headlines Crypto Market Decline

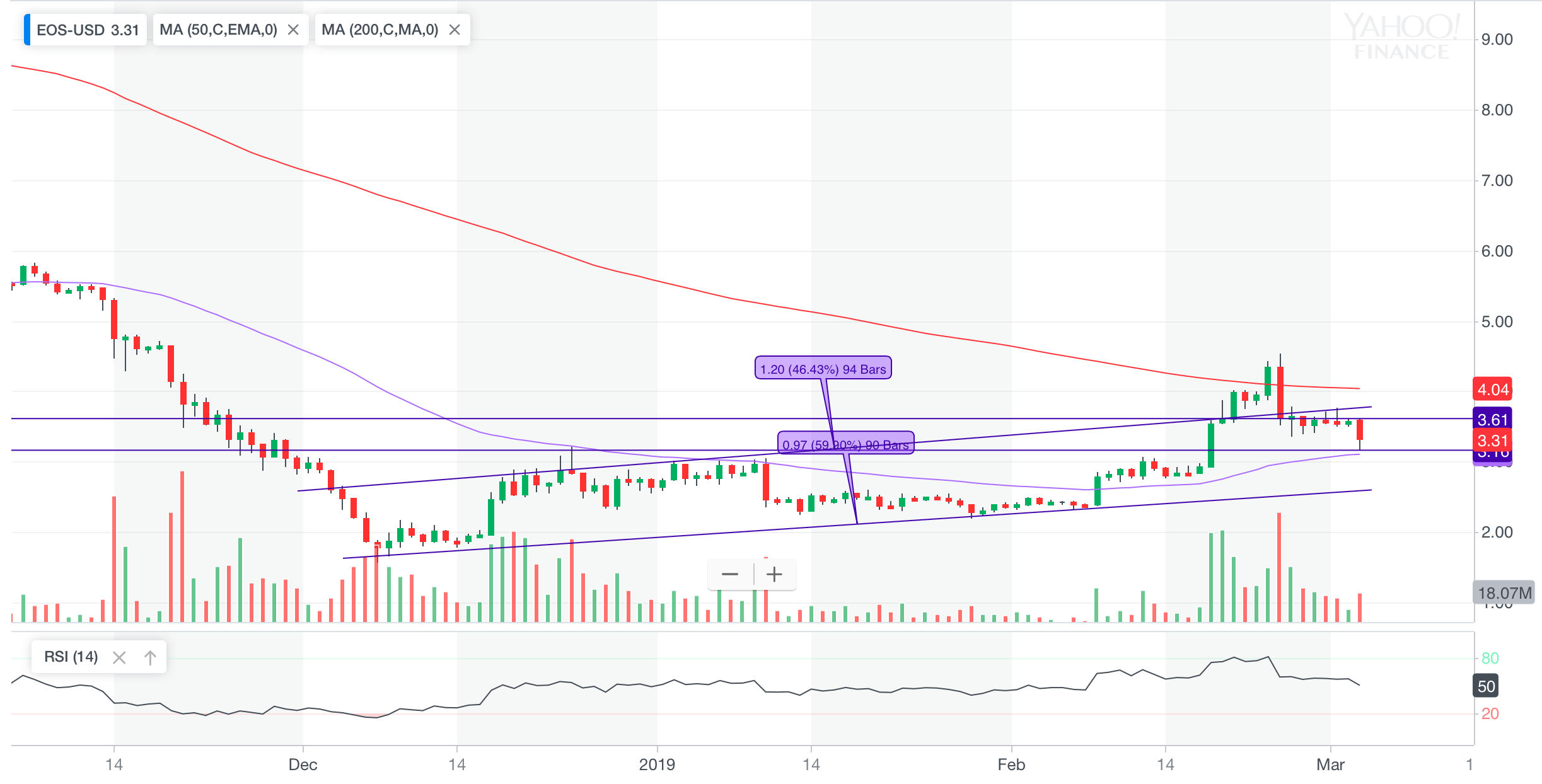

As of the time of writing, the EOS-to-dollar exchange rate (EOS/USD) was trading at $3.290 on the Yahoo Finance index, up 3.94% from the intraday low. Meanwhile, the daily fluctuation pushed EOS’ market capitalization down to $2.95 billion. On Sunday, the coin’s market cap had peaked near $3.25 billion. On a 24-hour adjusted timeframe, volume was close to $1.51 billion, which was approximately 5% of the total cryptocurrency market volume.

In the same timeframe, EOS/USD had traded in a narrow range defined by $3.309 and $3.213. At its current price, the pair is down 30% from its weekly high near $4.52.

Elsewhere in the cryptocurrency market, almost all the top coins are taking losses. Bitcoin Cash and Tron followed EOS closely in terms of depreciation, falling close to 5-6% in a day. Stellar, Litecoin, and Ethereum also slipped 3-5% in the same timeframe. In contrast, Bitcoin, Binance Coin, and XRP depreciated minimally – between a 0.5-2% range.

Are Weak Fundamentals Weighing on EOS?

The market-wide mood explains that EOS was not the only crypto asset which fell. However, in contrast to other top coins, the blockchain asset attracted the maximum negative attention on Monday. While there were technical reasons at play, it was the fundamental reasons that maximized EOS losses.

The biggest news to hit the EOS market was of a blacklisted account that reportedly stole 2.09 million EOS, which was close to $7.26 million at the time of the theft. It was the second time since December 2018 EOS faced a security issue that required block producers to censor an account. Earlier, hackers had reportedly stolen 400,000 tokens.

Soon after the reports of $7.26 million hack went to press, EOS/USD crashed 22.5% in a day. From the technical perspective, the pair formed a giant bear pole. Later, it underwent a sideways consolidation period, creating a bear flag pattern on low volume days. However, today it broke further down after validating the bear flag, establishing yet another bear pole and confirming the interim downtrend.

Coming back to fundamentals, investors may have shorted EOS the most after they found that the blockchain project, compared to its competitions, was developing at a slow speed. CryptoMiso, a portal which tracks blockchain projects’ development activity, reported a decline in EOS commits on GitHub in the last three months.

A commit signifies developers’ proposals to improve the blockchain in concern. If the core likes a commit, they integrate their code in the next upgrade. Typically, a healthy number of commits signifies steady development.

EOS: Technical Outlook

The EOS/USD price action is taking place inside an ascending channel.

The EOS downtrend has located a support level near the 50-period daily moving average curve (indicated in purple). To the upside, the 200-period daily moving average is capping the bullish attempts from flourishing. An extended selling action could have EOS/USD break the 50-EMA to target the ascending channel’s support as a potential short target. This lower trendline has provided support to EOS downtrends on multiple occasions, so its relevance is higher in the context of current price action.

Conversely, a bounce back could allow EOS to retest the ascending channel resistance while targeting the 200-SMA as a potential long target.