Markets tend to behave in massive cycles. One of those cycles is the previous Bitcoin (BTC) price cycle from 2014 to 2017. However, within those cycles, are multiple smaller cycles that could often repeat.

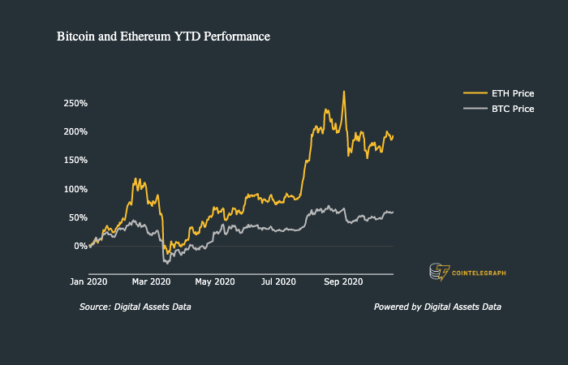

A similar approach and analysis can be made for Ethereum’s Ether (ETH), which is outperforming BTC year-to-date, as the majority of its impulse upward moves have corrected heavily to retest previous resistance levels.

When is the best period to buy ETH/USD and what potential levels can be hit in the next move? Let’s take a look at the charts.

Ether looking for a higher low to confirm new uptrend

ETH/USD 1-week chart. Source: TradingView

The weekly chart shows a clear breakout above the 100-week and 200-week moving averages (MAs) earlier in the year. A breakout that also caused the price to break above the crucial resistance level of $300.

This $300 barrier has been a resistance zone for close to two years, ever since the bear market for Ethereum began in February 2018.

Since this accumulation period, the price of Ether has been hovering between $80 and $300. Finally, after almost two years, ETH/USD broke above $300, rallying toward the next resistance zone around $500.

However, a breakout during this run is unlikely as the crypto markets still appear to be consolidating within a new cycle. This buildup is relatively dull and doesn’t provide massive volatility.

Another clear signal of this accumulation period is the incentive to continually back-test every previous resistance zone as support. These retests add further momentum for more upside later on.

$300 resistance zone could very likely be the support level

ETH/USD 1-week chart. Source: TradingView

a higher high is already established as the chart is showing regarding the current trend. After such a higher high, the market is looking for a clearcut higher low to confirm the existing trend switch.

However, the crucial question in this regard is at which level can a higher low be established? The most profound answer to this question is the previous resistance at $300 becoming support.

But even if the $300 level doesn’t support, the 200-week MA at $220-245 can sustain and confirm the higher low. These two zones should be watched for investors to see whether buyers are stepping in. The $300 level already held as support, increasing the likelihood of Ether holding above this level.

Second, as the markets tend to move in substantial cycles, new potential resistances can be defined. The impulse move usually lasts the shortest as accumulative and corrective movements tend to take the most prolonged period.

If the $300 area sustains support, new resistances and levels can be defined through horizontal price levels and the Fibonacci extension tool.

ETH/USD 1-week chart. Source: TradingView

The next levels of potential resistance can be found through these indicators and tools at $600 and $775-825.

This would mean that Ethereum could surge more than 100% in the next impulse move, driving the markets to the next level. If Ethereum 2.0 gets released, the strength will only increase, indicating that the second level has been most likely reached.

Patience is required to buy ETH based on the BTC chart

ETH/BTC 1-week chart. Source: TradingView

Multiple arguments and analysis can be derived from the ETH/BTC chart. One of them is the range-bound construction between the 100-Week and 200-Week MA, which indicates that the upwards move was rejected at the 100-Week MA.

However, another indication is made that the price of Ethereum provided weakness throughout the fourth quarter of the year.

The bottom constructions were made in December and January, after which a large impulse move occurred. Therefore, the best period to get into ETH, therefore, is December and January, a move that has historically rewarded patient investors.

If the bottom construction is finished and history repeats itself, potential resistance zones can be found at 0.058 and 0.072 sats, similar to the USD values.

ETH/BTC 1-day chart. Source: TradingView

The daily chart of ETH/BTC is showing clear support at the 0.03 sats level. However, this support level has seen several tests, meaning another test would likely cause the price to drop further south.

This isn’t horrible, however, as the lower support level didn’t see a confirmation test (a support/resistance flip) yet. Traders should watch 0.026 sats if the level of 0.03-0.031 sats is lost for support.

In general, tremendous opportunities may be arising in the markets in the coming weeks/months as 2020 comes to a close, particularly if history repeats itself.

Moreover, the further you get into a cycle, the bigger the impulse moves will be. Another run of 100%+ for Ether is, therefore, likely to occur if the $450 breaks.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.