Ethereum (ETH) options open interest increased by 5 fold over the past three months to reach $337 million.

Although this figure pales in comparison to the current $1.8 billion Bitcoin (BTC) options market, Ether options have grown to reach the same size the BTC options market was roughly 15 months ago.

ETH options open interest in USD terms. Source: Skew

Options are divided into two basic instruments: calls, aimed mostly for bullish strategies, and puts, used chiefly on bearish trades.

This is a simplistic view, but it provides a bird’s-eye-view of what professional traders expectations are as large trades weigh heavier on the index.

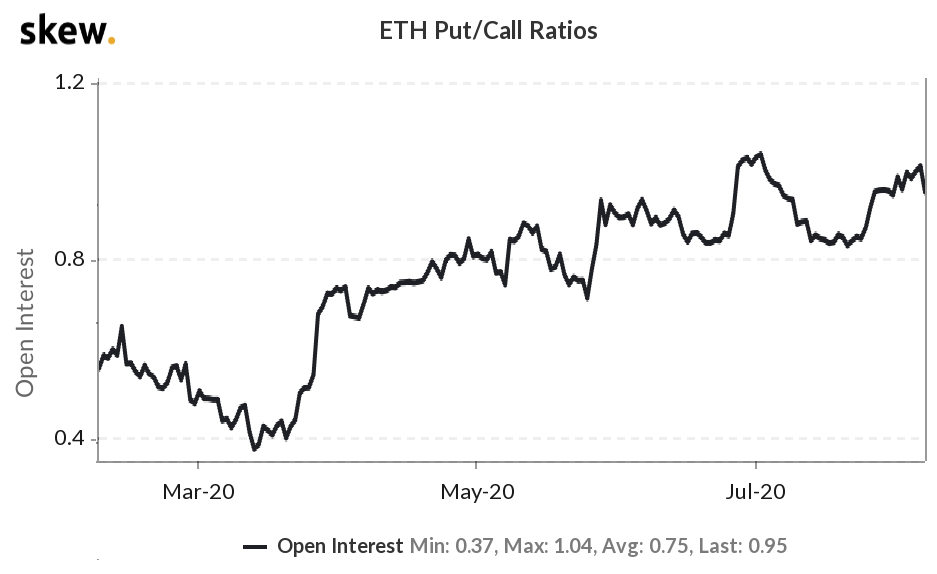

ETH options open interest put/call ratio. Source: Skew

This put/call ratio touched 0.37 in mid-March, indicating put options (bearish) open interest was 63% lower than call options (bullish). All this changed after the crypto market crash on March 12 when Ether price collapsed by more than 40%.

Traders began building protective positions at an impressive pace, and the put/call ratio reached 1.04 in early-June, indicating put options had higher open interest than calls.

As Ether (ETH) failed to break $250 level, open interest receded a bit to 0.84 in mid-July.

Oddly enough, despite the recent 64% rally to current $390 since July 20, options markets continue to add more bearish put options. This indicator shouldn’t be analyzed on a standalone basis as these puts could be worth pennies if their odds are considered low.

Strikes above $400 are not common

Another widely used indicator is the comparison of open interest above and below current market levels.

To reduce the impact of the $400 expiry concentration, one should analyze open interest 6% below the current $390 Ether price and 6% above, thereby excluding such levels.

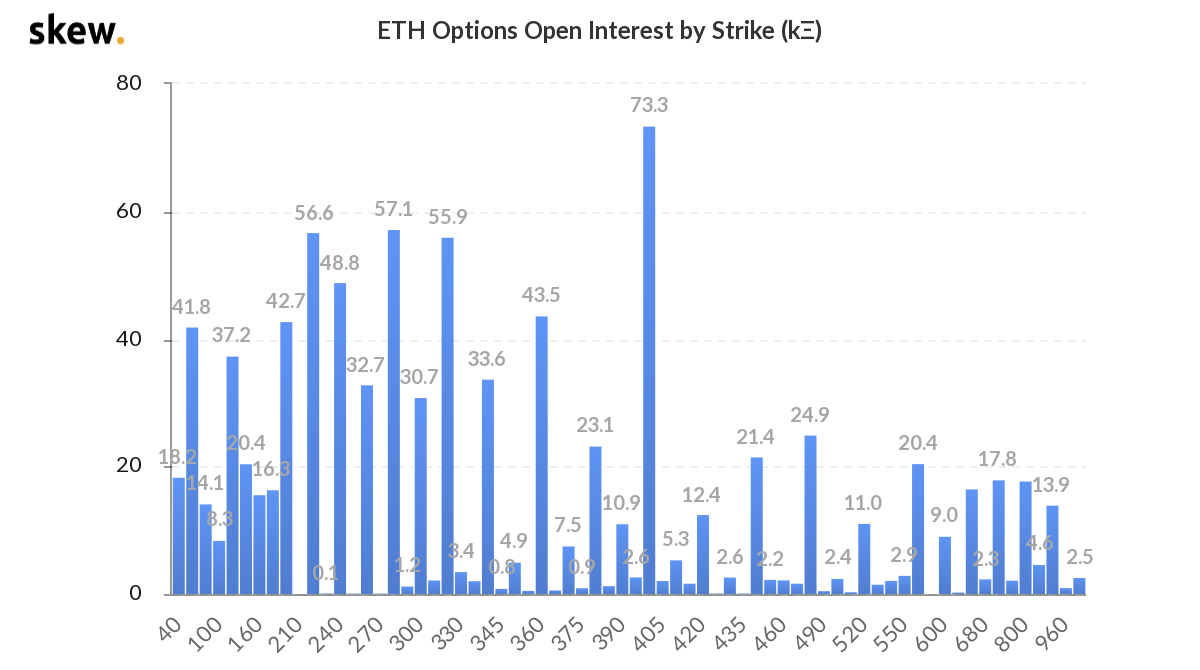

ETH options open interest by strike (thousand). Source: Skew

There are currently 530K ETH options below the $370 expiry, versus 280K ETH with strikes above $400. This indicates 65% options strikes regardless of calls or puts, below current market levels.

Such an indicator might prove most traders were not expecting such a strong rally, although it doesn’t necessarily translate to bearishness.

Given enough time, more trades should go through expiries above $400, and this ratio could balance itself.

Not every indicator is bearish

Options skew measures how much more expensive call options are relative to similar risk put options. A hands-on approach of measuring it compares a call option price 10% above underlying futures reference to a put option 10% below.

In a neutral market, the mark (fair) price for both should be very similar. If the call option is more expensive, it indicates market makers are demanding more money for upside protection.

This is a bullish signal, whereas the opposite with a more expensive put option equates to bearishness.

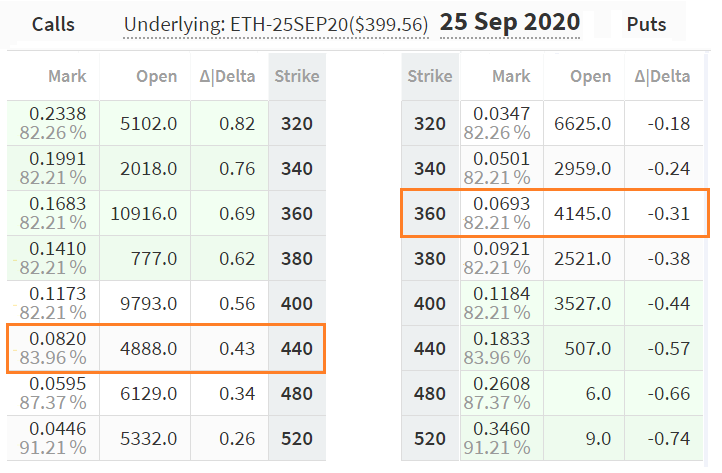

Deribit Ether (ETH) options for September 25 expiry. Source: Deribit

On August 8, ETH markets relative to the $400 underlying September futures are signaling bullishness. Upside protection (call options) 10% above are trading at 0.082 ETH while downside protection (put options) at 0.0693, hence 15.5% cheaper.

This is undoubtedly a bullish indicator, and shouldn’t be biased by recent price changes as market makers continually reevaluate bids and offers according to volatility and market conditions.

Futures contracts also favor bulls

The single most important indicator of a futures contract is the basis level. This is measured by comparing 1-month and 3-month contracts versus the current spot price.

A healthy market should display a contango situation, with futures trading at a 5% or more annualized premium.

Bearish markets will either display a neutral basis, below 5% annualized, or even worse in a situation known as backwardation as the basis goes negative.

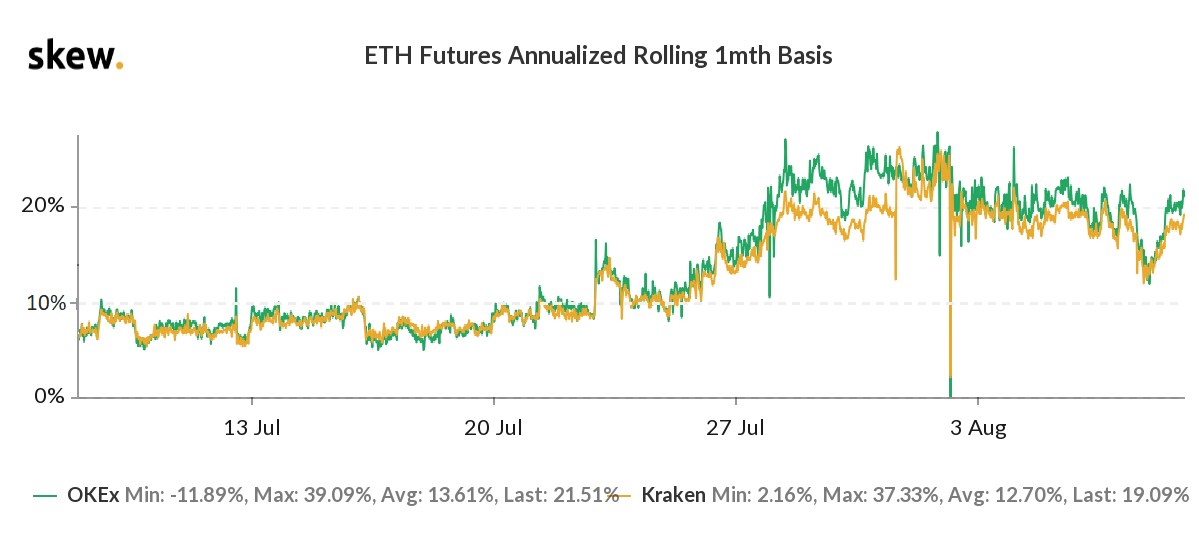

ETH 1-month futures annualized basis. Source: Skew

Currently, ETH futures annualized basis has been sustaining levels above 10% for the past two weeks, indicating a very bullish tone from the standpoint of futures trading.

One should note that the current 20% contango might indicate excessive leverage from buyers, but it is not necessarily dangerous. If most of the leveraged futures positions have been created below current price levels, buyers are comfortable enough to pay for the high carry cost.

Past performance is no guarantee of future results

Many technical analysis traders only analyze the daily and weekly charts to provide insight on an asset’s future possibilities but this generates an incomplete view of the asset’s situation.

Monitoring how market makers are currently pricing options markets and the status of the current future contracts’ premium seems a better way to gauge professional traders sentiment.

Both options put/call ratio and the amount held at each strike level seem contaminated by volumes that happened over two weeks ago, when Ether was trading below $300.

At the moment, trading data on options and futures markets points to a strong bullish perspective from professional traders. This is a good indication that the $400 resistance can be broken over the next couple of weeks.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.