Key Highlights

- ETH price remained in a bearish zone and it is currently trading below $90 against the US Dollar.

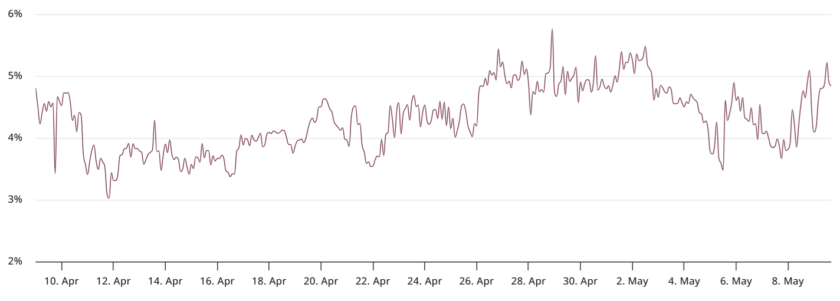

- This week’s followed important bearish trend line is active with resistance at $90 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair may decline in the short term towards the $85 level or the $82 support zone.

Ethereum price failed to extend gains and declined against the US Dollar and bitcoin. ETH/USD might continue to face sellers near the $90 and $92 resistances.

Ethereum Price Analysis

There was a decent support formed near $95 in ETH price against the US Dollar. The ETH/USD pair started a short term upside correction and traded above $88 and $90. There was a break above the 23.6% Fib retracement level of the last slide from the $98 high to $85 low. However, the failed to gain pace above the $90 level and the 100 hourly simple moving average.

The price was rejected near the 50% Fib retracement level of the last slide from the $98 high to $85 low. Moreover, this week’s followed important bearish trend line is active with resistance at $90 on the hourly chart of ETH/USD. The pair retreated from the $91-92 zone and declined below the $90 level. At the moment, it seems like the price may continue to decline towards the $85 support level. If there is a downside extension, the price could revisit the $82 support zone. On the upside, a close above the $92 level and the 100 hourly SMA is needed for a bullish break.

Looking at the chart, ETH price is clearly trading near a major turning point above $82 and $85. If it fails to climb higher, it could even break $82 and drop towards the $75 support level.

Hourly MACD – The MACD has moved back in the bearish zone.

Hourly RSI – The RSI dropped below the 50 level, with a bearish angle.

Major Support Level – $85

Major Resistance Level – $92

If You Liked This Article Click To Share