On Saturday Bitcoin (BTC) and Ether (ETH) price perked up as BTC briefly pushed above $9,700 and Ether set a 2020 high at $309.

The weekend surge comes as a bit of a surprise as weekends are typically marked by low trading volume and some traders avoid the markets due to the volatility that sometimes accompanies the weekly close.

Crypto market weekly price chart. Source: Coin360

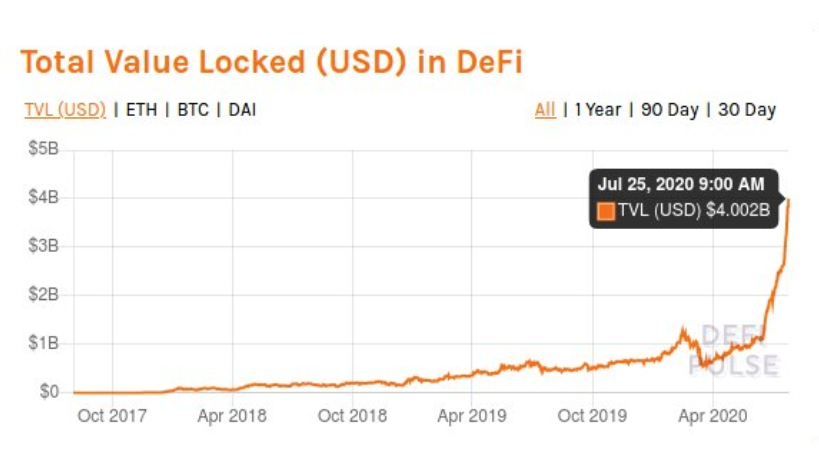

Technicals aside, Ether’s rapid ascent to $309 could also be receiving a sentiment boost from the news that the total value of funds locked into decentralized finance platforms (DeFi) reached $4 billion today.

Total value locked (USD) in DeFi. Source: DeFi Pulse

Currently, the top three DeFi platforms are Maker Aave, and Compound with each having $875 million, $639 million and $616 million locked into an assortment of contracts.

Data from DeFi Pulse shows that the decentralized finance sector has grown tremendously in 2020 as the value locked at the start of the year was slightly below $1 billion.

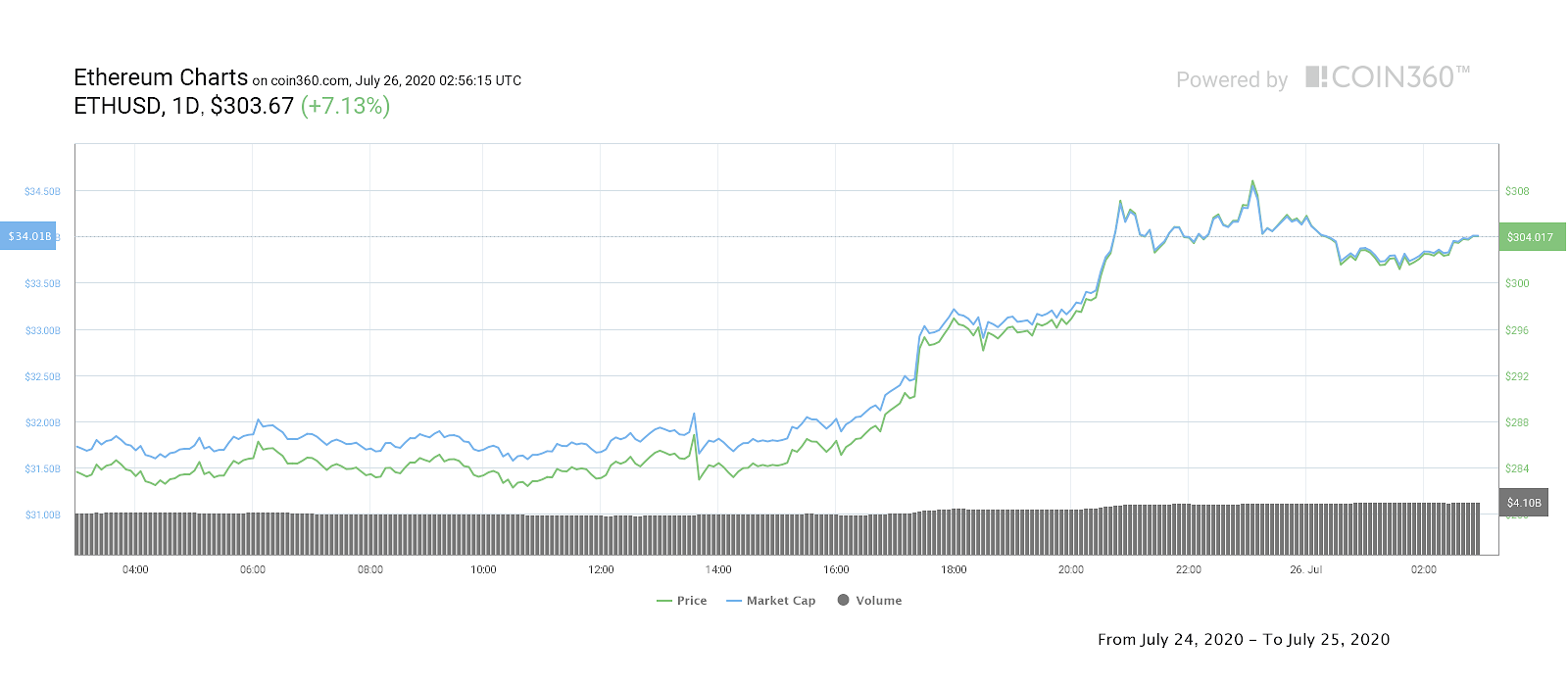

As discussed in a previous market update, Ether’s was expected to push toward the $317 level if the Feb. 14, 2020 high at $288.32 was cleared and Saturday’s rally to $309 fell just $8 short of topping the resistance cluster extending to $317.

Ether daily price chart. Source: Coin360

After a nearly 30% rally this week, a period of consolidation is to be expected but if bulls find renewed or Bitcoin rallies into the weekly close, there is a possibility that the price could clear $317 and the absence of overhead resistance could see bulls target the 2019 high at $367.

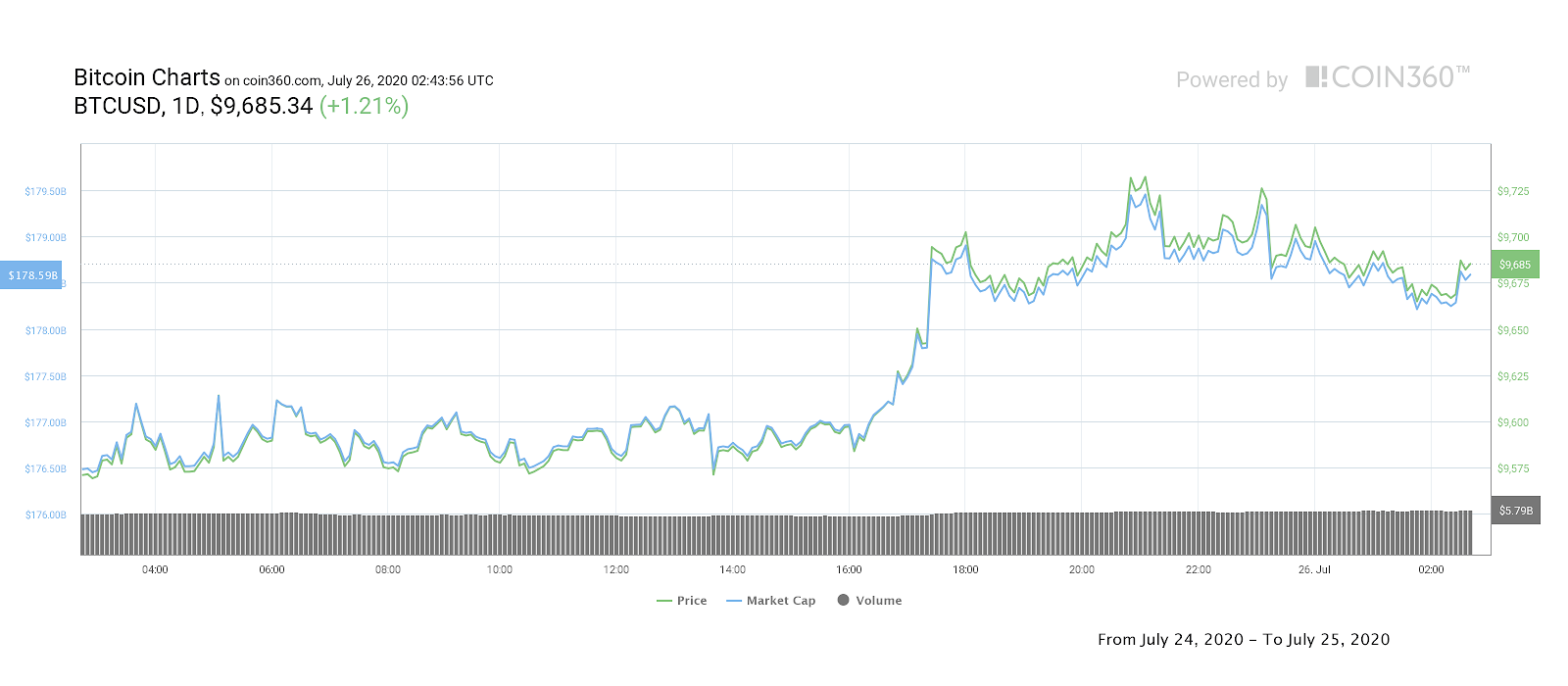

Bitcoin approaches a key resistance

As Ether surged to a new 2020 high, Bitcoin price pushed higher to $9,733. Traders are now watching closely to see if the top-ranked digital asset on CoinMarketCap can surge above the $9,900 level as this would place the price above the long-term descending trendline from the 2017 all-time high.

According to Cointelegraph contributor Michael van de Poppe: “A major parabolic move is unlikely to happen so soon, as the price has some untested levels above, namely $9,900 and $10,100.”

Van de Poppe further explained that:

“The most likely scenario would be a “staircase” pattern where the price of Bitcoin rallies towards the resistance zone, rejects, and then successfully tests the previous resistance zone for support. Next, the price move is likely to accelerate upward once Bitcoin breaks above the high of $10,100.”

At the time of writing Bitcoin price has pulled back slightly from the daily high at $9,733 but the daily chart shows the digital asset continues to notch higher highs and high lows and the price remains above the 20-day moving average.

Bitcoin daily price chart. Source: Coin360

As Bitcoin and Ether pushed higher, a number of altcoins also made significant moves.

Cardano (ADA) surprised investors with a strong 21% upside move to $0.1457, Binance Coin (BNB) also continued to rally with a 5% gain. Litecoin (LTC) followed alongside Bitcoin with a 12.88% move to $49.47.

According to CoinMarketCap, the overall cryptocurrency market cap now stands at $294.6 billion. Bitcoin’s dominance index currently at 60.5%.