The price of Ethereum (ETH) is continuing to rally, reaching $2,000 on April 2 on the back of strong technical momentum following a high-profile announcement from Visa.

As Cointelegraph previously reported on March 29, Visa will allow its partners to use USDC on the Ethereum blockchain network to settle transactions.

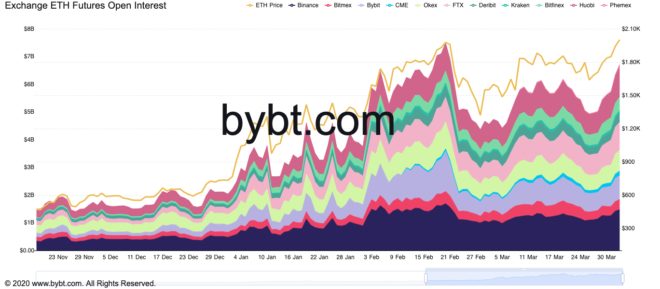

Since then, the interest in Ethereum across both futures and options markets is seeing an uptick, with the former approaching $7 billion, the highest in over a month.

The options market for Ethereum is particularly optimistic

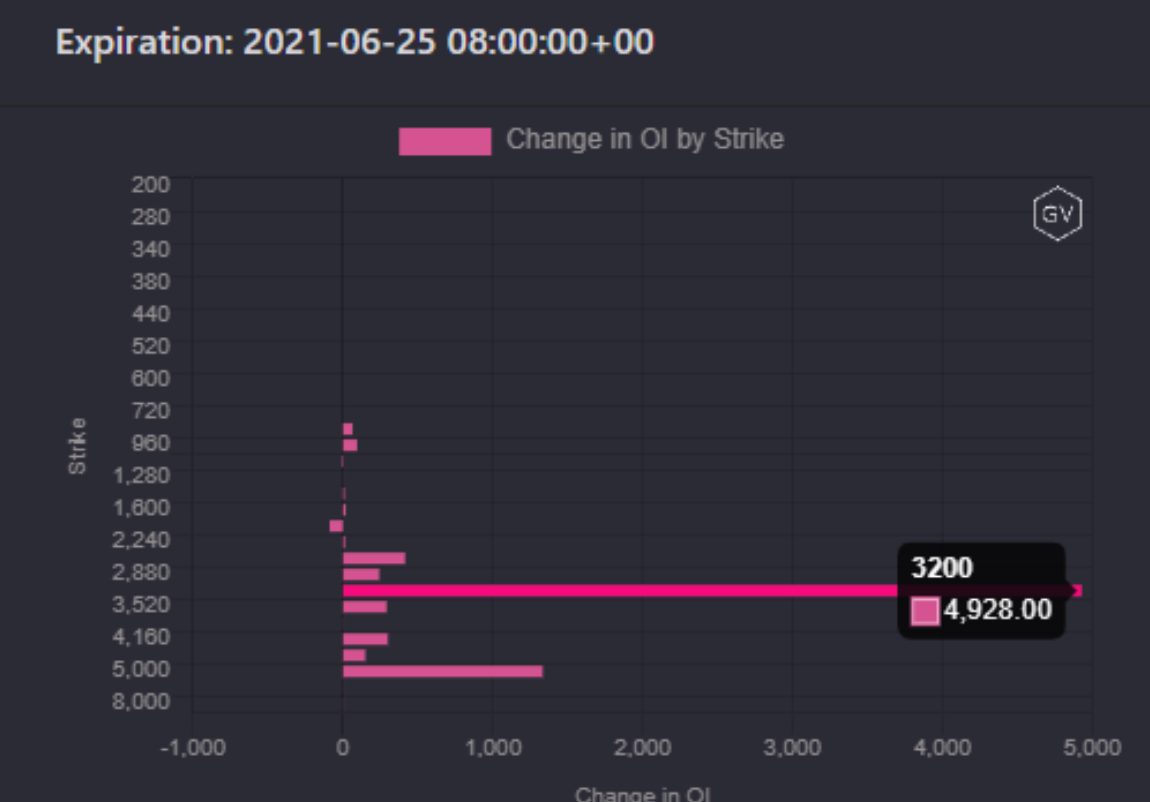

According to Cantering Clark, a cryptocurrency trader and analyst, the Ethereum options market shows big bets heading into June.

The strike price with the highest open interest is $3,200. Although this does not necessarily mean that there is a high probability of ETH hitting $3,200, it indicates that there is significant interest at that price level. The trader said:

“Is it the start of $ETH season? Options market making some big bets into June. 3200 strike has a bullseye on it.”

While there could be multiple reasons why traders might be anticipating ETH to surpass $3,000 by June, one of the biggest factors is the much-anticipated EIP1559 upgrade.

EIP1559 is set to go live in July 2021, which would overhaul the existing fee structure of the Ethereum blockchain.

Simply put, the proposal burns fees that are paid in ETH rather than paying miners, which proponents say should stabilize fees for transacting on the Ethereum blockchain. As Cointelegraph reported, the cost of using the blockchain rose 77% over the past few days in line with a 31% increase in the price of Ether.

EIP1559 essentially burns some of the ETH paid for transacting, which should reduce the circulating supply of ETH and hence put upward pressure on its value.

Since a lot of options targeting the June strike price would expire right before the EIP1559 implementation, it means traders are expecting a rally going into the implementation phase.

Massive ETH outflows are also being spotted

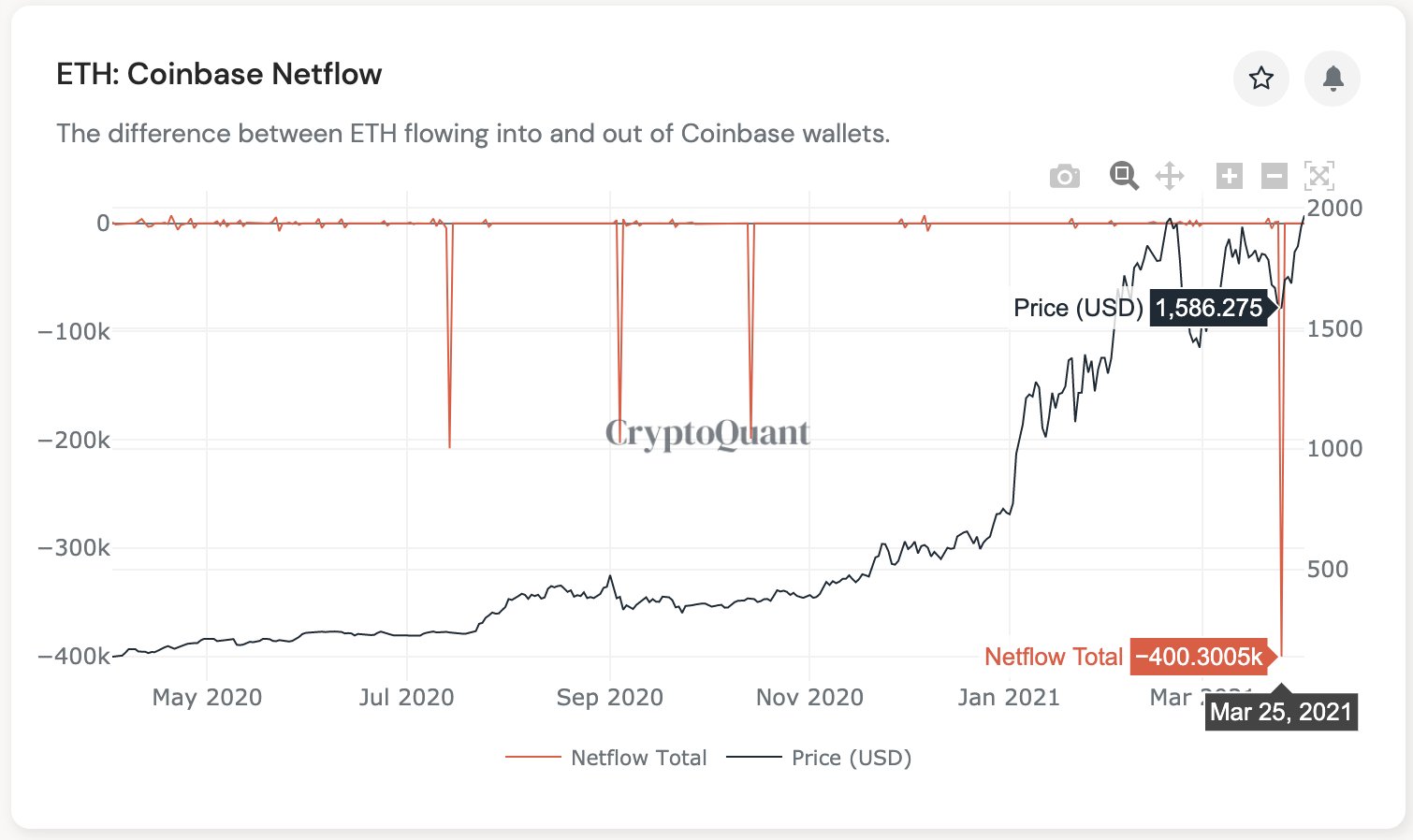

Meanwhile, Ki Young Ju, the CEO at CryptoQuant, points out that Ethereum has been seeing massive exchange outflows in the past few days.

Earlier this week, Ki noted that 400,000 ETH left Coinbase, which could signal a spike in institutional interest in ETH. He said:

“400k $ETH flowed out from Coinbase a few days ago. Speculative guess, institutions are now buying $ETH.”

Outflows often signal strong accumulation by institutions and high-net-worth individuals because when whales buy cryptocurrencies on an exchange, they typically move their holdings to self-hosted wallets.

Hence, the view is generally optimistic for Ethereum over the next few months because positive on-chain data is supplementing a strong fundamental catalyst in EIP1559.

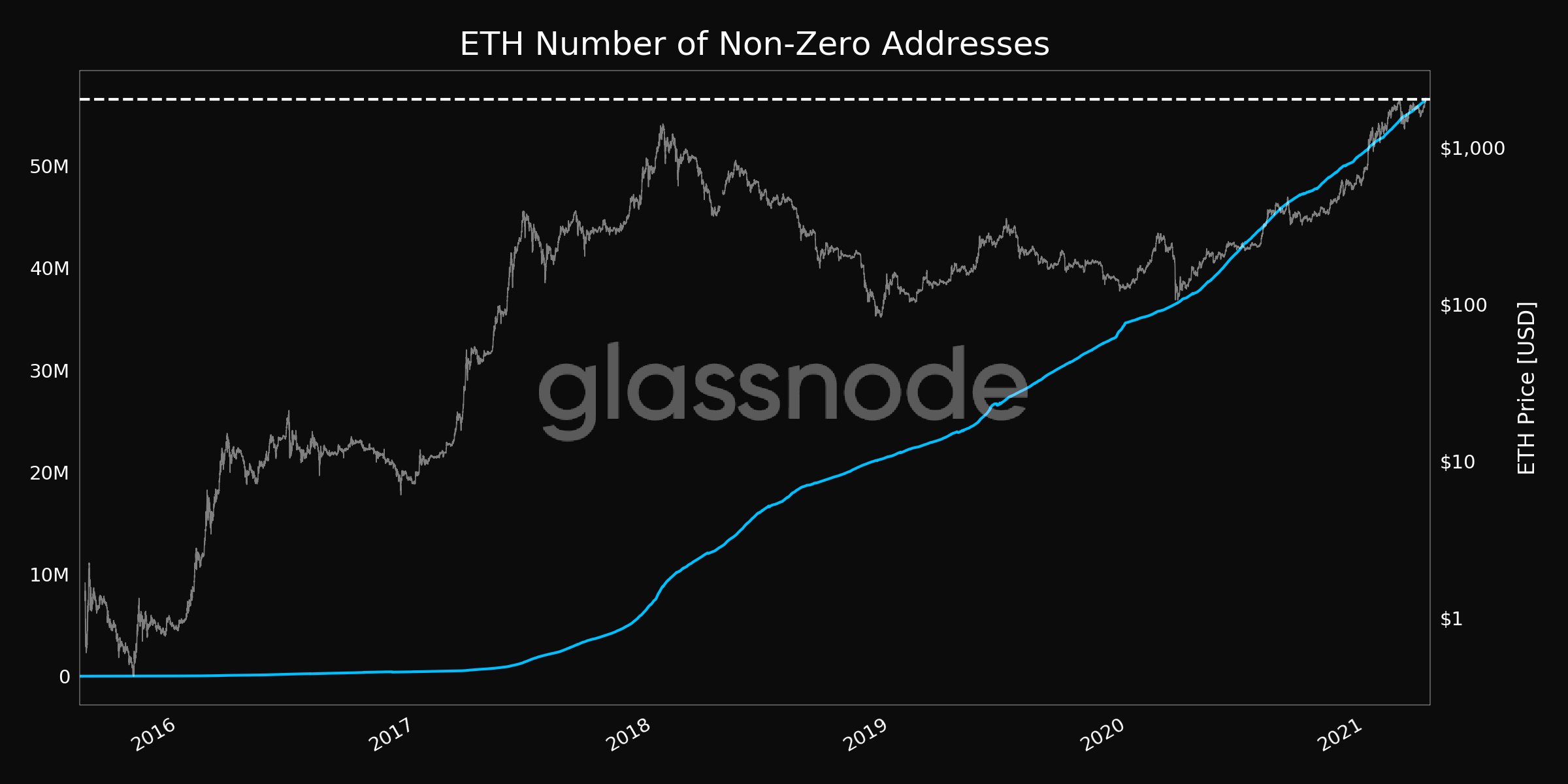

Atop this, the number of active addresses are continuing to increase with exchange reserves consistently declining, indicating rising user activity and demand for ETH.

Glassnode also reported that the number of non-zero addresses hit a new high, suggesting that user activity is on the rise.

Researchers at Glassnode said:

“Ethereum $ETH Number of Non-Zero Addresses just reached an ATH of 56,543,380”