Ether (ETH ) has broken a critical price point against Bitcoin (BTC ), signalling that altcoins may be about to see huge gains.

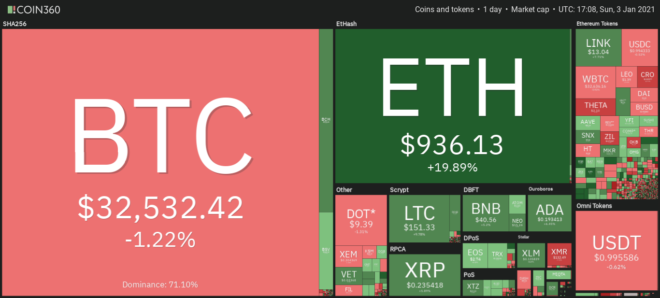

Cryptocurrency market overview. Source: Coin360 I’d take Ether bet “all day long” — Winklevoss

Data from Cointelegraph Markets , Coin360 and TradingView showed ETH/BTC pass the essential 0.026 level in just one daily candle on Jan. 3.

After staying weak throughout December, Ether has rebounded in the first few days of 2021, and Sunday’s performance could be the start of something much bigger.

As Cointelegraph Markets analyst Michaël van de Poppe noted last week, 0.026 BTC is a significant breakout point, and flipping it to support indicates “strength and continuation” of a bullish resurgence.

“It’s time for #Ethereum, #Polkadot, #Cardano, #Chainlink and more to break all-time highs,” he told Twitter followers on Sunday.

ETH/BTC 1-day candle chart (Bitstamp). Source: TradingView At press time, ETH/USD was approaching landmark price levels of its own, taking aim at $1,000 on the back of 21% daily gains. The last time that the pair traded at four figures was in January 2018.

“$ETH was the best performing asset (up 450%) of 2020 hands down and still below its all-time high,” Cameron Winklevoss, entrepreneur and co-founder of exchange Gemini, added on Twitter.

“Today it’s the equivalent of 15K #Bitcoin I would take that bet all day long.”

Altseason is here at least?

With the prospect of “altseason” now firmly back on the menu , top ten market cap altcoins are showing signs of life against Bitcoin.

Litecoin (LTC ) is up 18% against the largest cryptocurrency, while Bitcoin Cash (BCH ) is 13.3% higher and Cardano (ADA ) 9.7%.

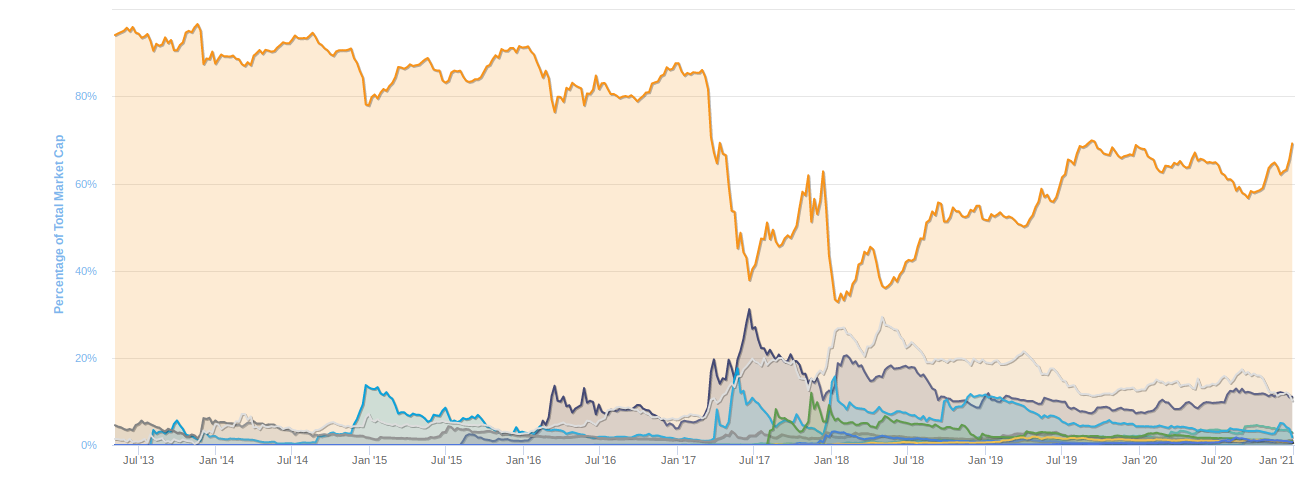

Even XRP , still struggling on the back of legal action against Ripple , is finding its feet again with 3.5% daily progress in BTC terms. Bitcoin’s overall market cap dominance remains above 70%.

<img decoding="async" src="https://fastcrypto.trade/wp-content/uploads/2021/01/1609695383_41_Ethereum-targets-1K-after-ETH-altcoins-rally-versus-Bitcoin.png"/> Bitcoin market cap dominance historical chart. Source: CoinMarketCap As Cointelegraph reported , meanwhile, a longer-term commitment to altcoins may also prove lucrative this year. Mining Ether, for example, could net over $120,000 per annum.

Original

Post navigation

<img width="640" height="360" src="https://fastcrypto.trade/wp-content/uploads/2025/06/coinbase-bitcoin-replacing-us-dollar-as-reserve-currency-840x473.jpg" class="attachment-large size-large wp-post-image" alt="" decoding="async" srcset="https://fastcrypto.trade/wp-content/uploads/2025/06/coinbase-bitcoin-replacing-us-dollar-as-reserve-currency-840x473.jpg 840w, https://fastcrypto.trade/wp-content/uploads/2025/06/coinbase-bitcoin-replacing-us-dollar-as-reserve-currency-649x365.jpg 649w, https://fastcrypto.trade/wp-content/uploads/2025/06/coinbase-bitcoin-replacing-us-dollar-as-reserve-currency-500x280.jpg 500w, https://fastcrypto.trade/wp-content/uploads/2025/06/coinbase-bitcoin-replacing-us-dollar-as-reserve-currency-768x432.jpg 768w, https://fastcrypto.trade/wp-content/uploads/2025/06/coinbase-bitcoin-replacing-us-dollar-as-reserve-currency-100x56.jpg 100w, https://fastcrypto.trade/wp-content/uploads/2025/06/coinbase-bitcoin-replacing-us-dollar-as-reserve-currency.jpg 1280w" sizes="(max-width: 640px) 100vw, 640px" />

<img width="612" height="434" src="https://fastcrypto.trade/wp-content/uploads/2025/06/Bitcoin-from-Getty-Images-44.jpg" class="attachment-large size-large wp-post-image" alt="" decoding="async" srcset="https://fastcrypto.trade/wp-content/uploads/2025/06/Bitcoin-from-Getty-Images-44.jpg 612w, https://fastcrypto.trade/wp-content/uploads/2025/06/Bitcoin-from-Getty-Images-44-515x365.jpg 515w, https://fastcrypto.trade/wp-content/uploads/2025/06/Bitcoin-from-Getty-Images-44-100x71.jpg 100w" sizes="(max-width: 612px) 100vw, 612px" />

<img width="640" height="360" src="https://fastcrypto.trade/wp-content/uploads/2025/06/cc123-840x473.png" class="attachment-large size-large wp-post-image" alt="" decoding="async" srcset="https://fastcrypto.trade/wp-content/uploads/2025/06/cc123-840x473.png 840w, https://fastcrypto.trade/wp-content/uploads/2025/06/cc123-649x365.png 649w, https://fastcrypto.trade/wp-content/uploads/2025/06/cc123-500x280.png 500w, https://fastcrypto.trade/wp-content/uploads/2025/06/cc123-768x432.png 768w, https://fastcrypto.trade/wp-content/uploads/2025/06/cc123-100x56.png 100w, https://fastcrypto.trade/wp-content/uploads/2025/06/cc123.png 1280w" sizes="(max-width: 640px) 100vw, 640px" />

<link data-minify="1" rel='stylesheet' id='wp-block-library-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-includes/css/dist/block-library/style.min.css?ver=1734834998' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='contact-form-7-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/contact-form-7/includes/css/styles.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='easy-sidebar-menu-widget-css-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/easy-sidebar-menu-widget/assets/css/easy-sidebar-menu-widget.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='wp_automatic_gallery_style-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/wp-automatic/css/wp-automatic.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='wordpress-popular-posts-css-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/wordpress-popular-posts/assets/css/wpp.css?ver=1734804993' type='text/css' media='all' /><link rel='stylesheet' id='jquery-bxslider-css' href='https://fastcrypto.trade/wp-content/themes/supermag/assets/library/bxslider/css/jquery.bxslider.min.css?ver=4.2.5' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='font-awesome-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/themes/supermag/assets/library/Font-Awesome/css/font-awesome.min.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='supermag-style-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/themes/supermag/style.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='supermag-block-front-styles-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/themes/supermag/acmethemes/gutenberg/gutenberg-front.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='the_champ_frontend_css-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/super-socializer/css/front.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='wp-paginate-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/wp-paginate/css/wp-paginate.css?ver=1734804993' type='text/css' media='screen' />