eToro senior markets analyst Mati Greenspan isn’t one to mince words. When responding to a query on entry-level crypto investing, the portfolio manager didn’t hesitate to point out the top three cryptocurrency choices that are currently piquing his interest:

Hi Paul. My top three favorite cryptos right now are BTC, LTC, & BNB.

This is not trading advice. I don’t know the future. Also, my personal portfolio & opinions tend to shift over time.

That said, diversification is key and you should always explore other markets as well. https://t.co/90w0awa6Wa

— Mati Greenspan (@MatiGreenspan) September 8, 2019

Greenspan’s favorite three coins for the long term include the likes of bitcoin, Litecoin, and Binance Coin. He also told CCN the reason behind one of his surprising picks. Let’s briefly run through some fundamentals and see how his picks stack up.

Bitcoin (BTC)

Bitcoin is the no-brainer on this list. Crypto’s flagship currency couldn’t be healthier. The number of resources committed to its network, or hash rate, continues to climb to record-breaking heights.

It’s combined computing power is rapidly approaching the 90 million tera hash mark, which unequivocally makes it the most secure blockchain around.

Bitcoin may be slower than its younger cousins, however, it has largely outperformed this year, registering an impressive 180% gain since January.

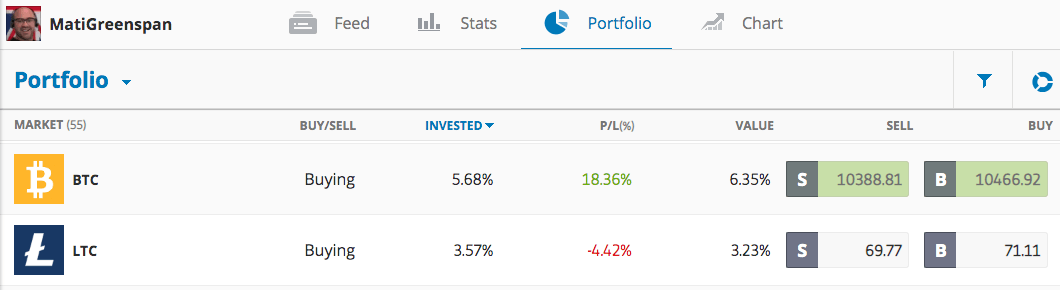

Most noteworthy, Greenspan’s portfolio currently includes a hefty weighting of 5.68% in Bitcoin.

Litecoin (LTC)

Litecoin is probably the odd man out in the bunch. The Litecoin Foundation was briefly entangled in controversy last month after a leaked telegram chat surfaced on Reddit.

The upload suggested that developers were losing interest in the protocol and that little progress was being made. CCN reached out to the Litecoin Foundation for comment at the time but received no response.

16/ Last thing I want to add is that I will work on better communication with the community and give more frequent updates on things.

— Charlie Lee [LTC⚡] (@SatoshiLite) August 11, 2019

Fortunately, Litecoin creator Charlie Lee subsequently promised to improve overall communication within the community. Greenspan agrees and explained to CCN why he specifically chose LTC as his second choice:

“Because it has great brand name recognition. Litecoin has a strong community and that translates into value.”

That and the recent Litecoin halving certainly have enticed buyers into the market. Litecoin is up a solid 138% this year. His portfolio weighting for Litecoin sits at around 3.57%.

Binance Coin (BNB)

It’s hard to justify the genuine utility of most cryptocurrencies in the aftermath of the altcoin bust. Binance has, however, completely bucked that trend thanks to the dominance of its exchange.

A recent interview revealed that the company has somewhere in the region of 13 million to 15 million users, all of whom are incentivized to own its BNB currency.

Owners benefit from regular coin burns and free BNB conversions for coins that leave trace amounts in their accounts. Both have resulted in significant appreciation this year.

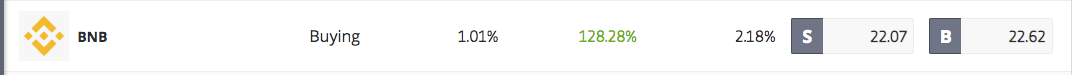

Binance Coin is up a mouthwatering 275% in 2019, though Greenspan’s portfolio has a much lower weighting at around 1.01%.

Mati Greenspan: DYOR

Given bitcoin’s momentous run in recent years, smart investors might want to have some exposure to crypto. But as Greenspan himself points out, don’t take this as investment advice. Do your own research.