After a sharp drop in Bitcoin (BTC)’s value on May 10 — just ahead of today’s halving of block rewards for miners on the network — several exchanges scrambled to inject liquidity into their BTC insurance funds.

Earlier today, Binance revealed it had used “over 13,000,000” Tether (USDT) yesterday to protect traders from the risk of auto-deleveraging (ADLs) on its platform.

“We will inject an additional 30,000,000 $USDT into the insurance fund, on top of the 7,500,000 USDT from April 30th,” the exchange pledged.

The exchange’s insurance fund balance for BTC/USDT contracts plummeted overnight from 21,005,925 USDT on May 10 to just 7,731,989 on May 11.

In response to a request from Cointelegraph, Binance declined to provide further comments beyond its official public announcement on social media.

The impact across the exchange sector

Fresh data for Bitcoin derivatives exchange Deribit reveals that its insurance fund balance remained relatively stable, declining just fractionally from 501.96 BTC on May 9 to 498.99 as of today, May 11.

Yet there was a significant surge of 386 bankruptcies among traders on May 10 — a 565% increase over the previous day.

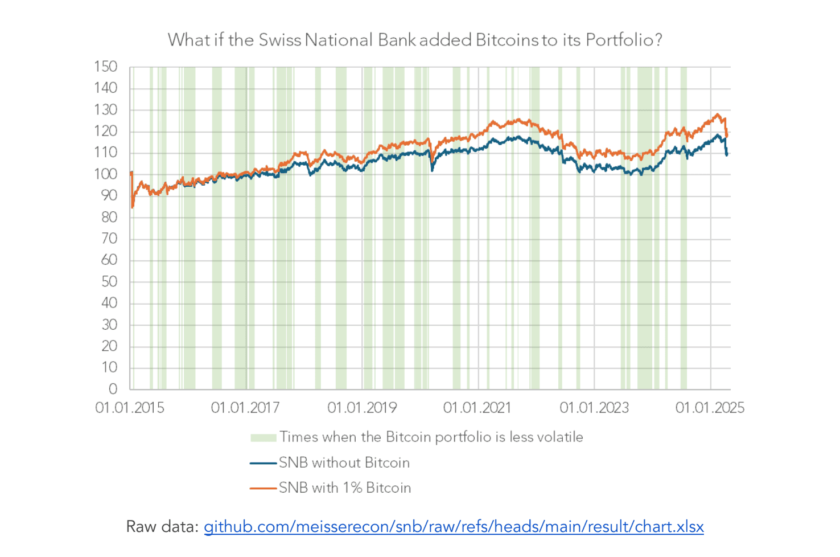

Deribit’s BTC insurance balance charts, May 11. Source: Deribit

On crypto exchange OKex, 31.67 BTC was deposited into its BTC/USD Futures Insurance Fund on May 10, with 35.1 BTC immediately withdrawn thereafter to cover a recorded bankruptcy loss.

Huobi’s insurance fund saw a reduction from 1,536 BTC on May 9 to 1,418 by May 10 — which has risen slightly to 1431 as of press time. Unlike OKex, Huobi does not provide a breakdown of the data that would reveal the pattern of withdrawals and deposits for its fund.

On crypto derivatives trading platform BitMEX, the exchange’s daily insurance fund dipped only slightly between May 9 and 10 — from 35,760 BTC to 35,374 BTC. As of press time, its balance is yet to be updated for March 11, limiting insight into the impact of the BTC price rout on traders.

With the Bitcoin halving imminent, the top coin has managed to break above the $8,800 resistance level and is trading at $8,914 as of press time, according to Cointelegraph’s Bitcoin Price Index.