Imagine a future where bitcoin has taken over from the U.S. dollar as the world’s de facto reserve currency. Assuming bitcoin’s notorious price volatility continued to that day, major currencies would be considered volatile assets.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

Here’s a chart of how foreign-exchange rates would have looked over the past few months had the dollar, euro, yen and British pound been denominated in bitcoin:

Such a mental exercise is one of the points highlighted in a recent report on “stablecoins” by Matt Walsh and Nic Carter of the cryptocurrency investment firm Castle Island Ventures.

In the taxonomy of digital assets, stablecoins are a category of tokens whose value is linked to dollars or other major currencies or assets. The idea is that their prices are more stable than those of bitcoin and other cryptocurrencies.

But Walsh and Carter refer to dollar-backed stablecoins as “crypto-dollars.” Stability, in other words, is in the eye of the beholder.

“Though initially dubbed ‘stablecoins,’ due to their emergence as a response to volatile ‘native’ cryptocurrencies, they are increasingly being referred to as crypto-dollars,” the report reads.

Such a rebranding could gain traction as dollar-linked stablecoins grow in popularity – even though they’ve been a pretty lousy investment option in recent months compared with bitcoin.

As detailed in First Mover last week, every digital asset in the CoinDesk 20 gained in July, except for dollar-linked stablecoins, whose prices were, by definition, unchanged in dollar terms.

That’s partly a reflection of how weak the dollar has been trading in foreign-exchange markets lately, which in turn is a reflection of investors’ pessimistic views on the dollar’s value as the coronavirus-induced recession drags on.

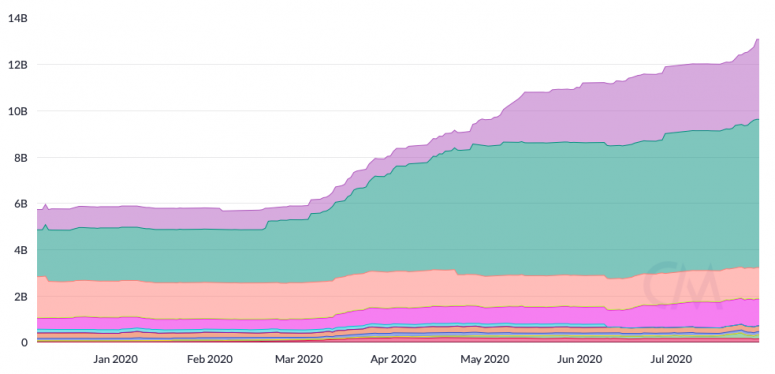

The total outstanding amount of these “crypto-dollars” has more than doubled in the past four months to about $13 billion, according to Coin Metrics, a cryptocurrency data firm.

Crypto traders use the tokens as a form of liquidity, transferring funds easily between digital-asset exchanges.

The tokens are essentially privately issued digital money, and Castle Island points out that they might someday figure in a “global patchwork of crypto-dollar issuers.” Already, a group of 16 of the dollar-linked stablecoins collectively has a broad monetary base greater than that of 72 countries.

There’s a “growing acceptance of crypto-dollars in commerce,” according to the report, as well as a “recognition that these assets are not merely tokens for inter-exchange settlement but have begun to see usage as non-bank dollar substitutes.”

Jump Capital, an investment firm, wrote in an op-ed for The Block last week that, at least for now, “people want dollars.”

“Despite potential concerns about U.S. monetary policy and debt levels, for billions of people around the world, the U.S. dollar is more stable than their local currency,” according to the piece. They predicted that the market value of stablecoins could eventually outstrip that of bitcoin, currently at $218 billion.

“We believe U.S. dollar stablecoins, or crypto-dollars, may very well end up being the ‘killer app’ for crypto,” the authors wrote. “We may very well end up hearing calls for ‘Stablecoins not bitcoin’ in the same way we heard ‘Blockchain not bitcoin’ a few years ago.”

Such an outlook assumes people continue to want stability in dollar terms. After all, prices for the oldest and largest cryptocurrency are up 65% this year against the dollar.

Which means those crypto-dollars are down 65% this year, in bitcoin terms.

Tweet of the day

Bitcoin watch

BTC: Price: $11,764 (BPI) | 24-Hr High: $11,982 | 24-Hr Low: $11,663

Trend: Bitcoin’s rally looks to be on pause after the bulls failed to keep gains above the $12,000 mark on Monday.

The leading cryptocurrency is currently trading near $11,760, representing a 1.3% decline on the day. Buyers pushed prices to a high of $12,070 on Monday, but the breakout was again short-lived and prices printed a UTC close below $11,800.

Bitcoin’s failure to establish a foothold above the psychological $12K hurdle validates uptrend exhaustion signaled by lower highs on the daily chart MACD histogram, an indicator used to identify trend changes and trend strength. Further, the 10-day moving average is no longer sloping upwards – also a sign of ebbing of bullish momentum.

As such, some chart-driven traders may start to sell, yielding a deeper pullback. Immediate support is located near $11,670 at the ascending trendline on the 4-hour chart. A breach there would expose the higher low of $11,219 created on the 4-hour chart on Aug. 7.

However, if the ascending trendline holds firm, a bounce to $12,000 may be seen.

That said, the greater short-term pressure may be to the downside, as gold has fallen back below $2,000 per ounce. Bitcoin generally rallied in tandem with gold in the second half of July.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.