A slowdown in cryptocurrency trading on so-called decentralized exchanges has helped to alleviate congestion on the Ethereum blockchain, at least temporarily mitigating concerns the network was becoming overloaded.

The trading lull comes as prices tumble for many of the hottest tokens from the fast-growing arena of decentralized finance, or DeFi. SushiSwap’s SUSHI token, one of this year’s splashiest debuts , fell by 77% in the past 30 days, while DeFi lender Compound’s COMP tokens lost 37%.

On Uniswap, the biggest decentralized exchange, or DEX, daily trading volumes have crashed to $224 million, versus a record high of $954 million on Sept. 1.

“Low volatility in the crypto market as a whole has contributed to lower transaction volume and costs,” said Connor Abendschein, a crypto research analyst at Digital Assets Data.

DeFi, a subsector of the cryptocurrency industry where entrepreneurs are developing semi-automated trading and lending platforms atop blockchain networks, had surged in popularity in recent months among investors and traders alike. But the resulting congestion raised concerns elevated fees for sending transactions over the blockchain might stymie some users, or push application developers to consider alternative networks.

Bitcoin Watch

Bitcoin remains comatose around $10,600 even though optimism has returned to equity markets.

S&P 500 futures are pointing to a positive open with a 0.53% gain. Stock markets in Asia and Europe eked out gains earlier today on renewed expectations for an additional U.S. fiscal stimulus.

The “risk-on” is weighing over the safe-haven U.S. dollar in the forex market. So far, however, that dollar weakness hasn’t propelled bitcoin higher.

The top cryptocurrency is currently trading around $10,600, down 0.6% on the day.

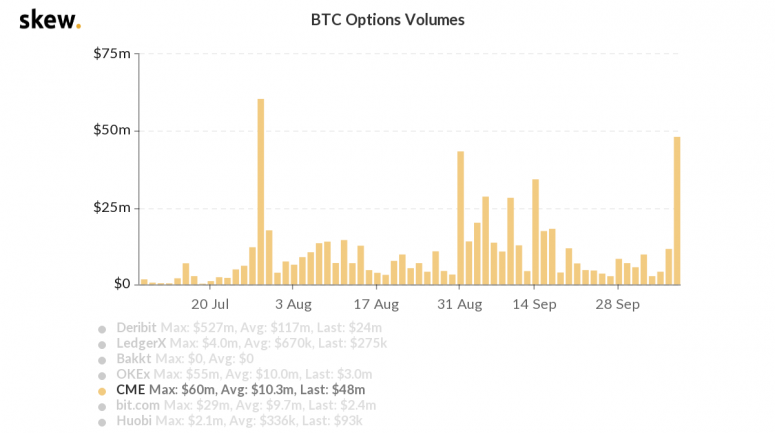

And while the cryptocurrency remains stuck in a narrowing price range for the third week, activity in options listed on the Chicago Mercantile Exchange has picked up the pace.

CME options trading volume surged by 300% to $48 million on Wednesday. The surge was fueled by increased activity in call options, according to Emmanuel Goh, CEO of crypto derivatives research firm Skew.

Traders likely employed bull spreads by buying December expiry call options at $14,000 and simultaneously selling December expiry calls at $16,000. Similarly, calls expiring in March 2021 were bought at $18,000 and sold at $20,000.

These traders foresee a bitcoin price rally but believe the upside will be capped near $16,000 till the end of this year and $20,000 in the fist quarter of 2021.

Token Watch

EOS (EOS): Alternative blockchain’s ecosystem gets boost for trading liquidity as non-custodial digital-asset exchanger Eosfinex launches beta version, though Google Cloud does not intend to take EOS rewards as a block producer.

Aave (LEND, AAVE): Blockchain data reveal increasing large-volume transactions in LEND tokens, suggesting “whale” accounts are migrating to the new AAVE governance tokens, IntoTheBlock writes .