Bitcoin climbed above topped $17,000 early Tuesday for the first time since January 2018, pushing this year’s remarkable rally to 137% on a year-to-date basis. That’s 10 times more than the Standard & Poor’s 500 Index of large U.S. stocks.

“Bears are in disbelief,” the digital-asset market analysis firm Arcane Research wrote early Tuesday in a report, noting that the cryptocurrency is on track to post its sixth straight weekly gain. “It seems like there is nothing stopping bitcoin at the moment.”

In traditional markets, European shares slid and U.S. stock futures pointed to a lower open as investors worried that the potentially economic scarring from a resurgence in the coronavirus. Gold weakened 0.1% to $1,888 an ounce.

Market moves

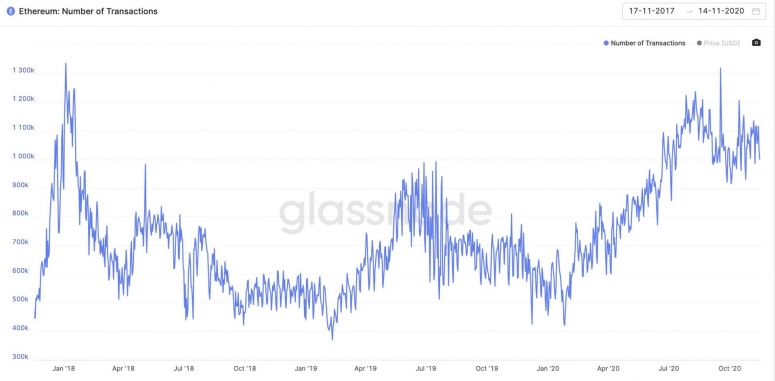

Look no further than the rapid growth this year in the white-hot arena of decentralized finance, or DeFi, and it’s clear why the Ethereum blockchain is dominating so many conversations right now in the digital-asset industry.

The second-largest blockchain’s native cryptocurrency, ether (ETH), is up 266% this year – twice as much as mooning bitcoin (BTC).

But a lot of savvy digital-asset investors are hedging their bets, buying tokens associated with upstart blockchains that could potentially grab market share from the Ethereum network, often referred to as a “world computer” due to its versatility and programmability.

One such token is dot (DOT), of the Polkadot blockchain, whose co-founder Gavin Wood was a co-founder of Ethereum. Wood wrote the original project white paper for Polkadot in 2016, just a year after the Ethereum network launched.

Since going live in mid-August on exchanges after the Polkadot network performed a 100:1 split, the dot token is up over 44%. Over the same period, Ethereum’s ether has only climbed a bit over 8%.

“The market and investor appetite has been really strong for Polkadot’s dot token,” said Keld van Schreven, managing director of the investment firm KR1, which includes Polkadot in its portfolio. An initial valuation from a pre-network launch fundraising was priced around $3, he said. “So to consistently trade above $4 since then has been really encouraging.”

Bitcoin watch

Bitcoin’s strong rally continues with demand outstripping supply amid the heightened expectations of swift global economic recovery on potential coronavirus vaccines.

The top cryptocurrency by market value rose to fresh 33-month highs above $17,000 during the early U.S. trading hours. Prices are up 20% this month alone.

Bitcoin has been characterized by some investors as “digital gold” due to a belief the cryptocurrency can serve as an effective hedge against inflation. But in recent weeks, bitcoin prices have gained as gold has struggled, following the news that two drugmakers, Pfizer and Moderna, had announced promising results in developing coronavirus vaccines.

The possibility that a vaccine might arrive early next year, helping the global economy to return toward pre-pandemic output levels sooner than expected, has triggered a rotation of money out of defensive assets and into risk assets, according to Ole Hansen, head of the commodity strategy at Saxo Bank.

Bitcoin, however, has stayed bid on strong holding sentiment and the supply shortage. “Since bitcoin was at $11,400 a month ago, miners have been selling an average of 11 bitcoins per hour on exchanges. In comparison, 214 coins per hour have been scooped off exchanges,” Willy Woo, an on-chain analyst and the author of The Bitcoin Forecast newsletter, tweeted early Tuesday.

With the global stockpile of negative yielding bonds at record highs and the U.S. dollar expected to depreciate on coronavirus vaccine optimism and continued money printing by the Federal Reserve, the odds appear stacked in favor of a rally to record highs above $20,000.

Token watch

Litecoin (LTC): Also-ran cryptocurrency flips bitcoin cash (BCH) in crypto rankings with rally to nine-month high.

Uniswap (UNI): Uniswap may re-up rewards as SushiSwap angles to catch itinerant yield farmers.

Origin Dollar (OUSD): Stablecoin project suffers “re-entrancy attack” early Tuesday, resulting in loss of $7M, including $1M deposited by company, founders and employees.

What’s hot

Anthony Scaramucci’s $9.2B fund-of-hedge-funds SkyBridge Capital seeks exposure to digital assets including altcoins (CoinDesk)

Coinbase goes down as bitcoin nears $17K (CoinDesk)

Galaxy Digital gets initial approval for new bitcoin fund in Canada (CoinDesk)

China’s crypto miners struggle to pay power bills as regulators clamp down on OTC desks (CoinDesk)

Cryptocurrency custodian Anchorage applies to U.S. regulator OCC to convert to national bank charter from South Dakota-based trust company (CoinDesk)

Israeli startup discovers loophole in DeFi lending platform MakerDAO’s collateralized debt positions market (CoinDesk)

Binance discontinues U.K. pound-linked stablecoin, calling it just an “experiment” (CoinDesk)

Decentralized exchange Uniswap and stablecoin tether (USDT) dominate the Ethereum network, taking up over 35% of transactions (CoinDesk):

Analogs

The latest on the economy and traditional finance

Citigroup says U.S. dollar could tumble 20% in 2021 (Bloomberg)

America’s zombie companies have racked up $1.4T of debt (Bloomberg)

Some 13M U.S. workers enrolled in emergency benefit programs that expire Jan. 1; Deutsche Bank estimates income could drop by $150B in first quarter, causing weaker consumer spending that would shave 1 percentage point off economic output (WSJ)

Ultra-low U.S. mortgage rates, thanks to easy Federal Reserve monetary policy, has allowed homeowners to refinance, reducing monthly payments and freeing up cash (Bloomberg)

Austerity nowhere in view as European Bank of Reconstruction and Development’s chief economist predicts a half-century repayment schedule for coronavirus debt (WSJ)

Japan now offering 0.1 percentage-point interest-rate sweeteners to incentivize consolidation in barely profitable banking sector (WSJ)

U.S. consumers flush with cash after paying down debt, helped in part by stimulus from the government (Bloomberg)