Bitcoin’s halving, the subject of amped-up buzz, hype and speculation since late 2019, proved anticlimactic on Monday as prices slid for a third straight day and the blockchain network slowed to a crawl.

Industry executives on a CoinDesk halving-countdown talk show, held via Zoom, had to pass the time with technical discussions of the future potential of bitcoin mining computers and how much the network’s speed might accelerate over the next four years.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

And then, finally, the network arrived at block number 630,000 – the moment everyone was waiting for. Someone posted a block of code on Twitter showing that the halving had indeed happened. There were some huzzahs all around, and everyone dropped out of the Zoom room. Happy halving!

“This is more of a holiday for the crypto community than anything else,” Mati Greenspan, of the foreign-exchange and cryptocurrency research firm Quantum Economics, wrote in a note to clients.

Bitcoin slid about 2% Monday, the fourth straight daily decline, to about $8,600. The cryptocurrency’s price is down 14% from last week’s high of $10,000, when excitement over the upcoming halving reached a fever pitch, based on the number of Google searches.

The only real surprise was for anyone expecting anything different, given that prior bitcoin halvings had little immediate impact on the market price. When the first halving took place, on Nov. 28, 2012, bitcoin’s price slid by 0.5%. And on July 9, 2016, the second halving, prices fell by 2.3%.

“We are seeing buy the rumor, sell the fact at work,” Russell Shor, a senior market specialist at the foreign-exchange and cryptocurrency-trading firm FXCM, said in emailed comments.

Many cryptocurrency analysts have noted that gains related to bitcoin’s prior halvings have played out over months or years, not days.

It was bitcoin’s third halving since the network launched in late 2009 in the wake of the previous financial crisis. The process was hard-coded into the blockchain’s programming as a way of automatically curbing inflation: Every 210,000 data blocks, or roughly every four years, the supply of new bitcoin automatically gets cut in half.

The process has prompted many cryptocurrency investors to predict that bitcoin could work as a gold-like inflation hedge against trillions of dollars of emergency money injections by the Federal Reserve, in response to the coronavirus-inflicted economic crisis.

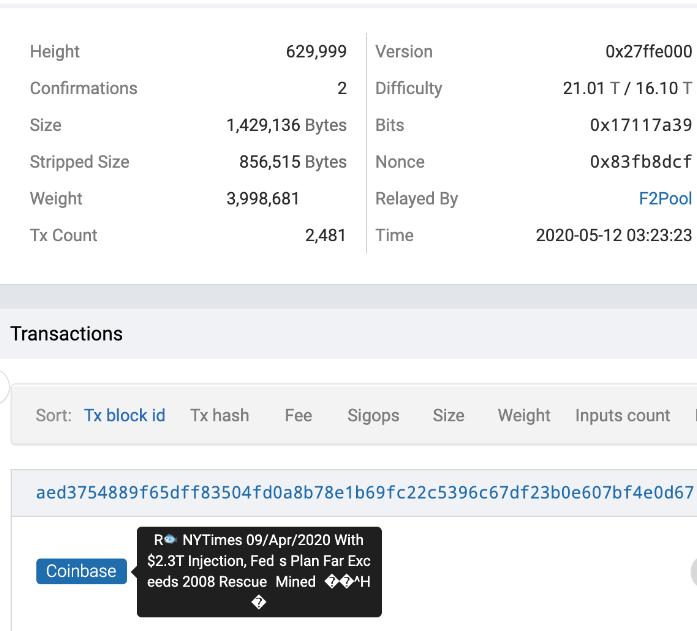

CoinDesk’s Wolfie Zhao noted Monday in an article about the halving that Chinese bitcoin-mining pool f2pool, which won the reward for block No. 629,999, embedded a message into the blockchain record: “NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue.”

This was an apparent homage to Satoshi Nakamoto’s iconic “brink of a second bailout” message in the original “genesis” block when bitcoin was launched in 2009.

In that sense, the halving served to call attention to bitcoin among the broader public, despite the anemic price action of late, analysts said.

“Even if the halving has a marginal ripple effect, it has been impactful in the psyche of retail and institutional investors alike,” Rich Rosenblum, a former Goldman Sachs managing director who now leads the markets group at the digital-asset trading firm GSR, said in an email.

The real-world impact of the halving falls primarily on bitcoin “miners,” the computer operators who help to secure the blockchain network by sending in quintillions of computations per second to confirm new data blocks, each containing the records of thousands of transactions.

Since the bitcoin produced with each new data block serve as miners’ rewards for participating in the distributed network, the halving essentially cuts their revenue in half.

And many of those miners were shutting off older-generation machines on Monday, evidenced by a slowdown in block times. Analysts had predicted in advance that the halving would reduce make Bitmain’s popular S9 mining computers, introduced in 2016, unprofitable except in places where electricity was unusually cheap.

The last 10 blocks before the halving averaged 13.3 minutes, compared with an average 8.5 minutes on Sunday. Block No. 630,001, the first after the halving, took 39 minutes to complete.

“The reduction in mining revenue poses concerns for mining operators,” the research firm TradeBlock wrote on Monday.

Regarding the price, cryptocurrency bulls kept a stiff upper lip.

Tyler Winklevoss, CEO of the cryptocurrency firm Gemini, said Monday during a panel discussion at CoinDesk’s Consensus: Distributed conference that he and his twin brother and co-founder Cameron “tend to invest in what we think is cool,” and in things that are “authentic to us.” Bitcoin makes their list.

The halving “marks a particularly significant milestone given the current state of the world we find ourselves in,” the research firm Delphi Digital wrote Monday in a report.

Mike Novogratz, founder and CEO of the investment firm Galaxy Digital, told CNBC on Monday there was a “lot of hype going into the halving.”

Still, he said he expected bitcoin “to start trading right back up.”

As is sometimes the case with the future of money, the big money may be some way down the road.

Tweet of the day

Bitcoin watch

BTC: Price: $8,763 (BPI) | 24-Hr High: $9,176 | 24-Hr Low: $8,206

Trend: Bitcoin is looking to gather upside traction a day after undergoing its third mining reward halving.

The cryptocurrency is currently changing hands near $8,760, representing a 2% gain on the day. The per block reward for mining on the Bitcoin network were reduced to 6.25 BTC from 12.5 BTC during Monday’s U.S. trading hours

Bitcoin rallied by more than 150% in the weeks leading up to the halving. One of the major catalysts for the price rise was the bullish narrative surrounding the supply-altering event.

With the lackluster performance in recent days, though, it seems safe to say that halving was priced in. As a result, the uptick seen at press time could be short-lived, more so, as the technical charts are sending bearish signals.

For instance, the five- and 10-day price averages have produced a bearish crossover, confirming a short-term shift in market sentiment. Meanwhile, the MACD histogram, an indicator used to identify trend strength and shifts, has crossed into bearish territory below zero. The 14-day relative strength index, too, has violated the trendline rising from March lows.

Prices, therefore, could soon revisit the 200-day average support at $8,041. Note that the long tails attached to the previous two daily candles show dip demand below $8,200. If that area again reverses the pullback, a stronger move toward $10,000 could unfold.

However, if bitcoin penetrates the all-important 200-day average, stronger chart-driven selling could be seen. At press time, that scenario looks unlikely as data provided by blockchain intelligence firm Glassnode shows no sign of an uptick in the exchange deposits. The metric indicates that investors are continuing to hold coins for the longer haul. The metric fell by over 10% in the March 12 to May 12 period as jitters from the “Black Thursday” crash eased.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.