Bitcoin was lower, pausing after after a three-day rally that saw prices approach $16,000, their highest since early 2018.

The recent rally left the largest cryptocurrency up 116% year-to-date, and some bullish digital-asset market analysts were already looking at even higher levels. Denis Vinokourov, head of research at the crypto prime broker Bequant, said in an email that there’s a potential for a squeeze in the options market to push up prices in the next several days.

“This, coupled with continued uncertainty around U.S. election results and the economic fallout from the Covid pandemic’s resurgence, could see us push towards $17,000,” he said.

In traditional markets, U.S. futures were lower ahead of a closely-watched government report due out Friday on employment trends in October. Gold rose 0.3% to $1,956 an ounce.

Market Moves

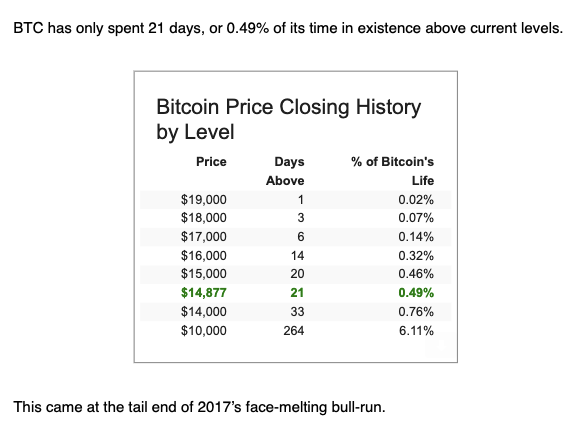

As bitcoin shot above $15,000, analysts on Thursday were reaching back into the cryptocurrency’s 11-year history for clues on what comes next.

Prices have already doubled this year, just as they did in 2019, and bitcoin is now being openly discussed by global banks like Deutsche Bank as the world’s best-performing asset. A lot of observers say the price movements are random and not necessarily linked to broad macroeconomic trends. While the relationship remains on the weaker side, for most of this year, correlation between the cryptocurrency’s price movements and traditional markets have been increasing.

And the investment narrative that bitcoin-fund marketeers are pitching looks pretty strong at the moment: Not only has the cryptocurrency been cast by many bulls as the future of money, and perhaps a threat to the existing financial system, but it’s also positioned as an inflation hedge at a time when the Federal Reserve and other central banks are printing trillions of dollars of money to stimulate markets and economies, with few apparent signs of any slowdown.

Now there’s a belief among many traders that the fear of missing out, or FOMO, could drive faster adoption of cryptocurrencies by both retail and institutional investors – and rapidly drive prices to a new record high above $20,000.

That’s where the history lesson comes in. As some analysts have been signaling this week, bitcoin prices have now entered a territory they’ve so rarely visited before that investors reading price-chart patterns – a widely followed practice among crypto traders known as “technical analysis” – see easy-to-spot stopping points between $15,000 and $20,000.

“The technical setup has been building for a while now, and it has finally broken through,” Mati Greenspan, founder of the foreign-exchange and cryptocurrency analysis firm Quantum Economics, told subscribers in an email.

The screen grab above, from the digital-asset-market analysis firm Messari, shows that bitcoin had previously traded just 20 days above the $15,000 price level, all of them in 2017.

And it was powerful indeed: Once the $15,000 level was breached, bitcoin quickly shot up to the all-time high near $20,000.

Matt Blom, head of sales and trading for the digital-asset firm Diginex, called it a “price vacuum.” So the speculation now is that a repeat might be in the cards.

This all might be wishful thinking from traders who analysts and investors who really have no more insight into the future than anyone else and are just lucky enough to be in digital-asset markets at a time when the fast-growing ecosystem seems to be one of the few sectors that’s truly thriving.

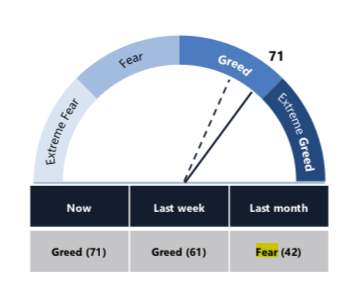

A slow, steady advance might be more convincing to newcomers and the “crypto curious” than a quick march to the top that’s quickly reversed. Whatever the case, the prevailing mood in the market is pushing toward “extreme greed” from “fear” just a month ago.

“The case for bitcoin gets stronger every day,” according to Messari. “Resistance is futile.”

If there even is any.

Bitcoin Watch

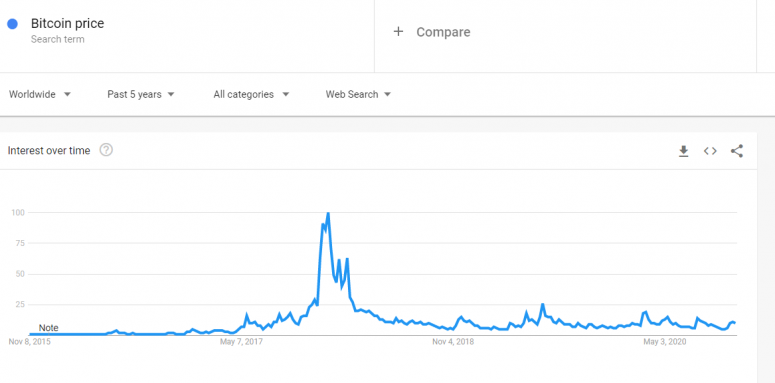

Web search data suggests popular interest in bitcoin remains at normal levels, despite a sharp price rally to near $16,000.

The top cryptocurrency has chalked up a nearly 50% gain in the past four weeks to trade as high as $15,971 early Friday, a level last seen during the bull market frenzy between December 2017 and January 2018.

Some observers say the rally is now being driven higher by retail greed and fear of missing out, known as FOMO. However, Google data suggests otherwise.

Google Trends, a barometer used to gauge general interest in trending topics, is currently returning a value of 10 for the worldwide search query “bitcoin price.”

That’s significantly lower than the value of 93 observed in early December 2017 following bitcoin’s record break above $15,000.

The current reading is also lower than the peak of 19 observed in the second week of May when bitcoin underwent its third mining reward “halving.”

Google’s data suggests that retail investors are showing calm over bitcoin’s recent rally and the market is far from being in a state of bull frenzy.

With popular interest still relatively low, it seems safe to say that FOMO is yet to take hold of the market and the ongoing institutional-driven rally has legs.

What’s Hot

Ethereum founder Vitalik Buterin sends $1.4M of ether in preparation for second-biggest blockchain network’s “2.0” upgrade to staking system (CoinDesk)

Jack Dorsey’s Cash App generated an eye watering $1.63 billion in bitcoin revenue during Q3 of 2020 (CoinDesk)

Buggy code in this Compound Finance fork just froze $1M in Ethereum tokens (CoinDesk)

Fidelity launches engineering hiring initiative to build out crypto trade and custody services (The Block)

Bitcoin “accumulation addresses” rise to record high of more than 519K (CoinDesk)

South Korean crypto firms must disclose users’ identities under planned law change (CoinDesk)

Lightning Network operators are bracing for the curious new users that usually come with a bull run (CoinDesk)

Bitcoin is the new Amazon (CoinDesk Opinion)

Swiss fintech firm Taurus wins Sygnum Bank as client of digital-asset custody services (CoinDesk)

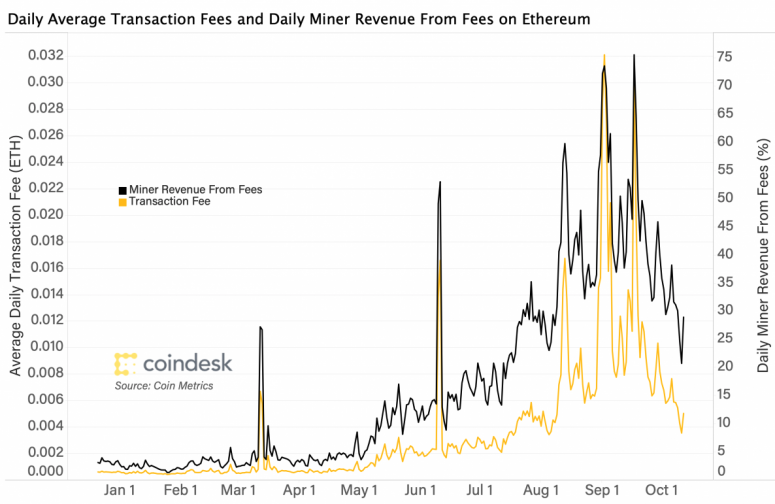

Ethereum transaction fees ebb as DeFi fever subsides (CoinDesk Research):

Analogs

The latest on the economy and traditional finance

U.S. October employment report expected to show gain in nonfarm payrolls of 530K, slowing from September’s 661K (CNBC)

Australian regulator reduces the assets banks must hold in a central-bank committed facility by $25B, acknowledging that institutions are increasingly buying government bonds considered low-risk to meet the threshold (Reuters)

U.S. jobless claims remain elevated, at higher-than-expected 751K for most recent week (St. Louis Fed)

Federal Reserve holds rates close to zero, maintains asset purchases, argues for more fiscal support, pledges more monetary support if needed (CoinDesk)