With fewer than four days left till bitcoin’s halving, popular interest in the once-every-four-years event is reaching a fever pitch.

Google Trends, a barometer for gauging interest in trending search topics, shows searches for “halving” or “bitcoin halving” at five times the peak in 2016, when the blockchain underwent its previous halving event.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

In the build up to the halving, prices have surged over recent weeks. The rise is also likely because of speculation that bitcoin might work as an inflation hedge against the trillions of dollars of new-money injections this year by the Federal Reserve and other central banks.

Bitcoin jumped 9.3% on Thursday to about $10,000. The cryptocurrency is now up 39% year-to-date, triple the returns for gold, which is seen by many investors in traditional markets as a hedge against inflation. The Standard & Poor’s 500 Index of U.S. stocks is down 11%.

Paul Tudor Jones, the hedge-fund magnate known for correctly predicting the 1987 stock-market crash, told Bloomberg News Thursday that his $38 billion Tudor Investment Corp. is putting money into bitcoin futures.

“I am not a hard-money nor a crypto nut,” Jones told clients in a market outlook note titled, “The Great Monetary Inflation.” But the “best profit-maximizing strategy is to own the fastest horse,” he wrote.

“If I am forced to forecast, my bet is it will be Bitcoin,” according to Jones. “The most compelling argument for owning bitcoin is the coming digitization of currency everywhere, accelerated by Covid-19.”

Such growing interest reflects how the size of the cryptocurrency market – and the industry supporting it – has ballooned over the past four years. In 2017, the Cambridge Centre for Alternative Finance reckoned there were about 2,000 people working in the digital-asset industry; fast forward to 2020 and companies like Kraken and Coinbase are hiring hundreds of people in a go.

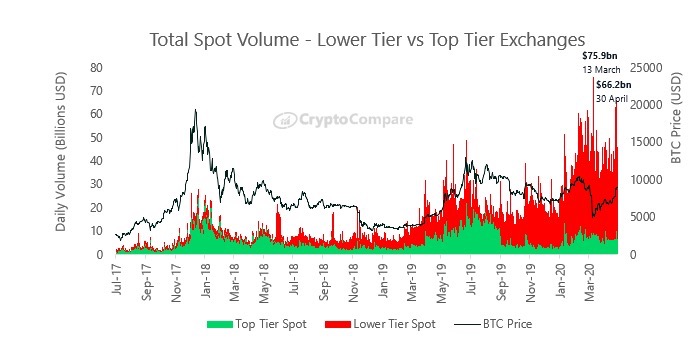

Trading activity is also up. CryptoCompare released data this week showing that April 30 saw the second highest trading volumes on record:

Some $66.2 billion-worth of cryptocurrencies changed hands that day, second only to the $75.9 billion traded during March 12’s 39% price plunge, when the economic devastation from the coronavirus suddenly became clear to traders in both digital and traditional asset markets.

According to Lewis Harland, founder at analytics site Formal Verification: “Higher volumes in the futures market in terms of open interest point to perhaps a greater interest from institutions.”

There’s also been an increase in the number of trading products and instruments offered in the fast-growing market.

Last month, the cryptocurrency derivatives platform FTX introduced a token that allows investors to trade bitcoin volatility.

And, this week, Bitfinex released a perpetual swap giving exposure to bitcoin dominance – essentially the market share occupied by the largest and oldest cryptocurrency, relative to the overall digital-asset market.

21Shares, which sponsors exchange-traded products tracking cryptocurrencies, launched a new token via its Amun arm that rises in value whenever bitcoin’s price falls, and vice versa.

If the last two halvings are any indication, next week will see an upswing in volatility, offering rich opportunities for traders to take advantage of. In the meantime, many are preparing by creating preferred exposure and using products to hedge or take positions on a specific market move.

Traders will continuously adjust their positions ahead of the big day, and soon enough the price action will separate winners from the losers. Some investors think the halving will drive bitcoin a lot higher; others say an event that’s been in the works for 11 years is so well-known that it’s already baked into the price.

What’s beyond dispute is how fast this market is growing. The spike in interest in the halving might just be another reflection of that.

Tweet of the day

Bitcoin watch

BTC: Price: $9,861 (BPI) | 24-Hr High: $9,999 | 24-Hr Low: $9,961

Trend: Bitcoin bulls are taking a breather so far on Friday, having engineered a rally to two-month highs above $10,000 on yesterday.

At press time, the top cryptocurrency by market value is trading around $9,860, down 0.5% on the day. The bulls failed to keep prices above key resistance at $10,048 during overnight trading. That level marks the 61.8% Fibonacci retracement of the drop from the June 2019 high of $13,880 to the March 2020 low of $3,867.

The 61.8% Fibonacci retracement, or the golden ratio, is widely tracked by chart analysts and traders. Hence, a move above that hurdle could cause more buyers to join the market.

Observers suggest the pullback seen over the last few hours could be temporary and prices will likely find acceptance above the Fibonacci hurdle ahead of the mining reward halving due on Monday. “We’ll go higher this weekend because of FOMO by retail investors” said Chris Jones, head of digital assets at Swissquote Bank.

FOMO, an acronym for fear of missing out, refers to an emotional reaction that pushes traders to invest in a less disciplined way. As prices rise, more and more investors become concerns that they will miss out on the opportunity to buy the asset at attractive prices. That fear forces them to invest in a less disciplined way and leads to stronger price gains.

Many in the investor community believe bitcoin’s imminent halving will put bitcoin on a long-term bull run and are likely to keep buying while heading into the event.

A convincing break above $10,048 would shift the focus to the next major resistance at $10,385. That level is currently housing the trendline falling from December 2017 and June 2019 highs.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.