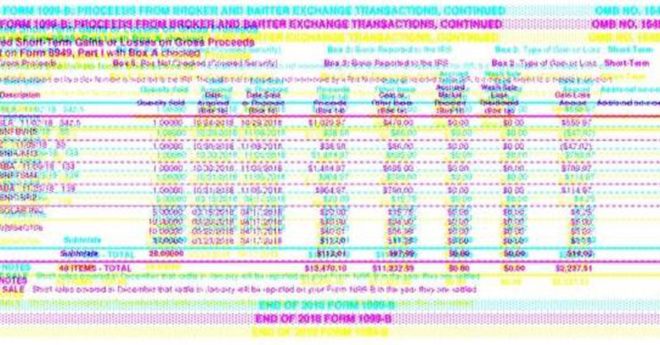

When the IRS receives a copy of this 1099-B, it will see that you sold $50,000 of bitcoin on Cryptocurrency Exchange B. However, it will not be able to see that your true capital gains for this transaction were actually only $30,000. It will be up to you to prove your cost basis was indeed $20,000. If you can’t prove it, you could be stuck with a zero-dollar cost basis and face a $50,000 capital gain tax bill.

Form 1099-B Is Not the Solution to Your Cryptocurrency Tax Problems