Mate Tokay, Bitcoin.com’s former CEO, is taking legal action against a small-cap crypto he advised for reportedly failing to pay him 37.5 million BRG tokens worth $525,000.

Tokay claims that he was never paid for his services, despite the project using his name for recognition to attract investment for Bridge.link’s $8 million initial exchange offering three months ago. He adds that Bridge’s founder Sina Estavi offered to compensate Tokay with “a far lower sum” than what was agreed in their contract, adding that other advisors have allegedly received similar treatment.

At current prices, the reportedly promised stash of 37.5 million BRG would be worth $525,000 in total.

Tokay further alleges that the circulating supply for BRG claimed by Bridge.link is inaccurate, noting he has informed “other crypto industry market leaders, price aggregations sites, and relevant exchanges” of the “massive” discrepancy between BRG’s purported and actual and circulating supply.

Tokay warned that the discrepancy could leave BRG investors vulnerable to a “classic pump and dump,” describing Bridge.link’s actions as “market manipulation.”

While crypto market data aggregator CoinGecko currently does not list data for BRG’s circulating supply or market cap, CoinMarketCap ranks BRG as the 231st-largest crypto asset with a capitalization of $141 million.

BRG has slumped from $0.019 to $0.017 over the past 24 hours, suggesting that some investors are dumping amid Tokay’s lawsuit — with more than 97% of volume originating from a single exchange.

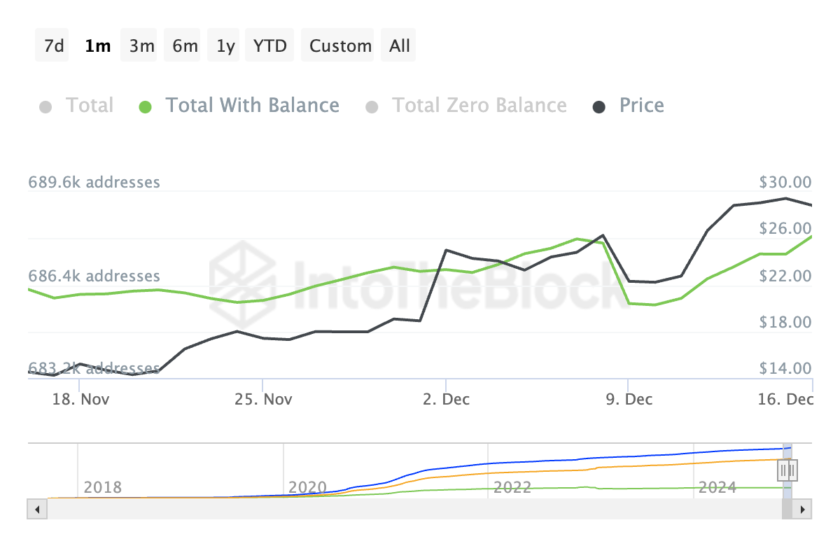

Despite the legal action, the price of BRG is up more than 200% over the past 30 days.

Bridge.link did not immediately respond to Cointelegraph’s request for comment.