- Goldman Sachs strategists believe the markets might be overestimating the risks from the November presidential election.

- While some analysts anticipate massive volatility spikes after the election, Goldman said S&P 500 would be able to gauge the winner.

- The confluence of surging COVID-19 cases and the uncertainty around the election are causing market stagnation.

Investors widely anticipate the volatility of the S&P 500 index to spike as the November presidential election approaches. Goldman Sachs strategists believe the market has priced in the risks, indicating a low probability of massive market movements.

In the past week, the uncertainty around the peaceful transfer of power after the election emerged.

It reached the point where Republican leaders reaffirmed an “orderly transition” following the election. Mitch McConnell, the U.S. Senate majority leader, said:

“The winner of the November 3rd election will be inaugurated on January 20th. There will be an orderly transition just as there has been every four years since 1792.”

Given the statements from Republicans and Democrats, Goldman Sachs says significant market risks from an uncertain election remain low.

Regardless of the Outcome, the S&P 500 Will Gauge the Winner

The S&P 500 has been stagnating due to the resurgence of the pandemic across Europe and the U.S.

The confluence of surging COVID-19 cases and the lack of clarity around stimulus has led investor confidence to plummet.

Atop the unfavorable fundamental factors, U.S. President Donald Trump was reluctant in committing to a peaceful transfer of power.

Referring to his skepticism towards postal voting, President Trump said:

“We want to make sure the election is honest, and I’m not sure that it can be.”

The controversy around the election and President Trump’s comments intensified the declining investor confidence, at least in the near term.

But according to Goldman Sachs strategists, the outcome of a massively negative impact on market risks is unlikely.

The strategists emphasized that the S&P 500 has already been pricing in significant uncertainty in recent weeks. They explained:

“While we recognize that an especially uncertain election outcome could have a significant negative impact on risk sentiment, we think this outcome is less likely than current market pricing—and client conversations—seem to imply.”

Critically, the strategist also noted that the S&P 500 would be able to gauge the winner with sufficient data.

A post-election market contention could materialize if the election results are disputed. But the strategists explained that there would be sufficient information on election night. They stated:

“It seems fairly likely that there should be enough information on election night from states that will report results quickly for the market to be able to gauge the likely winner. In other words, the S&P can trade the likely outcome, even if the AP does not call the race.”

Goldman Sachs explains why markets are overestimating the election risks. Watch the video below:

How Would Stocks Fare Leading up to the Election?

Since the monthly peak, the S&P 500 index has dropped 334.25 points, recording a 9.33% decline.

In the short term, the market outlook would likely remain gloomy as long as the stimulus stalemate continues.

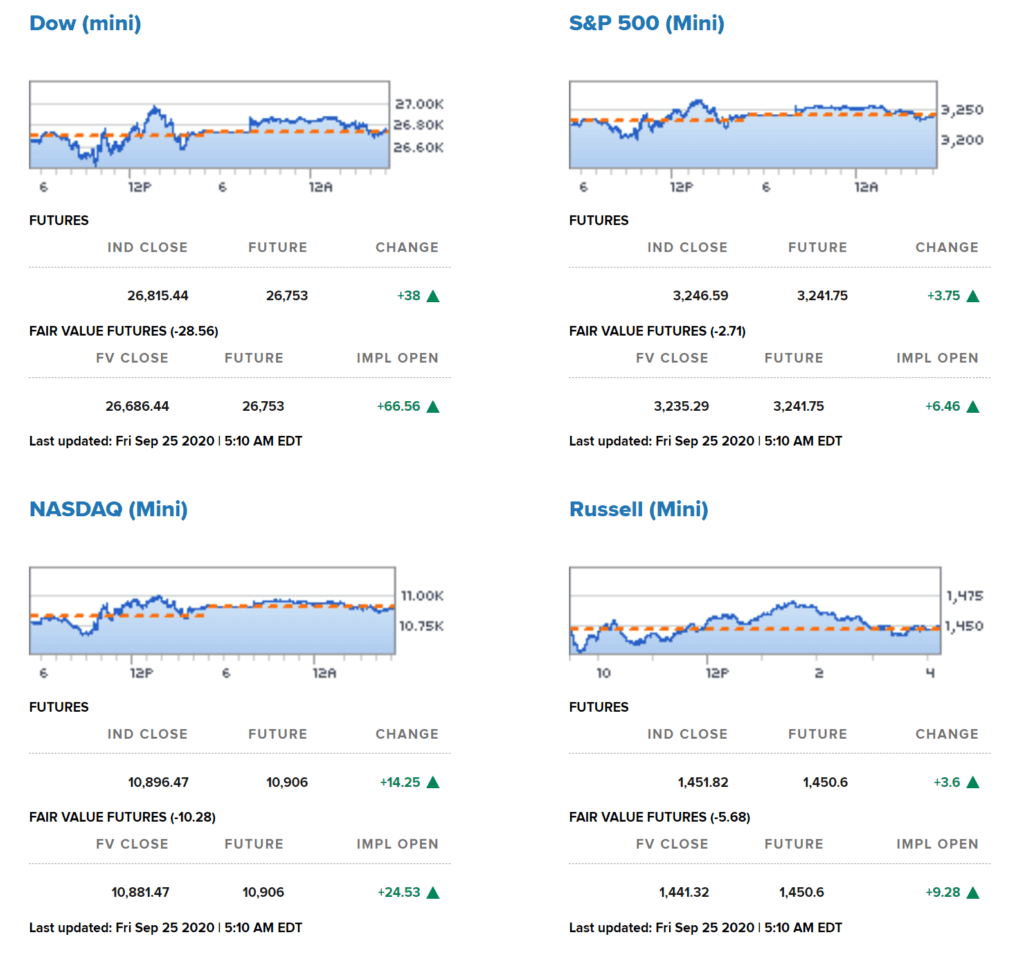

Pre-market data suggests a minor rebound in the U.S. stock market following the preparation of a $2.4 trillion stimulus deal from the Democrats.

The Trump administration initially offered a $1.3 trillion stimulus package, which the House rejected earlier this month.

Whether a stimulus package would get approved before the election would likely dictate the S&P 500’s performance in the short-term.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.

Samburaj Das edited this article for CCN.com. If you see a breach of our Code of Ethics or find a factual, spelling, or grammar error, please contact us.