Digital asset manager Grayscale is bringing back its controversial “drop gold” campaign just in time for the potential Bitcoin (BTC) bull market.

CEO Barry Silbert tweeted Tuesday that the 30-second advertisement will be “running on major networks all over the country.”

The commercial implores investors to “leave the pack behind” by dropping gold and adding digital assets like Bitcoin to their portfolio.

“In a digital world, gold shouldn’t weigh down your portfolio,” the commercial says, adding:

“Digital currencies like Bitcoin are the future. They’re secure, borderless and, unlike gold, they actually have utility.”

Grayscale launched its #dropgold campaign in May 2019 when Bitcoin was trading at roughly $5,400. At the time, few institutional investors had come out publicly in favor of digital assets.

Times have certainly changed.

Since that time, institutions like JPMorgan Chase, Deutsche Bank, Citigroup and Guggenheim have expressed varying degrees of interest in cryptocurrencies.

JPMorgan and Deutsche Bank have reportedly stated that institutional investors are shifting some of their allocations away from gold and into Bitcoin.

In the case of Citigroup, managing director Tom Fitzpatrick has seemingly forecast a $318,000 BTC price in the next 12 months.

Meanwhile, Guggenheim has filed an amendment with the United States Securities and Exchange Commission to allocate $500 million to Grayscale Bitcoin Trust.

As Cointelegraph Magazine reported in August 2020, Grayscale’s #dropgold campaign could introduce millions of people to Bitcoin, much in the same way that Merrill Lynch’s 1948 New York Times ad introduced boomers to stocks.

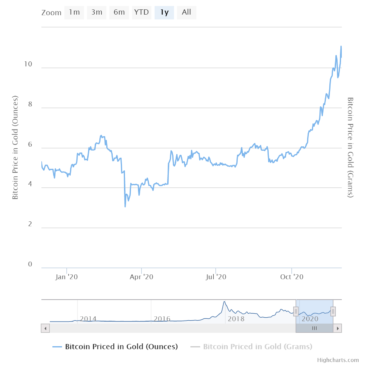

Gold is coming off its worst month since 2016, all while Bitcoin recorded its highest monthly close on record. Currently, 1 Bitcoin buys you 10.539 ounces of gold, the highest in almost three years.