Grayscale Investments’ Bitcoin Cash Trust and Litecoin Trust have been approved by the U.S. Financial Industry Regulatory Authority (FINRA) for public quotations. The two add to Grayscale’s four existing publicly traded investment products: Bitcoin Trust, Ethereum Trust, Ethereum Classic Trust, and the Digital Large Cap Fund.

Grayscale’ Publicly Traded Offerings

Grayscale Investments announced Monday that shares of two of its cryptocurrency trusts have been approved for public quotations by the Financial Industry Regulatory Authority (FINRA). Shares of Grayscale Bitcoin Cash Trust and Grayscale Litecoin Trust will be quoted on OTC Markets under the symbols BCHG and LTCN respectively. The company says that they are “the first publicly-quoted securities in the U.S. deriving value from bitcoin cash (BCH) and litecoin (LTC).”

The trusts have offered a private placement to accredited investors since March 2018. They are not registered with the U.S. Securities and Exchange Commission (SEC). “There will be no trading volume in the shares’ public quotations until the respective shares are DTC eligible, which BCHG and LTCN are expected to receive soon,” Grayscale emphasized, elaborating:

Investors will be able to buy and sell freely-tradable BCHG [bitcoin cash] and LTCN [litecoin] shares through their investment accounts in the same manner as they would other unregistered securities.

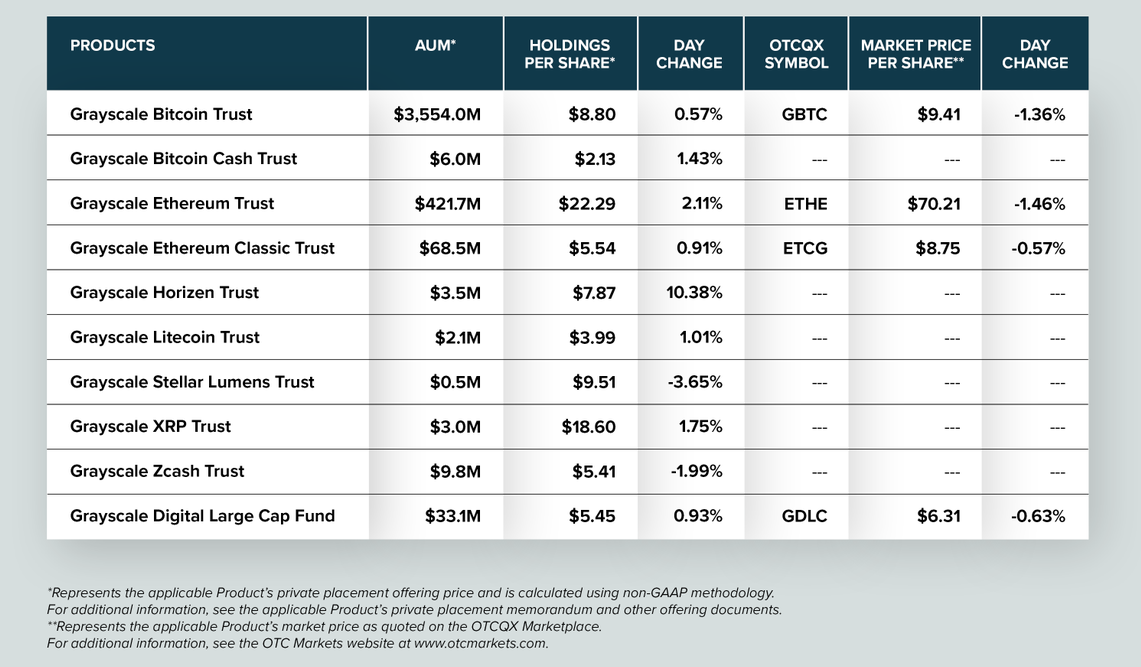

Grayscale Investments currently offers a total of 10 investment products with a total asset under management (AUM) of $4.1 billion as of July 20. They are Bitcoin Trust, Bitcoin Cash Trust, Ethereum Trust, Ethereum Classic Trust, Horizen Trust, Litecoin Trust, Stellar Lumens Trust, XRP Trust, Zcash Trust, and Grayscale Digital Large Cap Fund.

Four of the 10 investment products above are already publicly quoted on OTC Markets, available to all investors with access to U.S. securities. Having previously gained approval from FINRA, the four are Grayscale Bitcoin Trust (GBTC), Ethereum Trust (ETHE), Ethereum Classic Trust (ETCG), and Digital Large Cap Fund (GDLC).

Among all of Grayscale’s crypto investment products, Bitcoin Trust has the most AUM of $3.554 billion. Bitcoin Cash Trust’s AUM was $6 million on July 20, while Litecoin Trust’s was $2.1 million. The company recently released its second-quarter performance report showing that its crypto products added almost a billion dollars during the quarter, 84% of which were from institutional investors. Both Bitcoin Trust and Ethereum Trust posted record quarterly investment inflows.

What do you think about Grayscale’s publicly traded offerings? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Grayscale Investments

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.