The EOS price is back in green following the upside correction witnessed throughout the cryptocurrency board.

The blockchain asset established an intraday high towards $5.84, up 4.47-percent since the Wednesday open. On a weekly timeframe, EOS was trading 17.97-percent higher than its seven-day low, confirming that the asset was trending higher on an interim basis. The latest push helped EOS to entirely recover its losses incurred during the November’s Bitcoin Cash hard fork fiasco.

On a 24-hour adjusted timeframe, EOS was trending 5.21-percent higher than yesterday. The coin’s market capitalization attracted a decent $32 million within the same timeframe, with daily volume surpassing $3.35 billion. The trading activity looked well-spread, with not one exchange taking more control of the EOS volume than the other. The maximum hands EOS changed was against Ethereum’s ETH, a competition, noting a 10-percent of the overall reported trading activities.

Bull trend confirmed

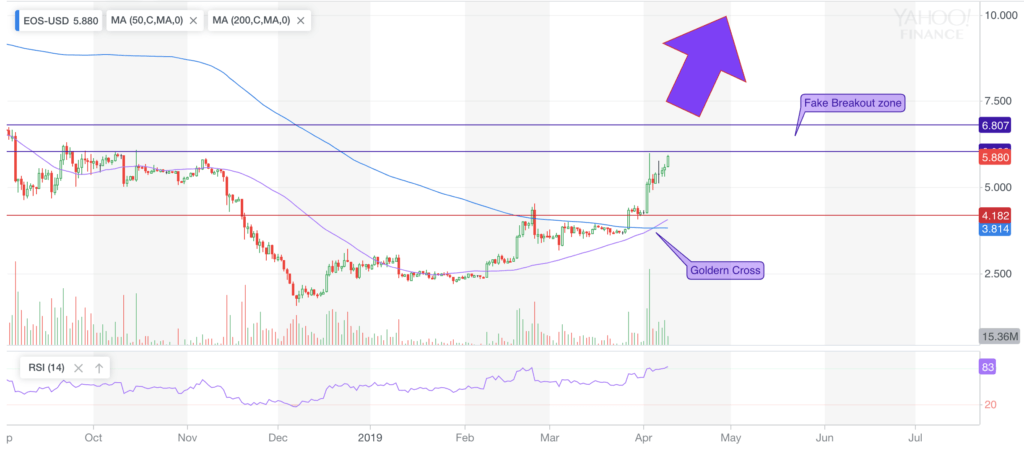

The ongoing candlestick pattern shows a short-term moving average (the purple curve) breaking above its long-term moving average (the blue curve). Dubbed as the Golden Cross, the pattern indicates a bull market in making, if the further price action accompanies higher trading volume. The market has already confirmed the same Golden Cross pattern on the hourly EOS chart, in which the 50-hourly MA moving above 200-hourly MA prompted a strong upside momentum.

The Relative Strength Indicator, a momentum oscillator, is way above 70, signifying that EOS is overbought. That coincides with the asset testing $6 as its interim resistance level. In fact, the range above $6 until $6.80 holds a strong price reversal sentiment. So there is a high probability that EOS would undergo a small correction upon testing this ‘fake breakout range.’ As a result, the daily RSI would dip towards 70 – or below it. It would allow more traders to open a new long position, leading to an uptrend continuation.

The theory sticks as long as the 50-daily MA stays above its 200-daily MA.

On the bearish side, a breakdown action accompanied by a strong selling volume could push EOS towards $4.18. Therefore, maintaining a stop loss a pip below the long position entries would minimize traders’ loss to an extent.

Overall verdict: Bullish

Click here for a real-time EOS price chart.