The Bitcoin price rose to as high as $7,770 on major cryptocurrency exchanges on April 23. The abrupt upsurge coincided with the expiration of CME’s BTC futures contracts for April.

Data from Skew indicates that the CME Bitcoin futures volume and open interest spiked to a monthly high. The surge in trading activity preceded the fast increase of the BTC price to above $7,000.

CME Bitcoin futures saw monthly high volume on April 23 (Source: Skew)

Bitcoin price historically sees large movement on the 24th of every month

The CME Bitcoin futures contract expires every fourth Friday in a given month. In most months, the BTC futures contract on the exchange expires on the 24th or 25th.

Prior to the expiration, the Bitcoin price tends to see a large price movement as traders make one last push towards either directions to benefit their contracts.

Long contract holders have the incentive of pushing the Bitcoin price up further to maximize gains from their monthly contracts, and vice versa for short holders.

After the expiration occurs, the Bitcoin price typically sees a price movement to the opposite direction from the run up to the expiration. If BTC surges ahead of it, the cryptocurrency is more likely to drop.

The upsurge of Bitcoin from around $7,050 to $7,770 comes right before the expiration of CME’s April BTC futures contract. Based on historical data, it leaves BTC vulnerable to a potential trend reversal.

“CME bitcoin futures volume & open interest reached a one month high yesterday ~1500 contracts were rolled from April to May, ~1200 contracts remain open for expiry later today,” researchers at Skew said.

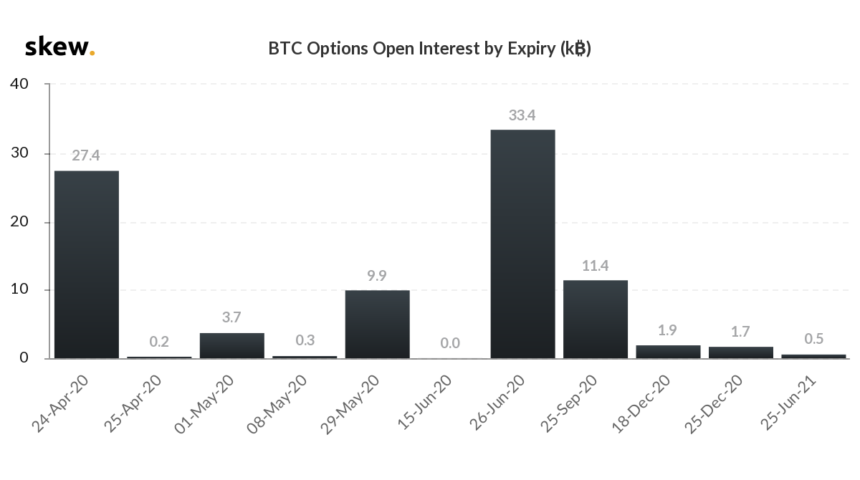

The short-term rally also coincided with 27,000 Bitcoin options expiring tomorrow. Many options on platforms like Deribit reflect large trades, and as such can have a significant impact on the price of BTC in the near-term.

Bitcoin options are expiring on April 25 (Source: Skew)

The Bitcoin market is largely divided into three parts: futures, spot, and options. In the early days of BTC, spot exchanges accounted for the vast majority of daily cryptocurrency volume. Over time, futures overtook spot exchanges.

Why futures exchanges have such a large impact on BTC

In a study published in March 2019, Bitwise Asset Mangement said that the real Bitcoin spot trading volume without counting futures exchanges like BitMEX is $270 million.

At the time, the company emphasized that CME and CBOE accounted for $91 million in daily volume, and CME’s volume has increased substnatially since then.

At least for a year, CME has accounted for around 35 to 40 percent of daily Bitcoin volume on paper. While the figure decreases when BitMEX, OKEx, and Binance Futures volume are included, it still accounts for a large portion of daily BTC volume.

“And, when you remove fake volume, CME and CBOE futures volume is significant ($91M), especially compared to the real spot volume (35% for Feb 2019). This is good news because it means CME— a regulated, surveilled market— is of material size, which important for an ETF,” Bitwise said in 2019.

As long as the CME Bitcoin futures market holds a relatively large share of the BTC market share, futures and options expiration are likely to have a continued impact on the short-term price trend of BTC.