Bitcoin’s consolidation channel formed since the start of May has been narrowing ever since it was first established.

The cryptocurrency is now trading sideways between $9,000 and $9,300, facing immense resistance at the upper boundary of this range.

From a fundamental perspective, the benchmark digital asset has been seeing stagnating market health, with this being driven primarily by a sharp decline in its liquidity.

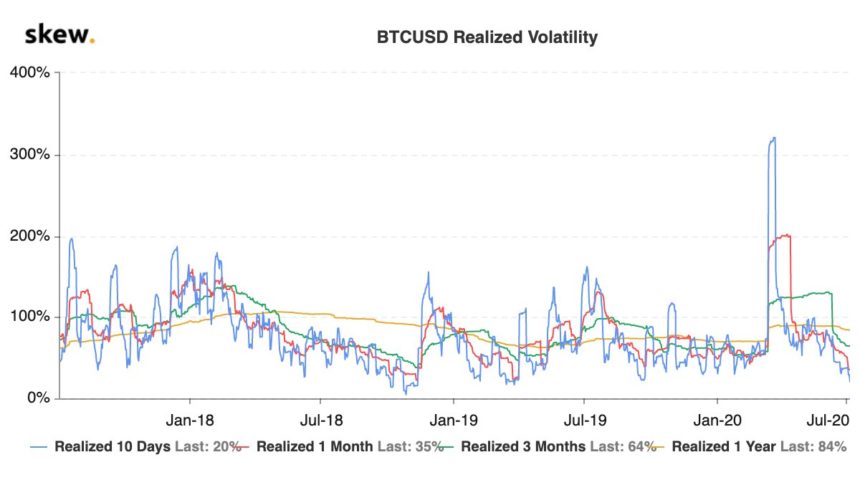

This trend will likely persist in the near-term, as data shows that BTC’s 10-day realized volatility is now at 20%. The last time this metric reached levels this low was just before the massive selloff seen in November of 2018.

A combination of drying liquidity coupled with low volatility may be laying the groundwork for the digital asset to post a massive movement in the weeks ahead.

Bitcoin’s Liquidity Shows Signs of Faltering as Sideways Trading Persists

Bitcoin has been unable to incur any decisive momentum throughout the past several days and weeks, with each attempt at garnering a clear trend being futile.

This past weekend, sellers attempted to push the digital asset down to lows of $8,900. From here, buyers absorbed the selling pressure and quickly led it back into its long-held trading range between $9,000 and $9,300.

Throughout the past 24-hours, buyers have been trying to shatter the massive resistance that sits around $9,300 but have failed to make any meaningful progress.

One byproduct of this trend has been a decline in Bitcoin’s liquidity.

According to a recent report from the analytics platform Glassnode, BTC’s liquidity was the only metric within their Network Index that declined in value over the past week.

They note that both trading and transactional liquidity declined in tandem over the past seven days.

“Liquidity dropped by 6 points over the past week, losing ground in terms of both trading and transaction liquidity as exchange deposits and on-chain transactions decreased.”

Image Courtesy of Glassnode

They further add that the cryptocurrency remains fundamentally strong, as its network health and investor sentiment have both increased over the same period.

BTC’s Low Volatility Suggests a Massive Movement is Brewing

Bitcoin’s low volatility seems to indicate that a sizeable movement is just around the corner.

According to data from Skew, BTC’s 10-day realized volatility has declined to levels not seen since just before the massive selloff seen in November of 2018.

“Bitcoin ten days realized volatility = 20%. Last time we reached that level, we had the great sell-off of November 2018 shortly after”

Image Courtesy of Skew.

As seen in the below chart, periods of tremendously low volatility like the one seen presently do not tend to last for long, signaling that Bitcoin could be coiling up to make a trend defining movement in the weeks ahead.

Featured image from Shutterstock.