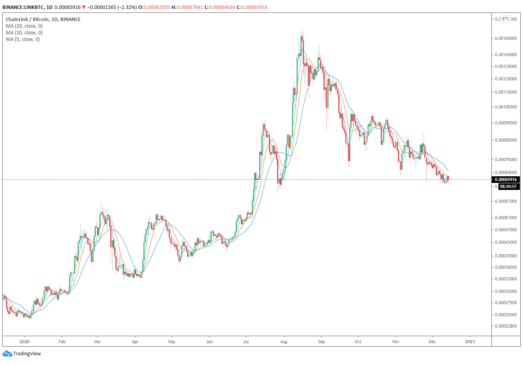

The price of LINK, the native cryptocurrency of Chainlink, has increased by 10% in the past three days with the recovery coming despite a “death cross” on the LINK/BTC chart.

Josh Olszewicz, a cryptocurrency trader and technical analyst, said the LINK/BTC chart encountered its first death cross since 2018.

What is the death cross and why is LINK seeing a relief rally?

In technical analysis, the term death cross is a candle chart formation that occurs typically before a large selloff. It lights up when an asset’s short-term moving average falls under its long-term moving average.

This formation normally indicates a short-term trend reversal as it tends to emerge as an asset sees a steep correction.

From Nov. 23 to Dec. 11, the price of LINK declined by around 30% within 17 days. Due to its sharp short-term drop the death cross appeared on the LINK/BTC chart. LINK’s short-term moving average fell under its long-term moving average for the first time in two years.

first death cross on $LINK / $BTC since 2018 pic.twitter.com/cvKHlGCRIF

— Josh Olszewicz (@CarpeNoctom) December 10, 2020

But a relief rally becomes likely if an asset begins to recover strongly from the death cross. Since the indicator appears after an asset sees a major pullback, the probability of a large short-term uptrend also rises as the death cross materializes.

On Dec. 13, buoyed by the recovery of the decentralized finance (DeFi) market, LINK posted a 10.5% rally within 12 hours. LINK has been consolidating since then, but the initial relief rally could lead to a broader uptrend if LINK price remains above the $12.3 support level.

Chainlink fundamentals still strong

At its core, Chainlink is an oracle network that provides relevant market data to DeFi applications.

Most major DeFi protocols rely on Chainlink’s oracles to fetch information that is used across lending and other financial applications.

Ryan Selkis, the founder of Messari, noted that oracle infrastructure is highly important for DeFi. Albeit its valuation remains high, Selkis said that he acknowledges the importance of data for DeFi. He said:

“Though we don’t think LINK is DeFi, oracle infra is critically important (and frequently exploited). Chainlink kills it on the partnerships front. I don’t grok the economics at $10bn, but I do get the importance of reliable DeFi data pipes.”

One of the major catalysts for LINK is its continued partherships and collaborations in the DeFi space. In the past two days alone, Unilayer and Dock integrated Chainlink’s oracles into their DeFi platforms.

Chainlink is now live on #BinanceSmartChain as their recommended oracle and used by @BreederDodo on BSC mainnet. Developers now can build smart contract applications on BSC with native access to #Chainlink oracles like Price Feeds. https://t.co/mYFFVWsjnl

— Chainlink – Official Channel (@chainlink) December 10, 2020

Most notably, Binance Chain integrated Chainlink’s oracle network on Dec. 10, allowing all decentralized applications on the blockchain to use Chainlink. A Binance blog post read:

“Binance Smart Chain (BSC) has successfully integrated the Chainlink decentralized oracle network on its mainnet as its recommended oracle solution. As a result, Chainlink is now available for use by any and all BSC smart contracts.”