Cryptocurrency market sentiment is often influenced by various factors, such as expert forecasts or political events. However, if analyzing on a wider time frame, it turns out that the prices of most cryptocurrencies — especially of Ether (ETH) — could mostly depend on the valuation of Bitcoin (BTC).

The results of research conducted by analysts from Skew in November 2019 showed that ETH had been the highest-correlated cryptocurrency to BTC for two years running, with an average correlation coefficient of 0.9. Meanwhile, ETH was the highest correlated asset in 2019, as reported by the Binance research team on Jan. 22, 2020.

If this is the case, is it worth relying on correlation when buying cryptocurrencies? Could ETH be less correlated to BTC than is commonly believed? To find the answer, Cointelegraph analyzed the cryptocurrency charts for the past three years and talked to experts with opposing views on the matter.

What is the correlation?

The concept of correlation in stock market trading refers to the phenomenon when the values of two assets move in a similar direction. However, when it comes to the cryptocurrency market, correlation may apply to all assets at once. This is what happened as a result of a massive Bitcoin price crash in early 2018, followed by a simultaneous drop in the capitalization of all other cryptocurrencies.

Opinion #1: Bitcoin is king

Do the aforementioned observations mean that Bitcoin is the front-runner and key influencer of the crypto market, and is therefore the main trendsetter? Cryptocurrency exchange charts show that a decrease in the BTC price inevitably affects the exchange rate of ETH, XRP, Litecoin (LTC) and other assets.

As such, the influence of BTC price on other cryptocurrencies, and particularly on ETH, is a natural event in the digital asset market, according to traders and market analysts. Pierce Crosby, general manager at financial trading charts platform TradingView, spoke to Cointelegraph on the matter:

“Everything correlates to Bitcoin, much like in the U.S. equity market, everything correlates to the U.S. dollar. Bitcoin is the largest store of wealth for the asset class, so everything is basically ‘pegged’ against its overall performance. It’s an important distinction to make, and something people don’t really understand or take the time to consider. When we see asset prices rise — i.e. ETH or LTC, we have to benchmark it against the broader index movement.”

According to the latest report on cryptocurrency volatility, published by San Francisco Open Exchange, the current correlation between the performance of BTC and ETH is significantly higher than the correlation between the values of BTC and other altcoins. The analysts noted the actively discussed and often controversial news about Facebook’s Libra as the main reason for similar behavior of the top two cryptocurrencies.

Michaël van de Poppe, a cryptocurrency market analyst and trader at the Amsterdam Stock Exchange, told Cointelegraph that Ether will always have some correlation to Bitcoin, as “Bitcoin is the king and usually the rest will follow in the market.” He compared this correlation with the commodities markets, where gold is the leading asset, its price changes followed by other metals.

So it seems that when it comes to the cryptocurrency market, Bitcoin price is indeed a barometer of investor sentiment regarding digital currencies in general. Therefore, if it changes due to systemic factors affecting the market — for example, increased volatility in traditional markets or a change in cryptocurrency regulation — the ETH rate may change in the same direction as that of BTC.

Opinion #2: ETH does not follow BTC

On the other hand, if there is an event that turns out to be a specific influencing factor for BTC price — for example, the United States Securities and Exchange Commission rejecting to accredit an exchange-traded fund application — the correlation may become negative, and ETH may increase in price amid the falling BTC rate. According to Van de Poppe, the correlation between the two leading crypto is different in various parts of the cycle:

“Some parts the correlation is high in which Ethereum outperforms Bitcoin, in some parts it’s low as Ethereum drops hard against Bitcoin, while Bitcoin trends up against USD. It’s different in different parts.”

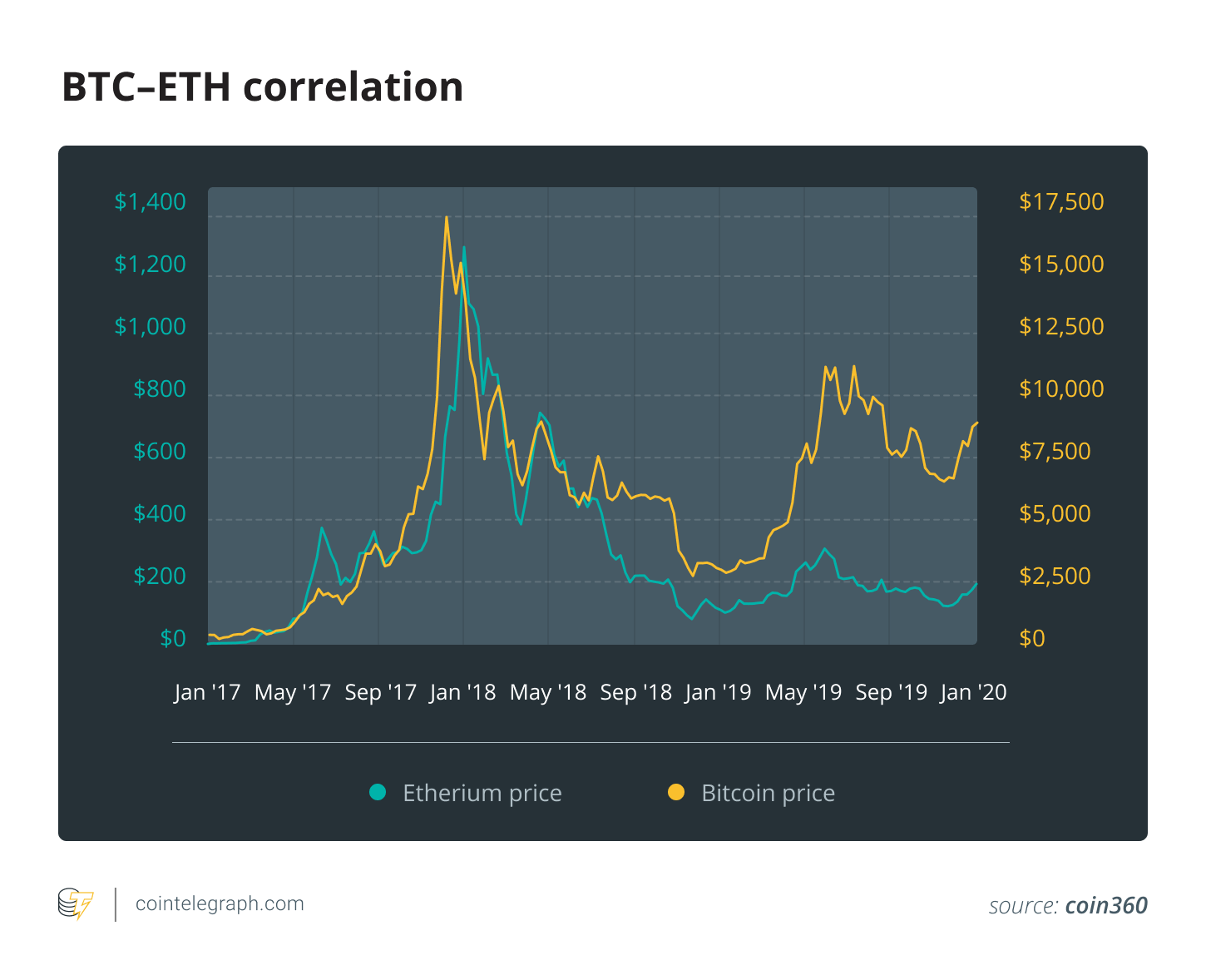

The comparison of the BTC and ETH charts shows that some patterns of their price movements coincide over a long period of time. This correlation can be either positive (from 0 to 1), or negative (from 0 to -1). A positive correlation, such as the current correlation between BTC and ETH, suggests that if the price of Bitcoin grows significantly, ETH can also increase in its value over the same period of time. This phenomenon is especially noticeable with large price fluctuations. Notably, the BTC–ETH correlation is instantaneous in most cases — when coin prices change with a difference of several minutes or hours.

The question is, however, whether Ether is so dependent on Bitcoin as is commonly believed? As it turns out, ETH does not always accurately repeat the BTC price movements and tends to show independence rather often.

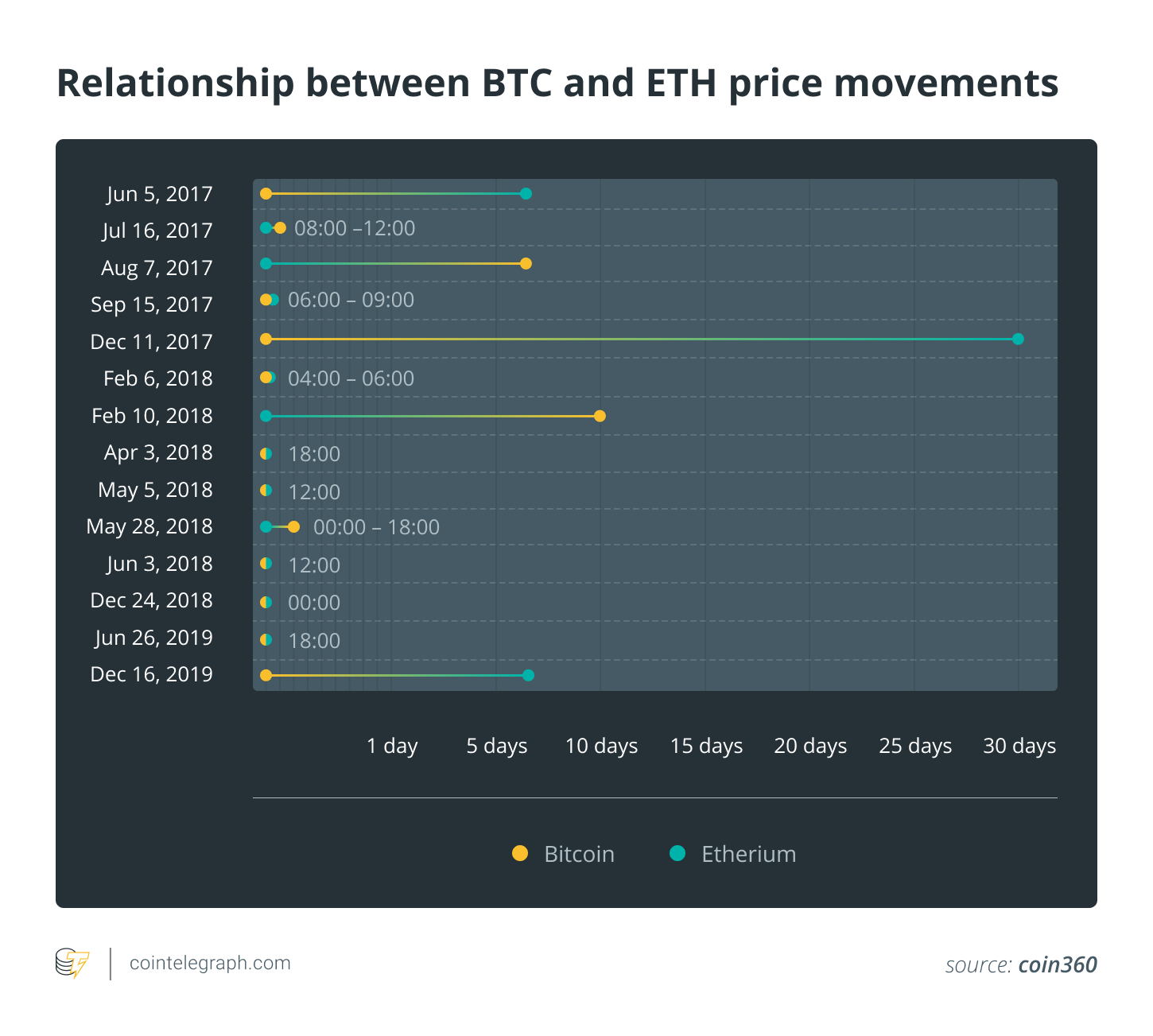

Such results were proven by the analysis of 14 significant changes in the price of BTC and ETH that occured in the period from June 2017 to December 2019, when their correlation coefficient varied from 0.26 to 0.89. The observation showed that in five out of 14 cases, the ETH price repeated the behavior of BTC — while in four cases, the correlation was negative.

The results presented above are also supported by research conducted by Three Arrows Capital hedge fund’s CEO, Su Zhu. According to his data, BTC and ETH have shown multidirectional dynamics nine times over the past three years.

Zhu also pointed to the fact that throughout the cryptocurrency market’s history, the first quarter of the year has always shown an interesting correlation between ETH and BTC. Each year, ETH demonstrated a 30% increase in price within one month, while BTC always decreased over the same period of time. Besides, Ethereum price growth almost always occurred from January to June. However, from October to December 2017, BTC showed its 538% growth followed by an increase in the prices of other cryptocurrencies. Van de Poppe told Cointelegraph on the matter:

“The reason is quite simple; the king of movers are Ethereum and Bitcoin and still, the majority of the ICOs are based on Ethereum. So when Ethereum moves, they usually follow. The same goes for the IEOs. If Binance Coin trends up, they usually follow.”

At the same time, according to Zhu, the correlation between the two cryptocurrencies indeed intensified over the past year. The possible reason for that change might be not a very successful year for the Ethereum network — particularly the team’s failure to release the full version of Ethereum 2.0.

However, researchers at San Francisco Open Exchange suggest that, in general, the high correlation of ETH may not suggest its dependence from BTC, but rather the fact that the Ethereum blockchain has received more recognition, and the price of ETH as an independent asset was significant compared to other altcoins.

What is wrong with high correlation?

The golden rule of any investor is diversification of the investment portfolio, which is usually achieved by acquiring assets with low correlation. Thus, if one of the assets rises in price, the other is likely to fall. The investor takes profit in the first case and waits for the growth of the asset’s value in the second.

However, in the cryptocurrency market, the change in prices of most coins usually occurs simultaneously. This observation is confirmed by the Binance Research study published on Jan. 22. According to its results, the average correlation between the leading altcoins by capitalization in 2019 was 0.7.

This means that in 70% of cases, cryptocurrencies such as Ether, Litecoin, EOS, XRP, Bitcoin Cash (BCH), Binance Coin (BNB) and others grew and fell simultaneously. Therefore, using them to diversify the investment portfolio might not make sense. Analyst Larry Chermak believes that the excessive interdependence between assets creates obstacles to the effective diversification of the investment portfolio.

An introduction of tokenized securities may somewhat mitigate the problem because such financial instruments do not correlate with the wider market. However, this is a separate class of digital assets, which — unlike permissionless assets — requires strict compliance with KYC/AML.

Proving correlations is possible but hard

In this unstable market, no one can know what the correlation of cryptocurrencies will be in a year, a month or even a week. Likewise, it cannot be argued that there is a complete and direct correlation between the ETH and BTC prices. Most of the time, ETH really follows BTC, but there are occasionally times when it demonstrates independence and shows good results.

Moreover, according to Salah-Eddine Bouhmidi, a financial market analyst at DailyFX & IG, there is still not enough data to prove whether the correlation is positive or negative: “The possible positive correlation may be only becoming visible because Bitcoin is still the main driver of the market. If Bitcoin gets momentum, others also start to pick up.” Van de Poppe shared the same point of view:

“Correlation is important in this market, however, the significance of correlation is hard to test in such a way that proving correlations is almost impossible. There’s been tests of seeking correlations between equity markets and cryptomarkets, but no correlation was found for several reasons, while the charts imply something else. Same goes for altcoin / Bitcoin cycles.”

Bouhmidi also noted that correlation is an important tool in the cryptocurrency market, but that one should not rely on it entirely — because when it comes to crypto, people should be careful:

“A correlation can only be statistically significant if you have a huge database or sample size. Cryptocurrencies are still young and do not have a huge historical data. I would say that we can see correlations in the crypto markets, but we still do not know whether they are robust.”