CCN spoke to James Ju, the CEO of the new Blue Helix Exchange (BHEX) and former CEO of Huobi Global.

Blue Helix is an exchange which is pushing toward a decentralized topology in a regulator-friendly manner. They raised $15 million from institutional investors including Huobi and OKEx by selling equity about six months ago, and last week they launched the beta of their exchange product, along with the BHT token.

Currently in Beta, the Blue Helix exchange offers OTC sales (for CNY) of Bitcoin, as well as a handful of trading pairs including EOS/USDT and ETH/BTC.

Not An ICO Token or ICO-Backed Exchange

The BHT token is not a typical fund-raising option in that people cannot simply make an investment in the network and receive a set number of tokens. Instead, BHT are rewards for buying “points” on the BHEX exchange. These points are then used to secure discounts on trading fees. It’s similar to the Binance BNB token, where for the first few years of the token’s existence, users get trading fee discounts if they choose to pay in BNB.

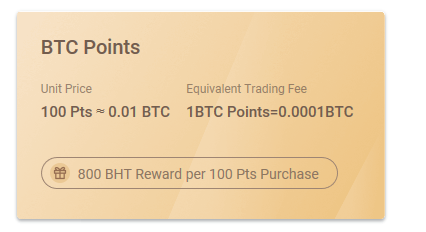

BHEX sells two types of virtual point cards. One is pegged to USDT and the other is pegged to BTC. The BTC card has each point pegged at .0001 BTC, but since Bitcoin is volatile, the points are first redeemed for that amount of BTC and then used against the trading fees due. This means that at various times points held in the BTC points card could be worth more than they were when they were secured.

When the BTC Point Card is used to offset the trading fee, the trading fee will be converted into BTC according to market price of the assets and then deducted from the corresponding Point Card.

The maximum points that can be purchased during the current period is 27,000 – don’t worry, it’s unlikely you’ll need that many, as that would cost you 2.7 BTC. The reward for buying points is BHT, 800 of the 2.1 billion issued for every 10 points (.01 BTC) you buy. The reward is roughly equal if you use the USDT version.

Tokens Generate Revenue

Actual BHT that circulate in the free world, free of lock-ups or other delegated purposes, is limited. The company has a full explanation of BHT here. The tokens you would earn buying points cards today come out of the following allocation:

15% of the total issuance, or 315 million BHT, is used to motivate seed users who support the platform. 315 million BHT will be rewarded through platform activities with no lock-up period, while stocks last.

The BHT tokens are issued 80% of fee revenues from the BHEX exchange. Users receive these dividends based on how many tokens they own. Other benefits are associated with holding the BHT token. All of them are predicated on the success of the exchange, which may be why the only way to obtain them directly at present time is through the purchase of point cards, which necessitate a need of such.

James Ju told us that in the future, the platform will be totally decentralized, using technology that BHEX has been developing since its inception.

Everything that centralized exchanges have, we also have it. But we are a decentralized exchange in the sense that – in the future, our assets will be stored and cleared through a decentralized technology.

The version that’s currently running isn’t fully decentralized, but BHEX is working hard toward this goal. They believe that a decentralized exchange will provide more security for users. In furtherance of this belief they also have BHOP – the Blue Helix Open Platform, which is a Software-as-a-Service product that other exchanges can use. This element speaks to why they’ve received investment interest from major exchanges like Huobi and OkEx.

BHEX Working Toward Fully Decentralized Exchange and Custodial Services

The advantage of decentralized exchanges for users is that they eliminate counterparty risk. Rather than the EtherDelta model, where the user simply connected his wallet to the exchange, the BHEX model will work as a staff member explained to this reporter:

We still adopt a username/password system, considering that if a user loses his private key, it is not retrievable. Decentralization comes into play in our “asset custody:” users store their assets not in their own wallets nor in BHEX wallets. Instead, users deposit their assets on the Blue Helix decentralized asset custody and clearing platform, which is the bottom layer beneath the BHEX exchange. This bottom layer is decentralized and not owned by BHEX exchange.

The other interesting aspect of BHEX is their social trading feature, called Super Guilds. Investors will be able to join a guild if they are invited to do so, and then they can optionally allow the guild to invest their funds for them. This is another way of building interest in the exchange, as it is a relatively unique feature. It formalizes trading groups. To motivate participation in super guilds, BHEX has set aside 3 million BHT which will be used to reward groups that are created.

BHEX is very new and thus its overall volume is negligible. However, the crypto exchange world is fast-changing. Binance was just an idea not so very long ago, and now it’s the dominant exchange in the world. There is a growing demand for decentralized exchanges for multiple reasons, and when BHEX launches their fully decentralized product, it would seem that users who have grievances with the existing system of exchanges will want to take advantage of it.

Get Exclusive Crypto Analysis by Professional Traders and Investors on Hacked.com. Sign up now and get the first month for free. Click here.