Bitcoin is making headlines left and right on media outlets everywhere, but none more so than CNBC. According to a well respected journalist, during a segment on CNBC it was said that gold would be trading at $3,000 an ounce if it wasn’t for Bitcoin.

Here’s why that statement is probably true, and why the cryptocurrency will continue to take market share away from the aging shiny rock.

Gold Would Trade At $3K If It Wasn’t For BTC

The digital narrative worked like a charm, and Bitcoin is now stealing any capital looking to park somewhere resistant to inflation.

Gold has traditionally served that purpose, and as the economy first began treading on thin ice, the ages old asset that was once the “standard” began to uptrend again.

Related Reading | Seller’s Remorse: Day Trader Dave Portnoy Swears Off Bitcoin

Gold eventually reached more than $2,000 an ounce at the height of its bull market. Natural profit-taking caused the price per ounce to pull back, but rather than go for another leg higher, capital well suited for gold made its way into Bitcoin instead.

Because Bitcoin exists, and money is pouring into the scarce cryptocurrency instead of gold, has prevented gold from trading at $3,000 an ounce, according to a statement overheard on CNBC today.

Statement on @CNBC today : if there was no #bitcoin , #gold would be trading at $3k today.

— Daniela Cambone-Taub (@DanielaCambone) February 19, 2021

The statement was shared in a tweet, fingering the blame on Bitcoin as the culprit for gold’s lack of price appreciation.

How Bitcoin Makes Metals Seem a Lot Less Precious

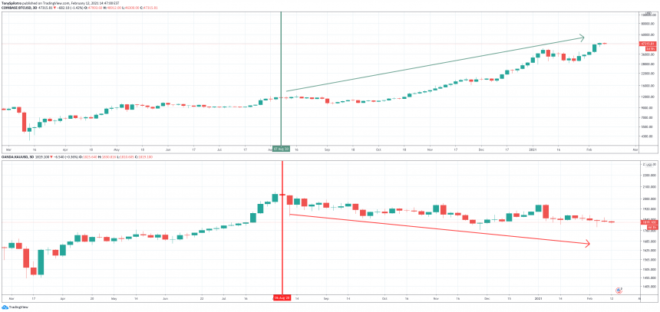

Charts don’t lie, fortunately, and comparing gold against Bitcoin definitely shows a correlation between when gold peaked and the cryptocurrency really took off.

The change took place just days after gold had topped, and publicly traded companies began buying BTC to add to company reserves.

That trend has now extended into the likes of Tesla, and more corporations are expected to follow suit and could be responsible for Bitcoin’s price appreciation.

Other reasons, however, are undeniably due to gold outflows from hedge funds and other investors. Even retail are now getting back into crypto, but are focused more on altcoins as the price per BTC becomes out of reach for the average person.

Related Reading | Chart Comparison Demonstrates Effectiveness Of Bitcoin Digital Gold Narrative

But even altcoins absorbing some of the capital that could have made its way into gold, is ultimately Bitcoin’s doing. It is because of the first ever cryptocurrency that the rest of the market exists, and according the the statement made on CNBC, is responsible for gold trading at under $2,000, let alone the $3,000 it would be otherwise.

Featured image from Deposit Photos, Charts from TradingView.com