The differences between instant and traditional exchanges do not make one inherently better than the other — they’ve been created for different use cases. Developing an understanding of instant crypto exchanges will help you determine which solution best fits your needs. Below are some of the potential benefits of opting for an instant crypto exchange:

Funds storage — safety

Perhaps the most fundamental way, in which instant crypto exchanges differ from their more traditional exchange counterparts is the way funds are kept. Instant crypto exchanges receive and deposit funds directly to your wallet, meaning you retain custody — as opposed to custodial trading exchanges that hold your assets for you.

As you know, not your keys, not your coins. By enabling you to retain custody of your funds, instant crypto exchanges grant you more control and better safety. If you practice good operational security, which typically includes not holding your funds on an exchange, then the likelihood of an attacker wanting to gain access to your wallet is relatively small compared to the massive honeypots of custodial exchanges. In 2019, we saw 12 exchange hacks, with stolen funds totaling over $290M. By using an instant crypto exchange, you can avoid the centralized exchange hack risk without having to constantly be shifting your funds on and off an exchange.

It should be noted that instant exchanges utilize traditional custodial exchanges to execute an order. This means that for the duration of a transaction the specific funds involved in the trade are briefly custodied by the underlying exchange.

Signups and interface — ease of use

If you don’t already have a favorite exchange, the signup and registration process is a factor to consider in choosing one to use. Many of the traditional exchanges have lengthy signup processes that include identity verification and long processing times. In contrast, many instant crypto exchanges allow you to exchange crypto-to-crypto trading pairs with only an email, mobile app or wallet address. Changelly, for instance, requires you to use an email or social media page to sign up for your account — a process that takes minutes before allowing you to trade. Not surprisingly, if you’d like to trade fiat-to-crypto, Changelly does require you to go through a Know Your Customer process and to connect your bank account, though purchases under $150 can be made without KYC.

Once onboarded onto an exchange, you will also see a major difference between the user interface of the instant vs. the traditional. Instant crypto exchanges feel more like modern financial apps than trading terminals; they’re sleek, simple to use and highly intuitive.

Source: www.changelly.com

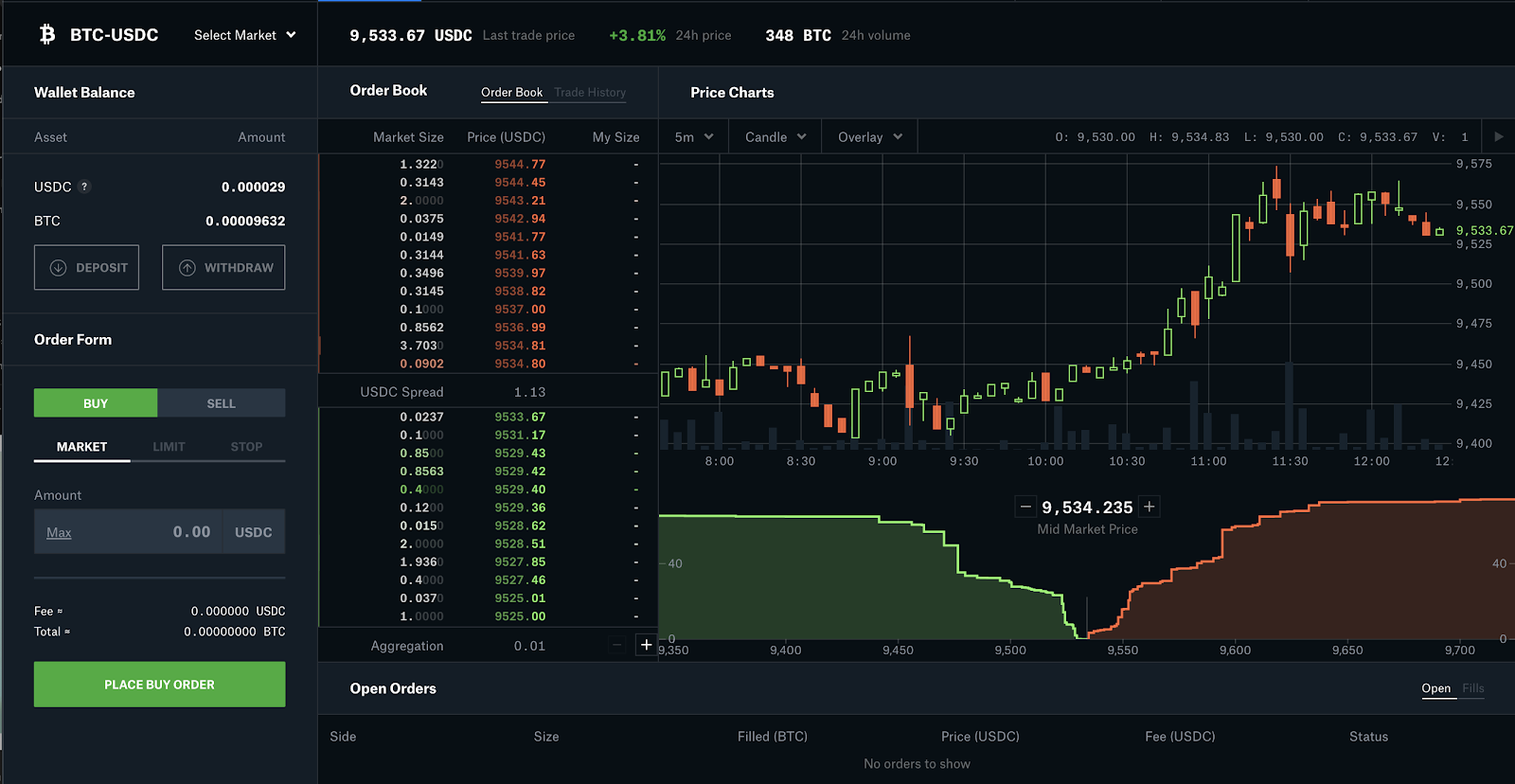

While this might feel minimalistic to an experienced trader, for those looking to simply invest or make a single transaction, it’s a highly attractive option. To compare, power-traders using options like Coinbase Pro see the following:

Source: pro.coinbase.com

As it is clearly evident, a traditional crypto exchange has a lot more information for an experienced trader to digest and act on. But for users looking to have an easy on-boarding and trading experience, instant crypto exchanges offer a much simpler alternative.

Aggregation and fixed/floating rates — price

For those of you familiar with traditional crypto exchanges, you’ll know why Coinbase Pro’s interface is so extensive in comparison: You need to know what the price and depth of the order book in order to make your trade. This order book depth is exchange-specific — it only includes the orders placed on Coinbase. Instant crypto exchanges, on the other hand, aggregate prices and liquidity from multiple exchanges, meaning you get access to the best prices those multiple exchanges have to offer, with deeper liquidity and less risk of slippage.

When placing the actual order, these two solutions also differ. A common traditional exchange order type is a limit that tells the system to execute the buy or sell order when the price is at or better than a specific limit. This gives traders more flexibility and control over their trades.

Instant crypto exchanges also have a beneficial feature in trading execution: fixed or floating rates. A floating rate is executed at the best possible price at the time of the transaction, which could be slightly above or below the quoted price due to market volatility. A fixed rate locks in a specific rate and guarantees the trade will be executed at that price, which, again, might be above or below the floating rate depending on market volatility.