Bitcoin smashed past $15,500 levels hitting its new 2020-high and eyeing its all-time high above $20,000. The overall crypto market has added $50 billion in the last week, The fiscal and monetary stimulus measures by the Fed push more people closer to buying BTC.

Bitcoin (BTC), the world’s largest cryptocurrency entered a mega rally surging over 10% in the last 48 hours. It’s for the first time since January 2018 that BTC price has inched closer to $16,000 levels. At press time, Bitcoin is trading at $15,691 with a market cap of $290 billion.

At this point, BTC alone dominates 65.5% of the total cryptocurrency market cap. Interestingly, the Bitcoin rally continues despite entering the overbought regions on technical indicators. With this price, Bitcoin’s year-to-date gains stand at 110%. With this, Bitcoin has outclassed every other asset class, stock indexes, gold, silver, etc. and stands as the top performer in the market.

Bitcoin!

YTD +108%

NDX +38%

Gold +27%

Silver +39%

US Banks down -31%

EU Banks down -39%

Dollar +1.6%

Copper +11%

TLT +26%The Super Massive Black Hole….#Bitcoin

— Raoul Pal (@RaoulGMI) November 6, 2020

There’s some massive buying of Bitcoin (BTC) by the big players in the market. Digital asset manager Grayscale has purchased over 16,000 BTC just over the last week. Interestingly, the total BTC produced by the miners was 6300, meaning Grayscale bought over twice the BTC produced. It’s about time that the retail FOMO triggers pushing Bitcoin price above its current all-time high of $20,000.

Grayscale bought 16,000 #bitcoin last week.

Miners created 6,300.Grayscale bought 2.5X more $btc than was produced!

INSANE SCARCITY coming into effect!

Moooonnnnnnn!!!!— Lark Davis (@TheCryptoLark) November 6, 2020

Moreover, as per the Glassnode data, the total number of “accumulation addresses” has hit a record high of 519,228. This accumulation addresses show the rising retail interest in BTC. Moreover, in 2020 alone, there’s a 9% jump in accumulation addresses while the BTC locked in these accumulation addresses has jumped by 20% to over 2.8 million BTC.

Data shows that a large number of investors accumulated Bitcoin during the market crash of March 2020 when BTC dropped below $5K. Similarly, the second-biggest purchase happened during September 2020. The price drop during both these times was only for a very short time as Bitcoin (BTC) quickly recovered post that.

Bitcoin and Overall Crypto Market Rally: Analysts Views

The overall cryptocurrency market looks flooded with buy order with all the top-ten cryptocurrencies gaining between 4-11%. The overall crypto market cap has added $50 billion in the last two days and is just short of $450 billion. Along with Bitcoin, the overall crypto market cap has also surged over 100% year-to-date.

At press time, Ethereum (ETH) is trading 7.2% up at a price of $432. The recent rally in ETH comes as the deposit contracts for Ethereum 2.0 go live two days back. The Ethereum 2.0 Beacon Chain is ready and will go live on December 1 kicking of staking contracts and rewards.

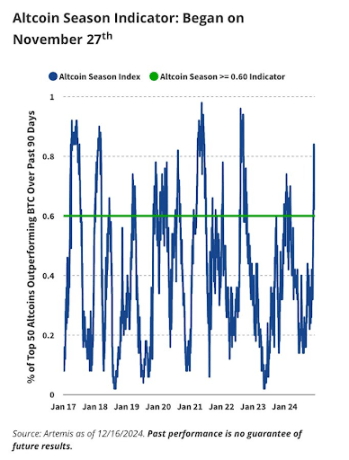

Other altcoins like XRP has gained 5.21%, Bitcoin Cash (BCH) has gained 3.76%, Chainlink (LINK) 7.54%, Litecoin (LTC) 10%, Polkadot (DOT) 6.87% and so on. Some analysts are already predicting an altcoin rally and a repeat of the post-Bitcoin rally as in December 2017.

This #bitcoin pump is super fun to watch, but it will be nothing compared to the insane #altcoin rally that will follow when the big boy finally takes a nap!

— Lark Davis (@TheCryptoLark) November 6, 2020

Fairlead Strategies founder Katie Stockton told Business Insider:

“The breakout puts [the] next and final resistance at the high from 2017 above $19,500. There are some signs of short-term upside exhaustion from an overbought/oversold perspective, supporting a few weeks of consolidation, but we would see this as healthy from a technical perspective”.

Federal Reserve Chairman Jerome Powell said that the economic activity will take longer than expected to recover. The fiscal and monetary stimulus and continuous pumping of money have raised concerns about inflation. Many crypto experts say this is a clear sign of buying Bitcoin.

This is code for buy #Bitcoin https://t.co/9k2wQVP0OG

— Tyler Winklevoss (@tyler) November 6, 2020

For other BTC news you can follow the link.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.