- General Motors has taken an 11% stake in Nikola.

- The two companies are working on an all-electric pickup truck.

- This could provide the first meaningful competition for Tesla Motors.

Shares of Nikola Motors are leading another poor day for the markets, as the company announced a partnership with General Motors. GM has provided $2 billion in equity for the electric vehicle company, and GM gets to nominate a director to Nikola’s board.

GM and Nikola Tech Will Combine for Fuel Cells, Trucks

In addition to equity and board seats, the partnership is really about sharing complementary technologies. General Motors will supply its fuel fells to Nikola’s existing Class 7/8 truck line, and the combined entity will work on the Nikola Badger pickup truck, which will be an all-electric vehicle running on a hydrogen fuel cell.

The partnership expects to save Nikola $4 billion in battery costs over ten years, and over $1 billion in savings from outsourced engineering work to GM. On GM’s end, their investment should appreciate, particularly if Nikola can grab a significant share of the all-electric pickup market.

The move allowed Nikola shares to surge nearly 40% in early-morning trading. Shares first exploded higher in early March after traders gravitated towards the company as a cheaper version of Tesla Motors, but have been trending down since.

The deal with GM will likely provide a floor under shares, as GM’s $2 billion, 11% stake equates to a market cap of just over $20 billion– slightly above where shares now trade.

Has Tesla’s Time Come?

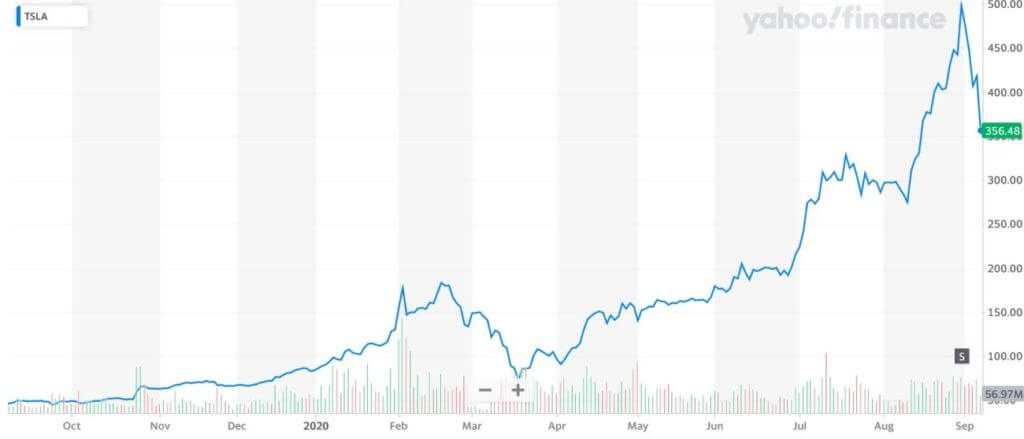

The news, which has been a tremendous boon for Nikola shares, comes as Tesla stocks continue their post-split meltdown. Shares were down as much as 19% in early market trading, adding to hefty losses from last week, and putting the stock into bear market territory.

The latest drop came as the S&P 500 Index rebalance added a few new companies—but not Tesla, as was widely expected. In addition to the snub, several analysts have started to question the company’s valuation and sales demand now that shares have begun to move down.

Given Tesla’s phenomenal move, with shares up nearly ten-fold in the past year, some pullback was always in the cards. That’s true for any tech company following a big run. Operationally, the company has improved significantly, hitting four quarters of profitability–making it eligible to be included in the S&P 500 in the first place.

Now, the company looks to have some competition in the all-electric truck space, all within a year of announcing its Cybertruck product.

But having a competitor is no guarantee of lost market share. Tesla may be down—and with the hefty valuation and surge in shares, it should be—but it’s not out yet. It just has to deal with increased competition, which in turn tends to mean better products at better prices for consumers. Don’t write the obituary on Tesla just yet.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.