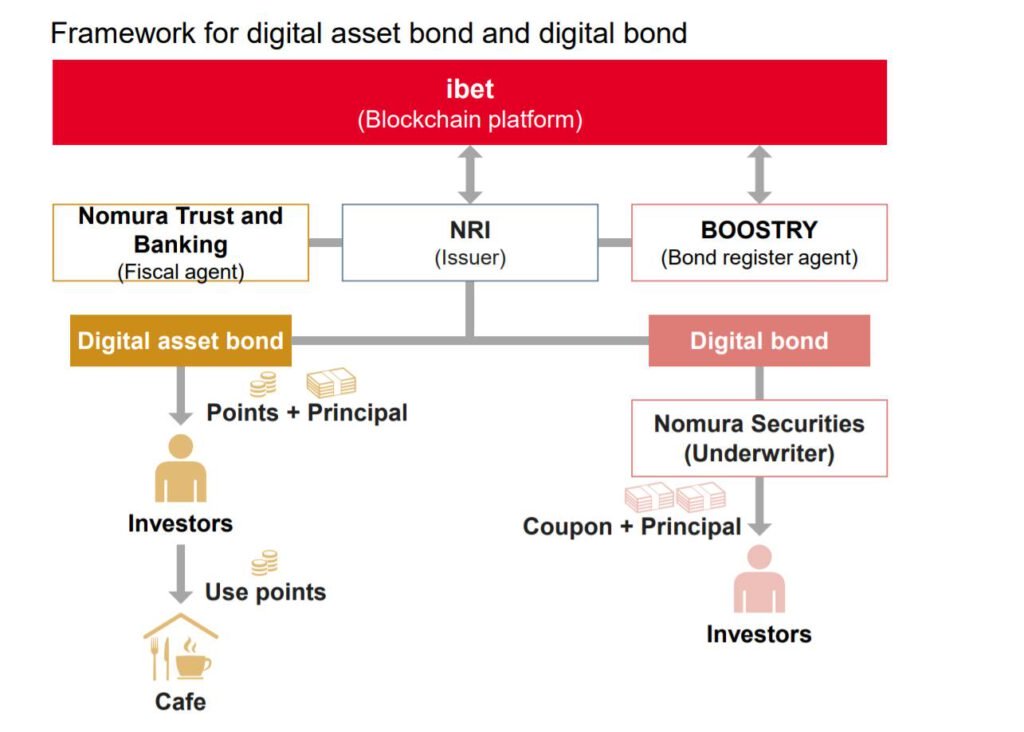

Nomura Securities (NS) joined the Nomura Research Institute (NRI) and BOOSTRY have joined up in a venture to create Japan’s first digital asset bond and digital bond to use value co-creation to help develop the countries’ capital markets, along with solving social issues.

The digital asset bond was offered directly to investors by NRI, while NS served as the underwriter, Nomura Trust and Banking (NTB) acted as fiscal agent, while BOOSTRY provided its blockchain platform “ibet” and acted as register agent.

The platform allows issuers to keep track of bondholders which is usually difficult with traditional bonds. The digital asset bond provides digital assets to investors instead of interest payments (the bond offers points which can be used in cafes). NRI solicited investors for the digital asset bond using a smartphone app that connects to ibet, a blockchain platform that has broad use, including issue and manages rights (securities, memberships, vouchers, etc.). It is also open source and is intended for companies interested in the digital asset business.

As well as providing funding through the capital markets, the digital asset bond represents a new form of collaboration between marketing and finance, which helps expand the way the capital markets function, with more agile fundraising through new financial services, including digital currencies.

By underwriting bonds that leverage new forms of technology, Nomura Securities aims to help issuers diversify their funding methods and realize more stable funding. They seek to offer new investment opportunities to investors and contribute to the development of the global capital markets with this move.

Payment and issuance of the bonds were completed today.

Nomura Group has also announced the establishment of a dedicated research group as part of its efforts to advance information communication technologies to meet and respond to the global diversification of financial transactions in the capital markets.

“In the U.S., security token offerings (STO1) have been gaining recognition, with the Securities and Exchange Commission clarifying how financing via blockchain and other forms of distributed ledger technology (DLT) would be treated under federal securities law.”

“In Japan, revisions to the Financial Instruments and Exchange Act this year will clarify how STOs and other rights transferrable via DLT are to be treated under the law.”

“Research on STOs is currently being conducted in a wide range of fields. In the financial and capital markets, proof of concept testing is being conducted for securities issuances using blockchain technology. However, further research is required to ensure that blockchain technology contributes to sound market development.”

“The new research group brings together academics, issuers, asset managers, settlement agencies, financial intermediaries and other experts in the field to focus on blockchain technology in the financial and capital markets. The group will take a multifaceted approach to identify relevant issues and determine how blockchain technology can be used to help enhance and diversify financial and capital markets and respond to the funding and investment needs of issuers and investors.”

Nomura is an Asia-headquartered financial services group with an integrated global network spanning over 30 countries. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its four business divisions: Retail, Asset Management, Wholesale (Global Markets and Investment Banking), and Merchant Banking. Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com.

- Japan’s Nomura Securities and BOOSTRY Issue First Blockchain Digital Bond Offering – March 30, 2020

- Opera Rolls out Update and Expansion of its Cryptocurrency-Friendly Browser Blockchain Architecture – March 30, 2020

- Hong Kong Bank Partners with Aegis to Focus On Asset Digitalization Using Blockchain Technology – March 30, 2020

- European Union Looking to Blockchain Technology for Defense? – March 30, 2020

- Tech against Corona (COVID-19) – Dutch Enterprise Blockchain Company TYMLEZ Helps Dutch Government – March 29, 2020

- Microsoft Patents Human Activity Mining for Cryptocurrency Systems – Data Generated Based on Body Activity can be Proof-of-Work – March 27, 2020

- Binance Kicks Off $5 Million Coronavirus Relief Campaign and Donates USD $1 Million – March 27, 2020

- Medici Ventures Keiretsu Companies GrainChain and Symbiont Working Together to Expand Global Operations – March 27, 2020

- Blockchain-Fueled Entertainment Platform Ficto Launches Premium Interactive Streaming Network – March 27, 2020

- SettleMint – Belgian blockchain startup raises USD $2.09 Million for Expansion – March 27, 2020

- Exclusive Interview: Bitcoin and Cryptocurrency Leader Michael Terpin Sees Light in The Covid-19 Tunnel – March 26, 2020

- Blockchain Real Estate Project Smartlands Raising Funds on Equity Crowdfunding Platform Seedrs – March 26, 2020

- Cryptocurrency Exchange OKEx Greenlights DEA Trade Token Deapcoin For Its Jobtribe and PlayMining Games – March 26, 2020

- Microasset – The International Blockchain Monetary Reserve Announces $3.48 M In Reserve Funding, New Listing on BiKi Exchange – March 25, 2020

- Social Login – KyberSwap Integrates Torus to Offer Quick and Easy Ethereum Wallet Management – March 25, 2020

- Michael Terpin’s BitAngels Launches Virtual Events to Connect Blockchain Community Amidst Global Coronavirus Pandemic – March 25, 2020

- Blockchain-Fueled Company Mateon Report Positive Results For Multiple Covid-19 Drug Candidates – March 25, 2020

- US Judge Slams Brakes on Telegram Token – March 25, 2020

- Game Development Companies Team Up with Blockchain Operation Forte to Unlock New Business Models for Games – March 24, 2020

- Blockchain Supply Chain Project Envoy teams up with KYC Hub – March 24, 2020

Also published on Medium.