This week Bitcoin (BTC) price rallied to a new 3 year high at $18,965, leading investors to believe a new all-time high above $20,000 is on the cards.

While these are exciting times, data does show that some professional investors feel antsy about the price at these levels and the absence of retail FOMO has some calling for a sharp pullback.

Data shows Bitcoin hasn’t seen a drop larger than 5% since Sept. 4 and over the past 77 days the digital asset has gained 84%.The last time similar price action was observed was on Nov. 25, 2019.

Back then, BTC made a 47% move from $6,900 to $10,150 by mid-February 2020, a 86 day sequence. Nevertheless, one should not jump to the conclusion that a substantial correction necessarily follows every movement without a 5% daily drop.

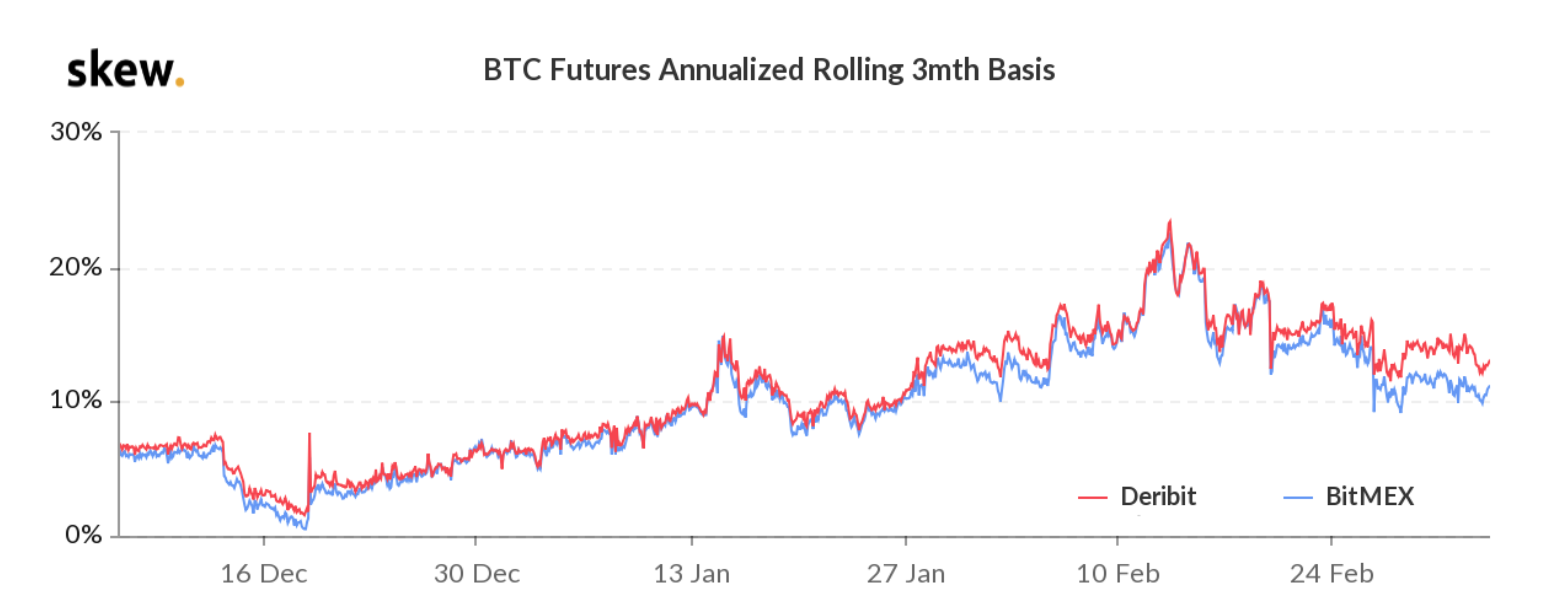

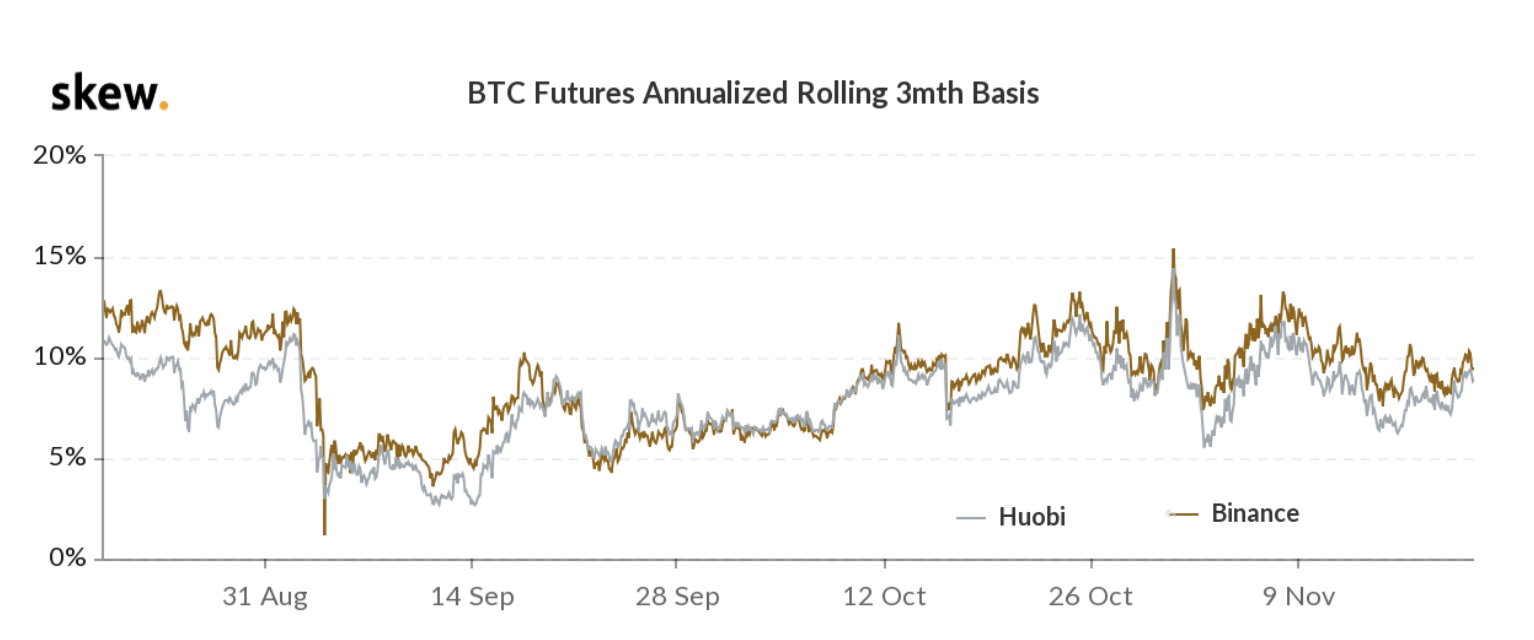

Evidence of such disparate expectations can be extracted from the futures contracts basis. Typically, the indicator should display a 3% to 10% annualized premium.

Take notice how traders were willing to pay an additional 20% annualized to carry leveraged positions back in February. This is rather unusual and a signal of extreme optimism.

This time around, the basis indicator has been gravitating near 10%. Therefore, it is safe to infer that the odds of cascading sell order liquidations is much lower this time.

Lack of optimism is a sign of reduced conviction

Traders have been taken aback by this unusual trend, and data confirms that there is a complete lack of conviction. Even though the BTC futures contracts premium currently stands at a bullish zone, that validify buying it indiscriminately.

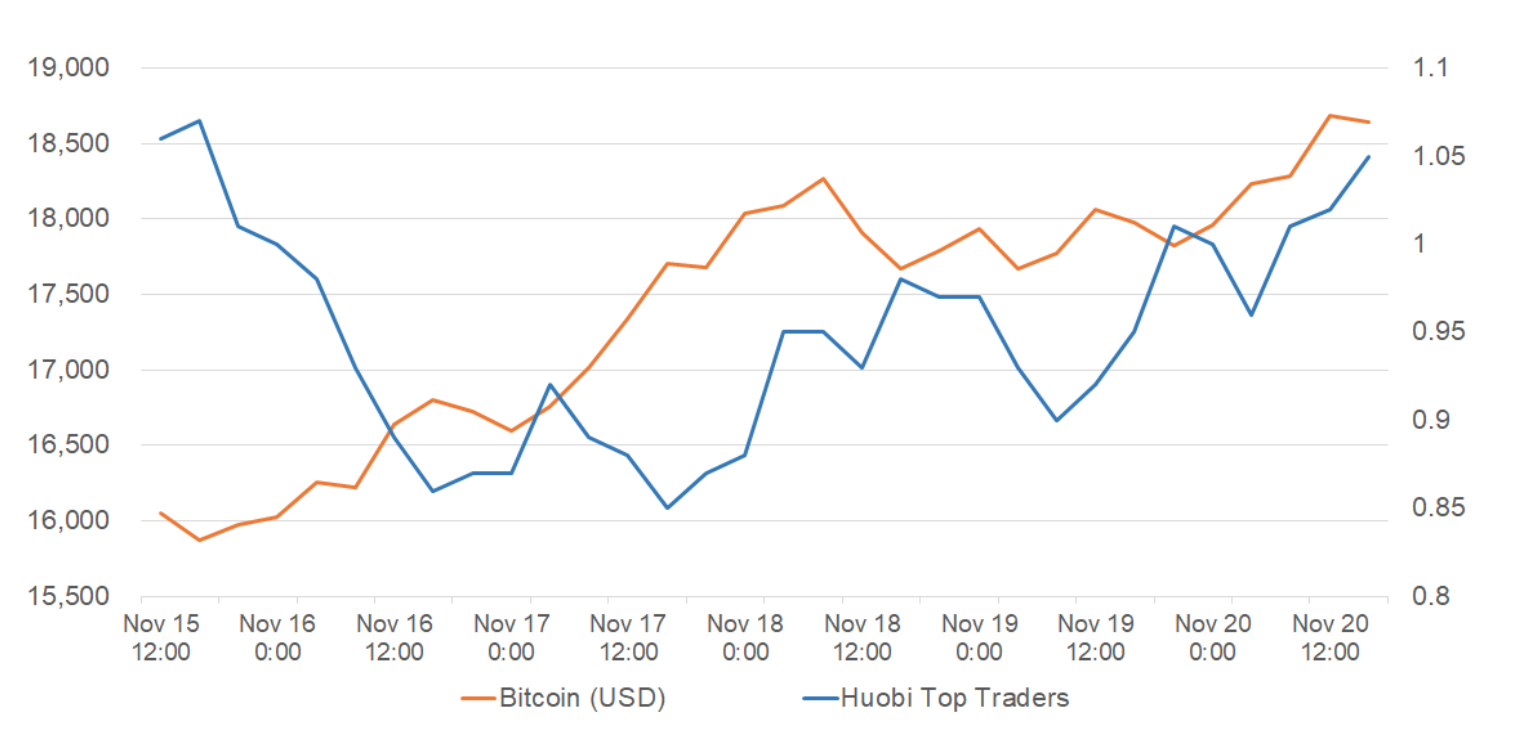

To effectively gauge whether professionals have been carrying long positions throughout this rally, investors should monitor the top traders long-to-short ratio at leading crypto exchanges.

At Huobi we can see that the top traders entered a net short position as Bitcoin surpassed $16,000 on Nov.16. On Nov.19, a few bearish bets appeared as BTC failed to break the $18,000 resistance. Once again, they were quick to close their losses and are currently flat. Therefore, one can assume that professional traders have been trying to guess a local top without much conviction.

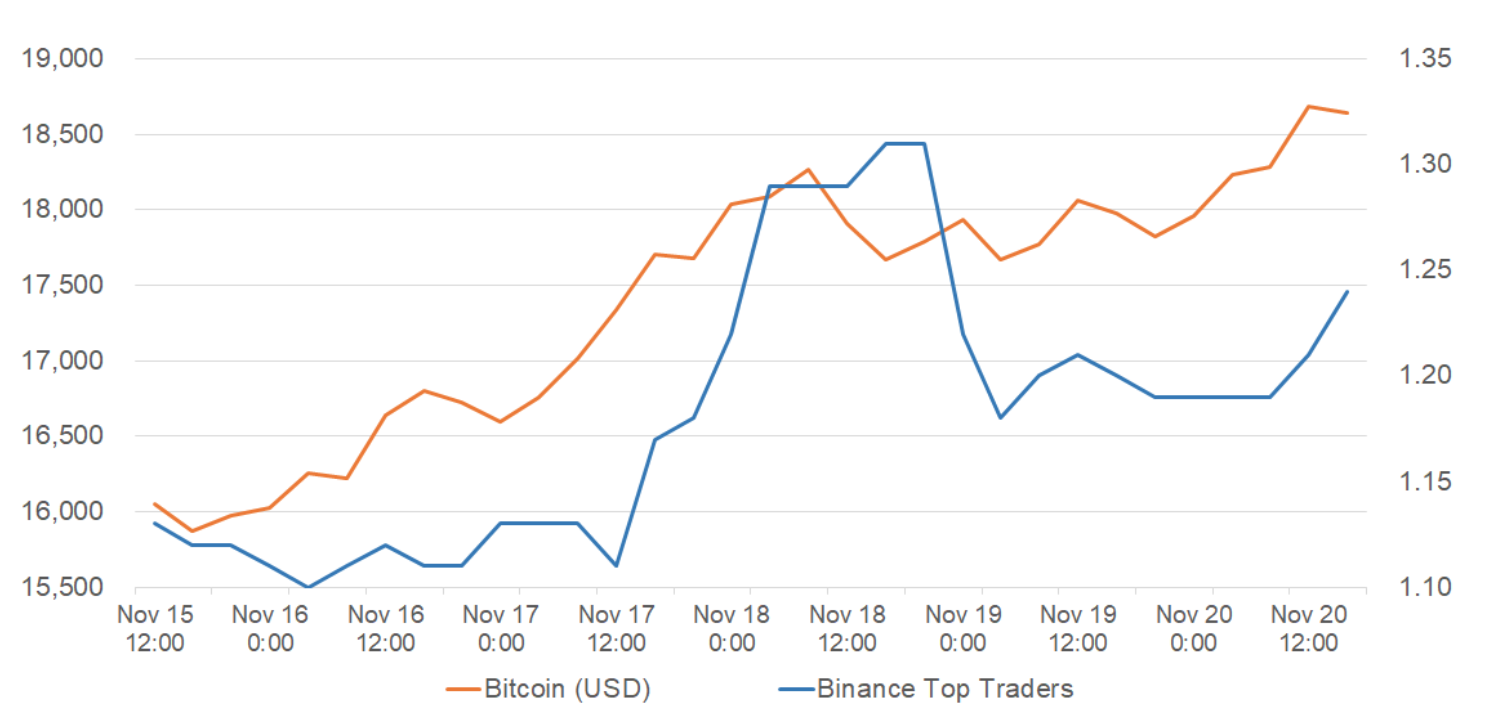

Interestingly, data from Binance shows top traders applying a different strategy. Despite this, it still reflects a lack of conviction, as one can infer below.

Binance top traders held a 10% net long while Bitcoin rallied above $16,000 but they then scrambled to buy after it shot above $17,500.

While still maintaining a bullish position, they significantly reduced it as BTC struggled to break $18,000 on Nov.18.

It is worth noting that exchanges gather top traders’ data differently, as there are multiple ways to measure clients net exposure. Therefore, any comparison between different providers should be made on percentual changes instead of absolute numbers.

Ultimately, the data signal that there is some indecision or at least a lack of strong conviction among top traders.

When the market is sending mixed signals there’s nothing wrong with sitting tight and not being in a position. At least, this is what savvy traders seem to be doing.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.