- Kodak rose by as much as 50% in pre-market trading after the company revealed that a prominent hedge fund had acquired a 5.2% stake.

- The company had been awarded a government loan of $765 million to produce drugs, but this loan is on hold amid accusations of insider trading.

- If any probe or lawsuit concludes that insider trading had occurred, Kodak’s strong rally this year will come to a bitter end.

Kodak (NYSE:KODK) stock has jumped by 50% in pre-market trading after the company revealed that hedge fund D.E. Shaw & Co. had acquired four million shares. The shares amount to a 5.2% stake in Kodak. The market has taken this acquisition as a signal of confidence in Kodak.

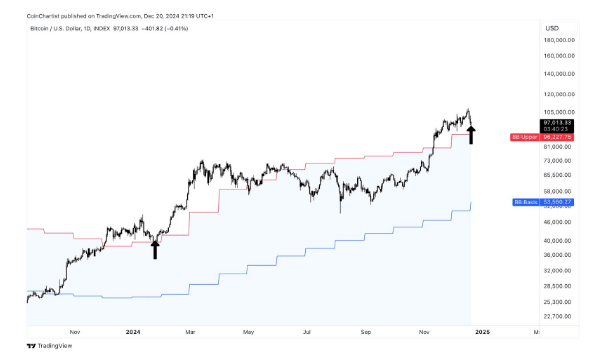

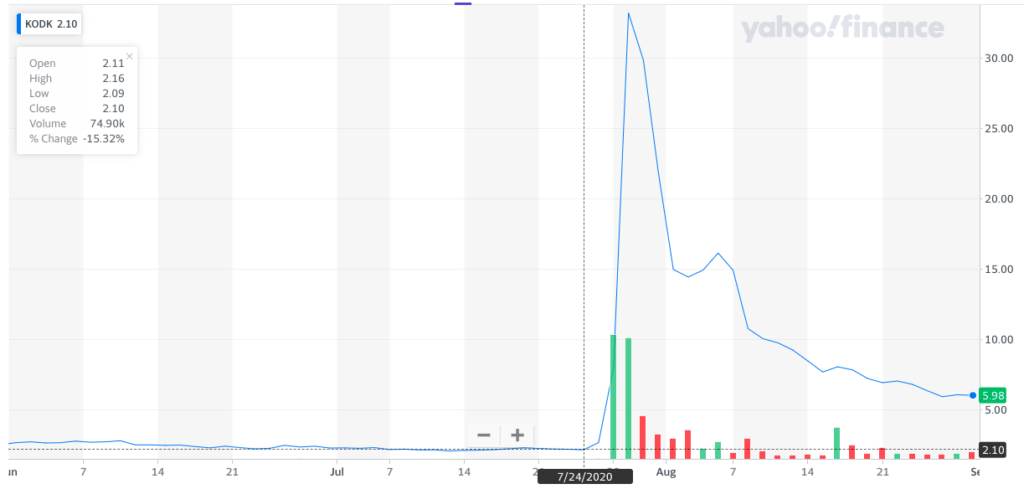

Kodak has already rallied massively this year, rising by 2,700% in late July after the U.S. government announced it would loan the firm $765 million to make generic drugs. Tuesday’s surge will renew faith in Kodak in some quarters, yet the rally is unlikely to last.

The Securities and Exchange Commission (S.E.C.) is investigating Kodak for alleged insider trading. Shareholders also opened legal proceedings against the company last week, claiming that insiders at Kodak bought up the company’s stock before the government loan was officially announced. These allegations have resulted in the $765 million loan being paused. It’s unlikely that the deal will go ahead at all.

Kodak Stock Jumps After Hedge Fund Buy

Kodak ended Monday at $5.98, a 0.7% decline on the day. The company then filed a 13G form with the S.E.C., revealing that a prominent hedge fund–D.E. Shaw & Co.–had acquired 3,943,770 shares in the company.

This filing sparked an after-hours and pre-market feeding frenzy. Kodak stock hit a high of $9.04 in pre-market hours, representing a 51% increase.

The rally is currently holding firm, having risen from 20% to 30% to 40% and then to 50%. But it’s unlikely to survive.

That’s because all is not well at Kodak. The U.S. International Development Finance Corporation–the governmental agency responsible for allocating the $765 million loan–has put the funding on hold amid allegations of insider trading.

Shareholder Lawsuit

On August 30, Jakubowitz Law announced that it had begun a securities fraud class-action lawsuit against Kodak on behalf of various shareholders:

Defendants failed to disclose that the Company had granted its Executive Chairman, James Continenza, and several other Company insiders millions of dollars’ worth of stock options immediately prior to the Company publicly disclosing that it had received the $765 million loan, which Defendants knew would cause Kodak’s stock to immediately increase in value.

The lawsuit also claims that Continenza and other insiders “purchased tens of thousands” of Kodak’s shares immediately before the announcement.

Combined with the suspicions of Congress and the S.E.C. probe, the picture doesn’t look especially rosy for Kodak. The U.S. government may not distribute the previously-approved loan if any investigation or legal case concludes that insider trading did occur.

And without the loan to begin manufacturing generic drugs, there will be nothing propping up Kodak’s rally. Disregarding pre-market trading, the stock is up 184% from where it was before the loan was announced.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the stocks mentioned.