On Nov. 4, crypto data market aggregator CryptoQuant published a chart indicating Binance’s Estimated Leverage Ratio — open interest divided by Bitcoin (BTC) reserves — has pushed into new all-time highs.

The record was set on Nov. 3 after a spike in open interest pushed Binance’s ELR above 0.18 for the first time. The spike in ELR came shortly before Bitcoin established a double-bottom at roughly $13,400.

New data suggests Bitcoin’s bullish push into 2020 highs above $14,000 may have been fuelled by leverage, which could mean markets will continue to see significant volatility in the short term.

However, Binance also recorded its largest daily BTC outflow on Nov. 3, with 58,861 Bitcoin worth $816 exiting the exchange in 24 hours.

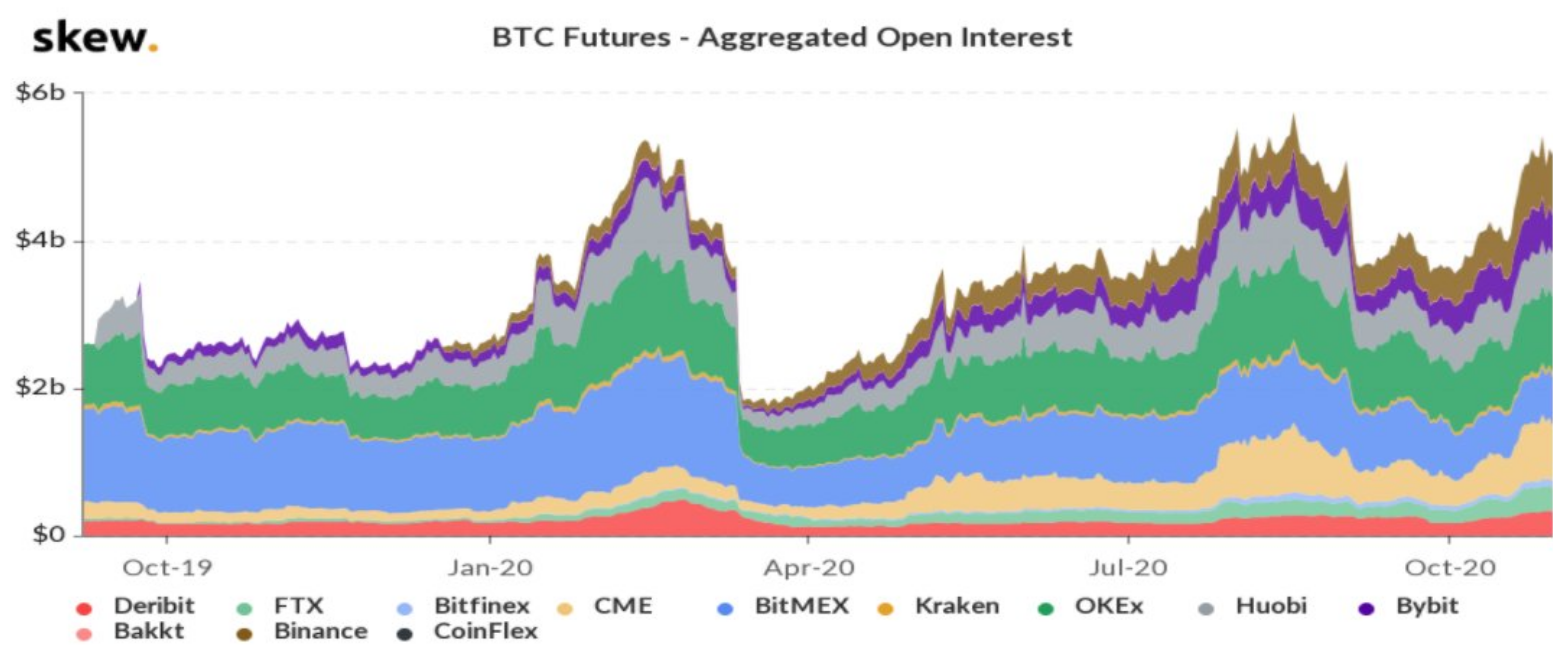

Binance was not the only platform to experience a recent spike in open interest, with data from Skew indicating combined open interest in BTC futures is testing all-time highs in the upper-mid $5 billion range.

The growing open interest also comes despite BitMEX’s recent decline in market share, with the exchange currently facing money laundering charges levied by the U.S. Department of Justice.

According to Messari, the boost in open interest may indicate “bullish sentiment,” provided it is being driven by long positions. The research firm also notes the data suggests new capital may be entering crypto:

“Rising prices during an uptrend while open interest is also on the rise could mean that new money is coming into the market.”

The increasing open interest also comes as the number of BTC on exchanges has been steadily dropping since May — suggesting that buyers are accumulating Bitcoin from exchanges and placing them in cold-storage as longer-term investments.

Long positions on Bitfinex have also steadily been gaining since the start of October, pushing up from 25,000 to 29,000 as of this writing. While shorts have also spiked since Oct.20, doubling from 3,250 to 6,770, the bulls appear to be firmly in control of the markets.

Over the last couple of hours, BTC has pushed into new highs for 2020 above $14,300.