Alameda Research has been a diligent user of decentralized lending protocols, originating hundreds of millions in uncollateralized loans so far. Its current outstanding debt on DeFi protocols, however, is rather small compared to earlier this year, meaning fewer investor funds are in danger if Alameda defaults on the loans.

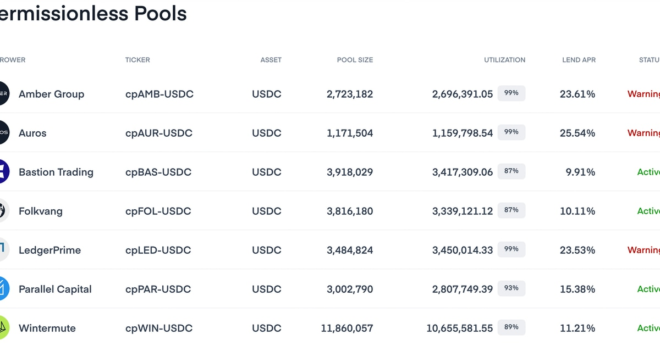

Liquidity Crunch Spreads to Crypto Lending as Institutional Borrowers Max Out Credit Pools