The Litecoin halving is just a few days away. Even with this bullish catalyst on the horizon, the No. 4 cryptocurrency appears to be struggling against bitcoin.

Litecoin (LTC/BTC) has posted four consecutive red candles on the monthly chart against bitcoin. The slump saw the coin’s value drop from the 2019 high of 1,893,900 satoshis in April down to lows of 797,600 satoshis this month. That’s plunge of over 57 percent in three months.

The good news is that the end of the correction might be in sight. Litecoin is printing multiple bullish signals against bitcoin. If our analysis is correct, the LTC/BTC market could skyrocket by over 60 percent in the next few months as the market ends wave two.

Rudimentary Elliott Wave Analysis Reveals That Litecoin May Have Ended Wave Two of Its Bull Run

While everyone’s busy predicting what bitcoin’s next move will be, Litecoin made a series of moves showing the correction has finally come to its end.

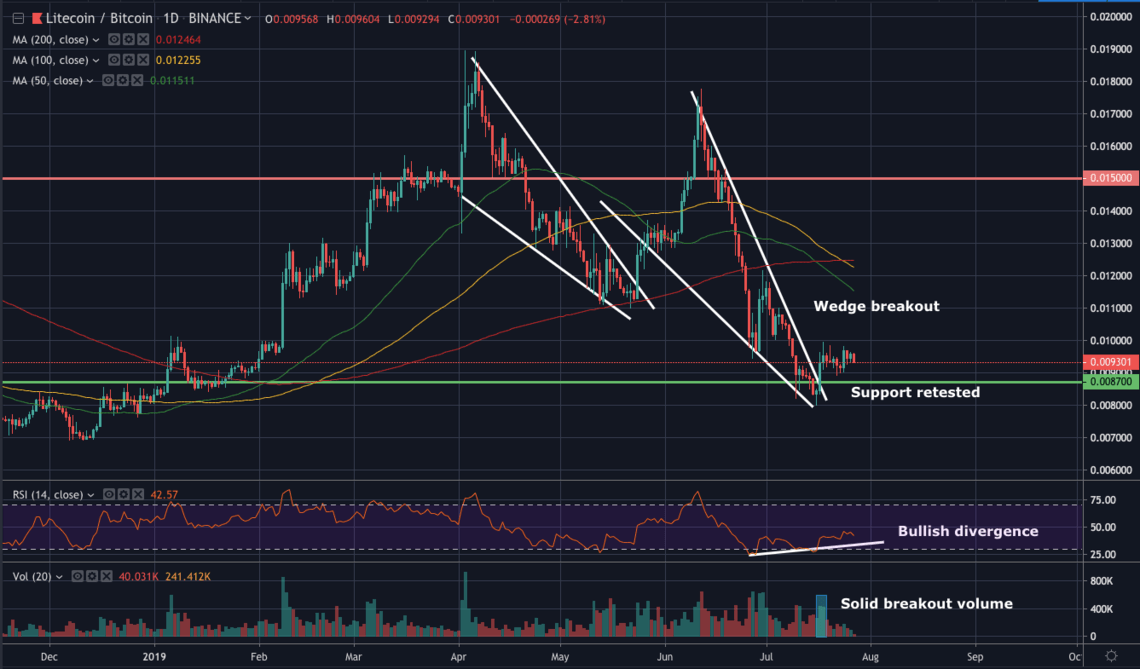

A rudimentary Elliott Wave analysis of the daily chart shows that the market completed wave one when it climbed as high as 1,893,900 satoshis on April 3. It then entered wave two and painted a corrective A-B-C wave. Typically, the corrective A-B-C wave drives the price down by 60 percent. The downward spiral to 797,600 satoshis on July 16 meets this requirement.

If our wave counts are accurate, this means that the cryptocurrency appears ready to blast off. Wave three is the longest wave up. In other words, Litecoin could surpass the 2019 high of 1,893,900 satoshis.

Litecoin Quietly Reversed Its Trend With a Bullish Breakout

Even if you analyze Litecoin’s chart from the classical perspective, you will still come up with the same conclusion: the cryptocurrency is done retracing.

We have this view because bulls were able to preserve support of 870,000 satoshis. This is a solid move on their part because bears successfully breached this level on July 15. However, buyers quickly stepped in and lifted the market back above support of 870,000 satoshis on July 17.

The price action emboldened bottom pickers who were staying on the sidelines.

As a result of the recovery of the support, the cryptocurrency broke out of a large falling wedge on the daily chart. This is a bullish reversal pattern indicating that the asset’s price will likely trend higher.

If you want an example, Litecoin also broke out of wedge on May 25. In a couple of weeks, the crypto token grew by over 57 percent.

We expect the same reaction considering how technical indicators are flailing bullish signs. For instance, the daily RSI is flashing a bullish divergence. This tells us that momentum has swung to the side of the bulls. On top of that, the falling wedge breakout was coupled with heavy volume. This is an indication that buyers are interested in buying at current levels.

Bottom Line

Litecoin may haven taken a breather for a few months. Nevertheless, both Elliott Wave analysis and classical charting tell us the same thing: fireworks may be on the horizon.

For now, investors who are interested in Litecoin might want to consider buying as close to support of 870,000 satoshis with a stop at 830,000 satoshis. With a target of 1,500,000 satoshis, investors stand to gain over 70 percent if the market revisits the support again. If we’re wrong, investors only risk 4.6 percent. That’s not a bad risk-to-reward ratio.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.