Thursday, June 6 — Bitcoin (BTC) and ether (ETH) are trending down slightly following the slump from the recent rally. Top cryptocurrencies are seeing a mix of ups and downs, according to data from Coin360.

Market visualization courtesy of Coin360

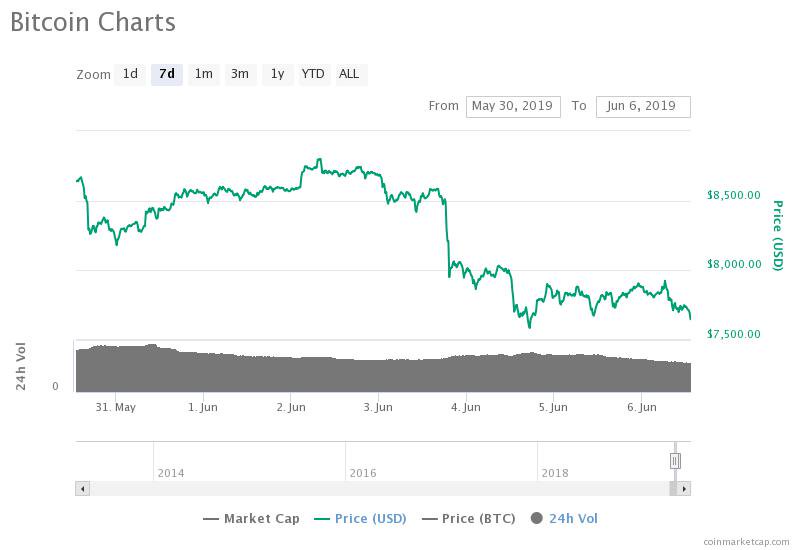

After its surge to $9,000 last week, BTC is down by 1.67% on the day, and is trading at just $7,676 according to CoinMarketCap. The leading cryptocurrency has fallen in market capitalization by about $10 billion since May 30, with a market cap of approximately $136 billion at press time.

Bitcoin 7-day price chart. Source: CoinMarketCap

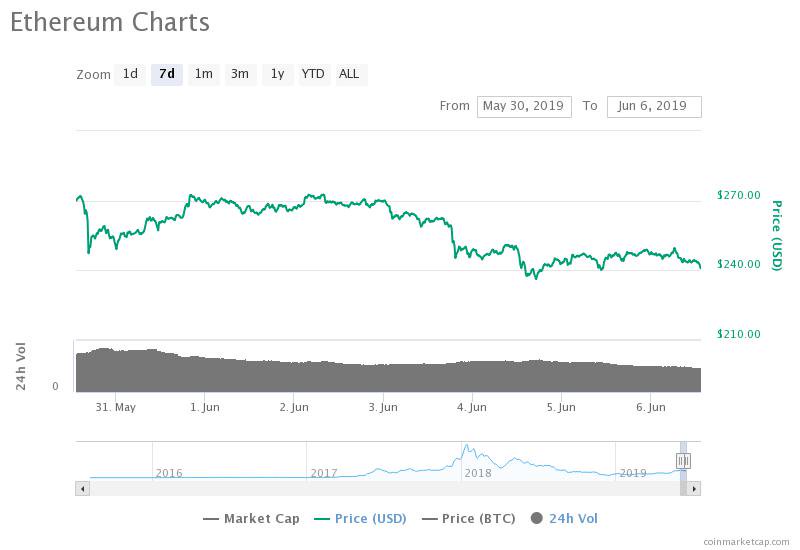

Top altcoin ETH is currently down by 1.8% and is trading at $241.77 at press time. With the recent market adjustments, ETH currently has a market cap approximately 19% the size of Bitcoin’s.

Ether 7-day price chart. Source: CoinMarketCap

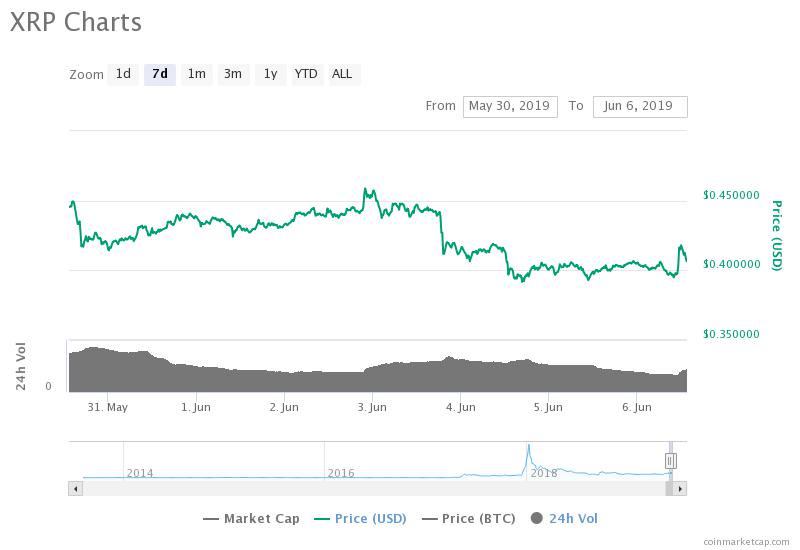

Ripple’s token XRP, however, is trending up by 2.32% on the day, and is trading at $0.408.

XRP 7-day price chart. Source: CoinMarketCap

The total market capitalization of all cryptocurrencies is currently at $243 billion. 24-hour trade volume is $62.3 billion.

Total market capitalization of all cryptocurrencies 24-hour price chart. Source: CoinMarketCap

Looking at the data provided by MarketWatch, gold is in the green, trading at around $1,342.40, up by 0.66% on the day. Oil, on the other hand, is down by .21% on the day, trading around $51.57 at press time. Aside from oil, however, other traditional assets listed on the website remain in the green.

As previously reported on Cointelegraph, investment advisory group San Francisco Open Exchange (SFOX) released a volatility report on June 6, saying that the crypto market has transitioned from “mildly bullish” to “uncertain.” SFOX cautioned that the bullish growth in May could have been unsustainable growth due to investor FOMO (fear of missing out).

In the report, SFOX conjectured that bitcoin’s major rally on May 13 might have been the result of the on-going trade war between the United States and China. It also noted that the “flash crash” on May 17 may have been the result of a sale on cryptocurrency exchange Bitstamp, in which 5,000 BTC was sold significantly below market value at $6,200.