Buoyed by bitcoin’s recent spike, altcoins including exchange-issued tokens recently made significant gains, while several of these crypto-assets went on to set new all-time highs (ATH). According to Messari data, Binance is leading the pack in this category, after its token went up by more than 150% from $47 on February 1 to an ATH of $148 on February 10. Nevertheless, at the time of writing, the token had retreated and was trading at $123.

Centralized Exchange Tokens Lead the Way

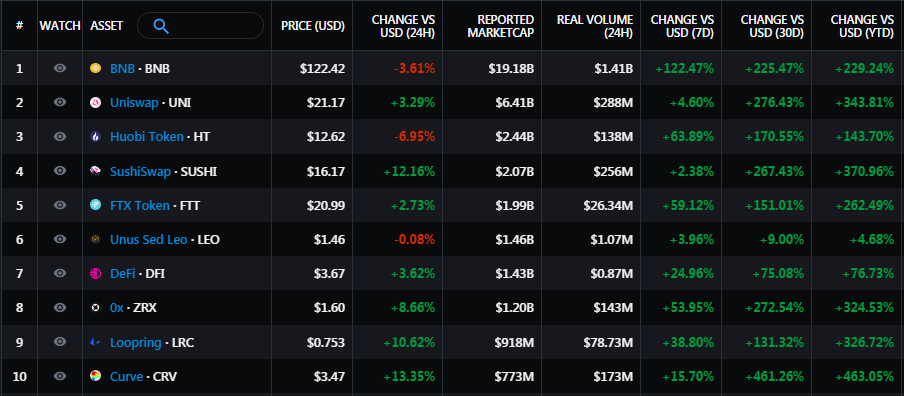

As a result of this surge, the market capitalization of the BNB token stood at just over $19 billion at the time of writing, while the crypto-asset has now moved up to number 6, as shown by Messari.io top asset rankings. Also, BNB’s seven-day change of 116% is one of the highest by a centralized exchange.

Meanwhile, also seeing similar growth action is Asian crypto platform Huobi whose token touched a new ATH of $13.95 on February 10. After starting the month at $6.54, the token was trading at $12.65 press time. As Messari data indicates, the HT token has grown by 170% in the past 30 days and this has resulted in its market capitalization growing to $2.47 billion.

Another Asia based centralized exchange to see its own token grow by more than 100% is FTX, a cryptocurrency derivatives platform. Having commenced trading at $11.16 on February 1, Messari data shows that this exchange’s token went on to set a new ATH of $22.77 on February 10. Yet, at the time of writing, the token was trading at $21.11, which equates to a market capitalization of nearly $2 billion.

Significant 30 Day Growth for Decentralized Exchange Tokens

Meanwhile, the Uniswap token, which has surged by 274% in the past 30 days, is the highest-ranked decentralized exchange asset with a market capitalization of just over $6 billion. While Uniswap’s token did record its ATH of $22.21 on the same day, as the centralized exchange tokens above, its seven-day value change of 2.35% is still much lower than that of BNB. Similarly, sushi, the next best performing decentralized exchange asset, had its own ATH of $16.30 on February 4 as well as a slightly higher seven-day change of 5.64%.

In the meantime, the Messari data shows that the exchange assets had an average growth in value of 70% over a seven day period and over 200% in the past month. At the time of writing, the total market capitalization of the 54 exchange assets stood at $43.67 billion.

What are your thoughts on the recent performances of exchange tokens? You can share your views in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Messari.io,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.