Bitcoin is back on a bull run but ether has hit a new all-time high and traders see it has room to grow.

- Bitcoin (BTC) trading around $37,092 as of 21:00 UTC (4 p.m. ET). Gaining 3.4% over the previous 24 hours.

- Bitcoin’s 24-hour range: $35,416-$37,245 (CoinDesk 20)

- BTC above the 10-hour and 50-hour moving averages on the hourly chart, a bullish signal for market technicians.

The price of bitcoin was in its second day of a bull run, with the world’s oldest cryptocurrency going as high as $37,245, according to CoinDesk 20 data. It was changing hands at $37,092 as of press time.

“While BTC did break back below $30,000 very briefly during the period of consolidation over the last few weeks, the fact that it didn’t break down entirely is inherently bullish,” said Chad Steinglass, head of trading at CrossTower Capital.

Bitcoin has closed daily over $30,000 for over a month now. On CoinDesk’s candle charts, which shows a fuller picture of price orders in trading, every time bitcoin ducks under $30,000 it quickly picks back up.

Technical analysts often refer to this phenomenon as “support,” an area where traders have orders placed or will start buying in, usually because they feel a particular price point is enticing.

“There seems to be a solid institutional buying and technical bids just below $30,000 that gives some decent support which takes out the aspiring shorts,” noted Jean-Marc Bonnefous, managing partner for investment firm Tellurian Capital.

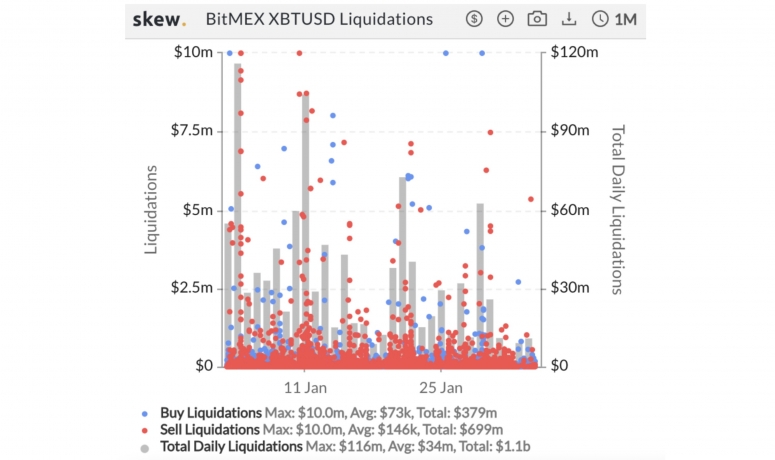

Looking at liquidations, which are automated crypto leverage margin calls on derivatives venue BitMEX, it’s clear there has been a larger proportion of short versus long positions eliminated in the past few weeks.

Of the $1.1 billion in BTC liquidations the past month, $699 million of that tally, or 63%, have been short-oriented wipeouts.

CrossTower’s Steinglass says large buyers are helping maintain price levels and are now pushing them higher. “After the brief pop from the buzz generated by Elon Musk’s tweet and support, we are starting to see another round of institutional support led largely by MicroStrategy’s Michael Saylor,” added Steinglass.

However, not everyone is a permabull. Although bitcoin’s price Wednesday has not been seen since Jan. 28, Joel Kruger, currency strategist at LMAX Digital, is cautious. “While we wouldn’t rule out another poke back above $40,000, we think the balance of risk over the coming weeks actually leans more towards an expectation for a choppy consolidation phase than anything else,” Kruger told CoinDesk. “Medium- and longer-term technical studies confirm this outlook as they are still quite elevated following the parabolic run-up into January.”

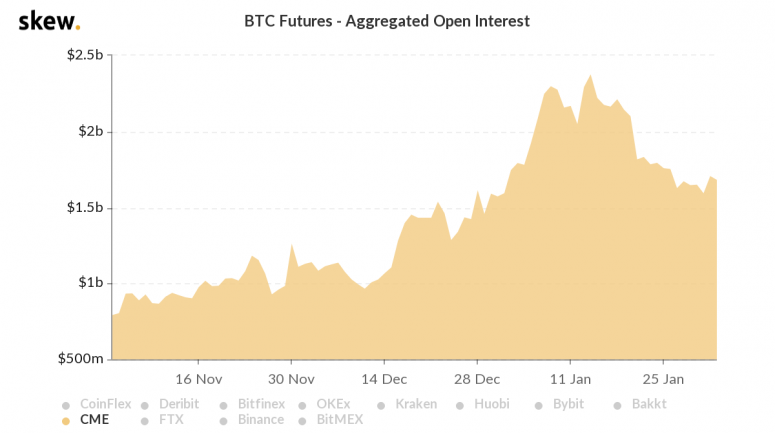

One interesting development: Futures open interest on CME, a platform that caters to institutional investors, has dropped 29% to $1.7 billion since hitting an all-time high of $2.4 billion in open interest on Jan. 14.

This is a sign there’s likely less interest in bitcoin hedging – and perhaps BTC overall – while investors test other waters such as ether.

“We believe that when it comes to consensus and adoption in the cryptocurrency space, everything runs through bitcoin,” Kruger said. “(But) where traders who perhaps felt like they had missed out on bitcoin, they looked to take advantage of the trend by way of ether.”

Ether price frenzy spills into options market

The second-largest cryptocurrency by market capitalization, ether (ETH), was up Wednesday, trading around $1,637 and climbing 6.6% in 24 hours as of 21:00 UTC (4:00 p.m. ET). It hit a fresh all-time high at around 19:00 UTC (2 p.m. ET) to $1,651 Wednesday, according to CoinDesk 20 data.

“Catching up on bitcoin’s recent surge, it seems that there is room for ETH to grow and to try new all-time highs in the coming days and weeks,” noted Elie Le Rest, partner at quantitative trading firm ExoAlpha. “With [decentralized finance] being a hot topic supported mainly by Ethereum technology and [with] ETH 2.0 moving forward, a significant ETH price surge throughout 2021 is highly anticipated.”

The booming price of ether has stirred up options activity on bellwether venue Deribit, noted Greg Magadini, chief executive officer of data aggregator Genesis Volatility. “Traders are paying relatively more for the ‘speculative options’ in anticipation of bigger market moves,” he told CoinDesk.

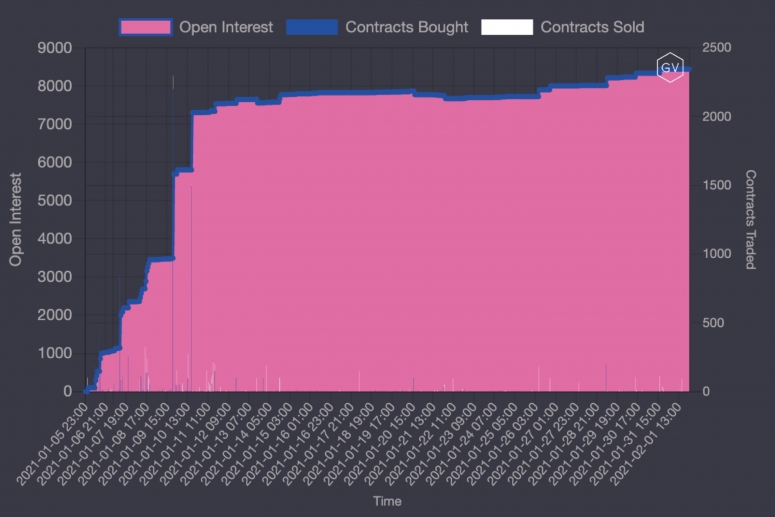

Deribit’s launch of $10,000-strike ether contracts in January is an example of this; more than 8,000 ETH in calls at that strike price are open as of press time.

“These calls were recently released by Deribit and there is already a lot of activity,” Magadini told CoinDesk. “Quintuple-digit ETH prices are starting to enter the market’s psychology.”

Other markets

Digital assets on the CoinDesk 20 are all in the green Wednesday. Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Oil was up 1.3%. Price per barrel of West Texas Intermediate crude: $55.78.

- Gold was in the red 0.19% and at $1,833 as of press time.

- Silver is gaining, up 1% and changing hands at $26.85.

- The 10-year U.S. Treasury bond yield climbed Wednesday to 1.135 and in the green 4.7%.