Bitcoin held steady around $57,000 on Friday after a near-10% decline over the past week. The cryptocurrency is roughly flat over the past 24 hours, compared with a 5% rise in ether and an 8% rise in Solana’s SOL token over the same period.

“Market sentiment seems short-term bearish/sideways – people are shorting BTC in the perpetual futures market,” Ki Young Ju, CEO of CryptoQuant, wrote in a blog post on Friday.

Analysts pointed to rising leverage as a possible sign of froth in the crypto market, which forced some traders to liquidate long positions earlier this week.

From a technical perspective, bitcoin’s long-term uptrend remains intact so long as support above $53,000 holds.

Latest prices

- Bitcoin (BTC): $57,828, -0.52%

- Ether (ETH): $4,272, +5.01%

- S&P 500: $4,697, -0.14%

- Gold: $1,846, -0.68%

- 10-year Treasury yield closed at 1.53%

Off the peak

The chart below shows BTC’s drawdown, or percentage decline from peak to trough. Currently, bitcoin is down about 13% from an all-time high of around $69,000. A slight drawdown is typical after a price reaches an all-time high, although losses can exceed 10%-15% even within a bull market.

Over the long term, bitcoin remains vulnerable to deep corrections along a broader uptrend. Still, drawdowns appear to be limited around 50% to 60% before a price recovery occurs.

Some analysts view the current drawdown as a warning sign of further downside in BTC’s price.

“A drop in total capitalization of another 5% would signal the onset of a bear market, assuming cryptocurrencies live by the same laws of psychology that underpin technical analysis,” Alex Kuptsikevich, an analyst at FxPro, wrote in an email to CoinDesk.

“The sell-off in cryptocurrencies from the May peaks ended only after the market lost more than half its valuation. The odds have significantly increased that the bears are aiming to sell the rate down to the $48K level, although there are still a few significant stops along the way,” Kuptsikevich wrote.

Bitcoin holders unmoved

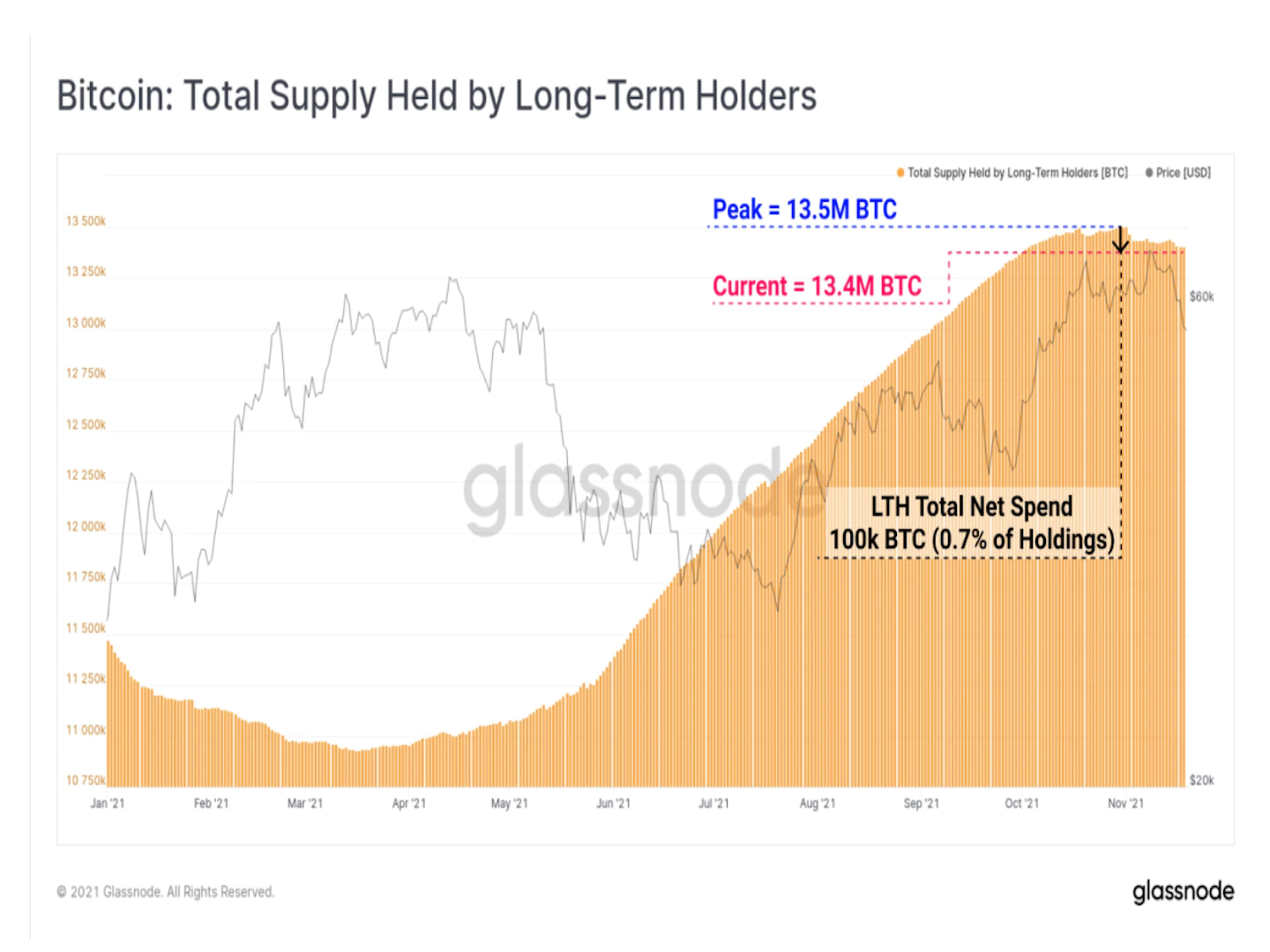

For now, blockchain data shows steady demand for bitcoin. “Even after a near 20% correction of the all-time high, long-term BTC holders do not appear to be spending their coins in panic,” Glassnode, a crypto data firm, tweeted on Friday.

“After peaking at 13.5M BTC, long-term holders have only distributed 100K BTC over the last month, representing just 0.7% of their total holdings,” Glassnode wrote. Still, long-term holders could eventually react to a potential down move in BTC’s price.

Altcoin roundup

- Layer 1 tokens outperform ETH: The rise of alternative layer 1 ecosystems have been a key theme this year, with several networks including Terra, Avalanche and Solana seeing a boom in usage as the multi-chain thesis takes shape,” Delphi Digital, a crypto research firm wrote in a Friday note. “LUNA (Terra), AVAX and SOL have performed remarkably well against ETH, especially as the market picked up in the second half of the year, according to Delphi.

- Macy’s Thanksgiving Day parade gets in on NFT craze with collectible balloons: The famed New York City parade’s 95th run will feature an NFT collection in partnership with the Make-A-Wish Foundation, CoinDesk’s Eli Tan reported.

- Binance fully integrates Ethereum scaler Arbitrum One: Binance has completed the integration of Arbitrum One mainnet, a way of expanding on the Ethereum network, and is allowing users to deposit ether via Arbitrum One Layer 2, the exchange announced on Nov. 19.

Relevant news

- Blockchain Tech Has Evolved Enough to Meet Some Demands of Financial Markets: RBC Report

- Chinese Local Government Warns of Digital Yuan Fraud

- Norway Considers Backing Swedish Crypto Mining Ban Proposal, Hints Minister

- Crypto Could Destabilize Nations, Undermine Dollar’s Reserve Currency Status, Hillary Clinton Says

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- Stellar (XLM): +6.89%

- Aave (AAVE): +5.11%

- Polygon (MATIC): +4.92%

Notable losers:

- Algorand (ALGO): -3.74%